Viewpoint

- The market’s insatiable demand for new data centers raises significant questions on where the required electricity will be sourced, what supporting infrastructure will be needed and what this means for decarbonisation.

- We believe increasing electricity demand owing to the data center boom is not only inevitable but is an important ingredient in the drive to net zero emissions.

- Our current allocation of 37% to US electric and multi-utilities within the Global Listed Infrastructure strategy[1] is driven by a combination of compelling valuations coupled with emerging opportunities around data center growth, digitalisation and decarbonisation. We believe these underappreciated structural growth tailwinds will persist for decades to come but are not yet reflected in the market prices for these assets.

Data centers form the backbone of our increasingly digitalised world, supporting various services from cloud computing to e-commerce and artificial intelligence. Their energy consumption is staggering, requiring immense electricity for server operation and cooling. According to the International Energy Agency (IEA), global power demand from data centers could surpass 1,000 terrawatts per hour (TWhs) by 2026 – roughly the equivalent of Japan's entire electricity consumption.[2] The market’s insatiable demand for new data centers raises critical questions about electricity sourcing, necessary infrastructure and the implications for decarbonisation efforts.

Power as an increasingly valuable resource

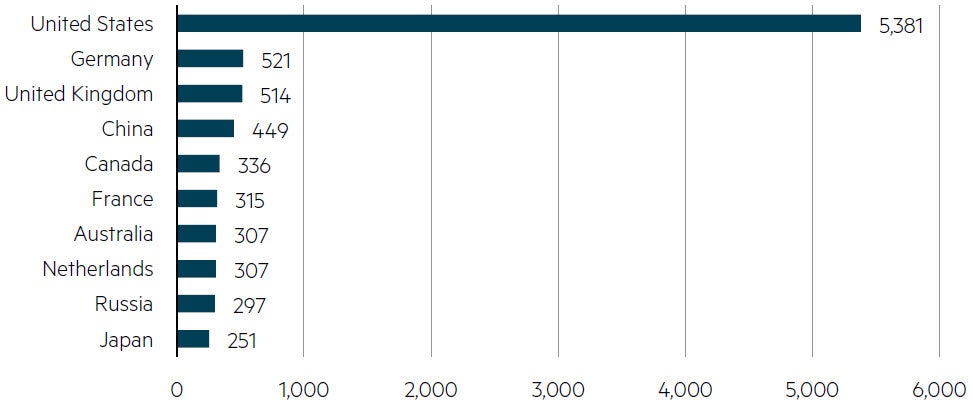

After a decade of relatively flat demand, the US is now entering a period of energy demand growth driven by the electrification of the transport and residential sectors, the growth of data centers and the onshoring of industrial processes. The incremental annual energy demand from data centers is projected to surge from 19TWhs in 2023 to around 44TWhs by 2030, translating to a remarkable 130% increase within a span of seven years.[3] The US is currently home to around a third of the world’s data centers.[4]

From an investment standpoint, we view this data center surge as an opportunity for regulated utilities to expand their customer base and revenue streams while spreading the energy transition costs across more consumers. The investment needs of the US power sector are staggering, with forecasts indicating a 7.5% increase in capital expenditure from US$155 billion to US$167 billion between 2023 and 2024, partially driven by growing energy demand owing to electrification and data center expansion.[5]

The exponential growth of data centers raises questions about meeting evolving electricity needs while addressing the energy trilemma of decarbonisation, reliability, and affordability. We believe an increase in electricity demand is a pre-requisite to decarbonisation. In fact, to reach net zero emissions by mid-century, the IEA estimates a 150% increase in electricity demand is necessary to accommodate the electrification and digitalisation of society.[6] Wide-scale electrification therefore fosters data center sector expansion and offers additional tailwinds for the power sector.

Finding this nexus depends on a host of variables working in tandem, specifically: appropriate and timely grid investment, renewable energy projects coming on line, maximising the potential of existing nuclear fleets and optimising energy use and efficiencies. Importantly, utilities need to demonstrate to regulators that any additional load growth from data centers does not contribute to higher residential customer bills.

Number of data centers by country (Top 10)

Source: Statistica, as at 2024.

