Viewpoint

- The Middle East is undergoing a period of significant growth

- Reforms, restructuring and investment create a positive tailwind for this decade

- The region has a young and growing population embracing the change

With the world opening up and travel coming back, we recently travelled to Riyadh and Dubai to meet our portfolio companies and see first-hand the impact of Saudi Arabia’s Vision 2030. While growth for 2023 is likely to slow from the post-COVID recovery last year, the structural outlook is exciting. In addition, according to Copley Fund Research data at the end of March 2023,* Saudi Arabia was the largest country underweight amongst GEM funds and the contrarian in us is encouraged to look for further opportunities.

Vision 2030

There are a number of drivers behind this structural outlook. While Saudi Arabia has long been known for its vast oil reserves, the country is now seeking to diversify its economy and transform into a modern, knowledge-based economy. As part of this effort, in 2016 the Saudi Government launched Vision 2030. This provides a roadmap for the Kingdom’s economic and social transformation over the next decade. With an estimated spend over USD900bn** on announced Vision 2030 projects (roughly 100% of 2022 gross domestic product), Saudi Arabia is potentially setting up a base for growth over the decades to come. Yes, diversifying away from oil will be difficult when the energy sector (oil and petrochemical