Renewable energy coming online

The rise of utility-owned renewables underscores the potential for synergies between data center expansion and decarbonisation investments. Over the past decade, the US power fleet has grown on a total MW-basis, while conventional fossil fuel generation has shrunk and supply has increasingly shifted towards renewables.[7] This trend is anticipated to continue, bolstered by new policy measures such as the Inflation Reduction Act, which incentivises and amplifies investment through approximately US$370 billion of tax credits.

Renewables offer not only a zero-carbon advantage but also greater ease of co-location with data centers given their compatibility with essential data center requirements such ample space, fiber optic infrastructure, water for cooling and access to labour in densely populated areas.

Amazon, Apple, Alphabet, Meta and Microsoft are among the major tech companies known as ’hyperscalers’ that rely heavily on data centers as part of their core business. As a result of their enormous energy demand, along with commitments to be 100% renewable or zero carbon, these companies alone account for over 45GW of corporate renewable purchases worldwide – more than half of the global corporate renewables market.[8] Aside from these major hyperscalers, more than 100 data center operators are members of the Climate Neutral Data Center Pact which includes, among other commitments, to purchase 100% carbon-free energy and make data centers climate neutral by 2030.[9]

From a portfolio perspective, Dominion Energy has a sizeable pipeline of zero carbon investments with approximately 23% of their US$43 billion 2025-29 capex plan allocated to solar, offshore wind, storage and nuclear. Notably, in Virginia – home to one of the largest data center markets globally – Dominion Energy has earmarked close to 30% of its US$35.5 billion 2025-29 capital plan for renewables, primarily to meet anticipated load demand in the state. This includes the development of one of the largest offshore wind projects in the US off the coast of Virginia with around 2.6GW of generation capacity.

In January 2024, Amazon AWS announced it would develop two data center complexes in the state of Mississippi with electric utility Entergy providing power to these developments. Entergy expects the complexes to start coming on line over the next three years and plans to expand their renewables footprint in Mississippi by over 400MW approved and a further 500MW solicited for delivery between 2026-27 to help meet load requirements.

The challenge is, of course, that renewables are intermittent and regionally correlated across the US. Data centers need 24/7 electricity. While there have been attempts to support battery electricity storage in data centers, an economically viable and long duration solution (>4 hours) is yet to emerge.

Grid investment

Grid capacity is critical not only for the decarbonisation of the transport, industrial and residential sectors – but also for data center interconnection. Integrating large quantities of variable solar and wind generation, whose peak output may not match moments of peak demand, requires significant investment and the sophisticated management of electrical grids.

By modernising the grid, utilities can improve reliability, enhance grid flexibility and accommodate the influx of renewable energy sources required to power data centers more sustainably. This is especially true with the advent of new digital technologies, which have the potential to forecast and match electrical supply and demand, thereby cutting costs, improving efficiency and resilience and reducing emissions.

American Electric Power (AEP), which owns more than 40,000 miles of transmission lines across the US, is one company we believe could benefit from the data center surge. AEP plans to invest US$40 billion in capital between 2023-27, of which US$29 billion is earmarked for grid upgrades and development and US$9 billion for regulated renewable energy. The company operates in some of the most popular states for current data center projects, such as Ohio and Texas.

The timing of grid investment has never been more important. The long lead time of grid planning versus the shorter timeframe to plan and build data centers creates a potential shortfall of capacity, thereby placing pressure on utilities and regulators to accelerate investments. This is, we believe, a positive tailwind for regulated utilities in the listed infrastructure universe.

Maximising nuclear fleets

The recent energy crisis in Europe and the ongoing need for low and zero carbon baseload power to complement renewables has re-ignited the longstanding debate around nuclear power, especially in the context of data centers. It is reasonable to assume that greenfield large and smaller-scale nuclear is unlikely to solve the near-term need for load growth. However, existing nuclear fleets with spare capacity have huge potential to assist hyperscalers with their electricity and zero carbon needs.

Linking existing nuclear fleets with data centers and skipping grid interconnection (also known as ’behind the fence’ power) is one such option for tech companies. In March 2024, Amazon AWS revealed it paid US$650 million for a data center campus connected to Talen Energy’s Susquehanna nuclear plant in Pennsylvania. Dominion Energy is an example of a company that is attractively positioned to partner up with hyperscalers. In 2023, Green Energy Partners purchased 640 acres next to Dominion Energy’s Surry nuclear plant in Virginia with plans to construct up to 30 data centers in the vicinity.

That said, there are risks associated with behind the fence solutions and not all nuclear plants have this optionality. Nuclear power could solve for some, but not all, data centers’ electricity needs. Therefore, more creative solutions are needed for pairing renewables with baseload and/or energy storage technologies, where viable. Much of this comes down to technology and project development timelines. There are six electric and multi-utilities in the Global Listed Infrastructure strategy with existing regulated and unregulated nuclear fleets[10].

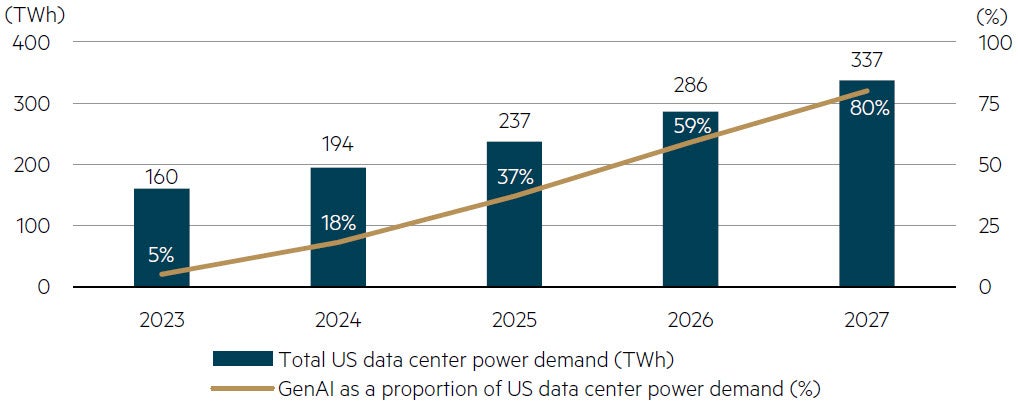

Estimated data center power demand in the US

Source: Morgan Stanley, as at April 2024. Total US data center power usage estimates include Generative AI.

Optimising energy use and efficiencies

Energy efficiency measures (such as LED lightbulbs and insulation) are often referred to as the ’first fuel’ in the energy transition, as they provide some of the quickest and most cost-effective solutions to emissions mitigation. Equally, demand side measures (such as smart meters) allow consumers to reduce or shift their electricity usage during peak periods in response to time-based rates or other financial incentives. In the context of data centers, energy efficiencies serve the important role of offsetting the increase in load on the grid while demand response measures help with grid flexibility.

According to the IEA, at a global level, rapid improvements in energy efficiency have helped limit energy demand growth from data centres and data transmission networks, which each account for about 1-1.5% of global electricity use. In the US, utility efficiency programs could reduce electricity use by over 365 billion kWh by 2040, reducing the projected annual growth rate in electricity consumption by 28%.[11] US electric utilities spent around $6 billion annually on energy efficiencies between 2014 and 2018, resulting in incremental annual electricity savings of around 27 million megawatts.[12]

Certain jurisdictions in the US reward utilities for energy efficiency investment. For instance, in Illinois, Ameren and ComEd (a subsidiary of Exelon) are able to earn a return on, and of, energy efficiency spend. Ameren has invested US$400 million in efficiency measures and Exelon has helped customers save around 25.5MWhs through energy efficiency programs. Exelon plans to invest a total of US$5.1 billion across all its utilities for measures such as home energy audits, lighting discounts, appliance recycling, home improvement rebates, equipment upgrade incentives and innovative programs.

It is worth noting that hyperscalers themselves are also making strides with technology efficiencies, for instance with advancements in chip and server efficiencies to improve and lower electric demand needs from data centers. Legislative initiatives, such as the Energy Act of 2020, mandate audits on data center energy and water usage, fostering accountability and driving efficiency improvements.

We expect there to be some continued capital investment opportunities, driven in part by state energy efficiency resource standards and expected demand growth from sectors such as data centers, although not to the scale of electrification or renewables investment.

Balancing digitalisation and decarbonisation with affordability

Balancing demand growth and energy transition goals with affordability remains a pressing concern for utilities and regulators alike. As utilities invest in grid modernisation and renewable energy projects, they must ensure that these initiatives do not unduly burden consumers with higher bills – especially in the context of investments needed to support data centers.

The key to this question is finding the right rate design. Industrial electricity prices tend to be very cheap in the US because regulators recognise that industrial operations lead to more employment, more residential customers and therefore lower rates for residential customers in the catchment area. In short, higher industrial load comes with clear benefits for everyone.

From a regulator’s perspective, however, data centers may not warrant such low rates because they typically bring fewer employment opportunities over the long term. If data centers’ rates are priced too cheaply, then this could result in higher customer bills for everyone else. Landing on the right rate design is therefore key to balancing these factors and ensuring data centers’ electricity bills are not being unfairly subsidised by others.

Beyond rate increases, utilities can also strike a balance between meeting data center demand and safeguarding the affordability of electricity by leveraging policy incentives and exploring alternative funding sources. These may include grants, loans and tax credits from federal and state programs largely made available under the Inflation Reduction Act and the Infrastructure Investment and Jobs Act, in addition to operational savings and asset sales. For instance, in 2023 Duke Energy sold 3,400MW of commercial solar, wind and battery projects for US$2.8 billion to help finance its 10-year US$145 billion capital spending plan.

In the longer term, electricity bills could fall as renewables’ share of the generation mix grows given technology costs are expected to decline further and wind and solar energy does not require fuel. Even more so, households that electrify with electric vehicles, heat pumps and other electric appliances could potentially see a 40% decrease in household energy bills by 2045 relative to what they pay now for electricity, gasoline and natural gas combined.[13]

Parting thoughts

At the heart of the data center conundrum lies the challenge of balancing growing energy demand with decarbonisation efforts. While data centers are driving electricity consumption to unprecedented levels, they also present an opportunity to accelerate the energy transition. By investing in renewable energy projects, extending the life of existing nuclear assets and modernising grid infrastructure, we believe utilities are well positioned to meet surging demand for electricity but also advance decarbonisation goals. The convergence of digitalisation and decarbonisation hinges on four overarching factors: customer bills and regulatory scrutiny, policy incentives, technological advancements and project timelines.

[1] Based on a representative fund of the Maple-Brown Abbott Global Listed Infrastructure strategy. As at 31 March 2024.

[2] IEA, ’Data Centers and Transmission Networks’, July 2023; IEA, ‘Electricity 2024’.

[3] Wolfe Research estimates, 2024.

[4] IEA, ‘Electricity 2024: Analysis and forecast to 2026’, 2024, p.32.

[5] Edison Electric Institute (EEI), ‘Resources & Media: Industry Data’, 2023.

[6] IEA, ‘World Energy Outlook 2023’, Net Zero Emissions by 2050.

[7] EIA, ‘Electricity Demand & Growth 1970-2023’.

[8] S&P Global Market Intelligence, 'Datacenter companies continue renewable buying spree, surpassing 40 GW in US' 28 March 2023.

[9] Climate Neutral Data Center Pact.

[10] Based on a representative fund of the Maple-Brown Abbott Global Listed Infrastructure Strategy. As at 31 March 2024.

[11] EPRI, ‘U.S. Energy Efficiency Potential Through 2040: Update on Potential for Energy Savings Through Utility Programs Across the Nation’, August 2019.

[12] U.S. Energy Information Administration (EIA), ‘Utility energy efficiency spending and savings declined in 2018’, 2020.

[13] Edison International, ‘Countdown to 2045’, September 2023.

Disclaimer

This information is prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, AFSL. 237296 (‘MBA’) as the Responsible Entity of the Maple-Brown Abbott Global Listed Infrastructure Fund (‘Fund’). This presentation contains general information only, and does not take into account your investment objectives, financial situation or specific needs.

Before making a decision whether to acquire, or to continue to hold an investment in the Fund, investors should obtain independent financial advice and consider the current PDS and Target Market Determination (TMD) or any other relevant disclosure document of those products. For the Fund, the PDS, AIB and TMD are available at maple-brownabbott.com/document-library or by calling 1300 097 995.

Any views expressed on individual stocks or other investments, or any forecasts or estimates, are not a recommendation to buy, sell or hold, they are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this document. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications not described in this document. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of this information, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on this information. Units in the Fund mentioned in this presentation are issued by MBA. This information is current as of 7 May 2024 and is subject to change at any time without notice.

© 2024 Maple-Brown Abbott Limited.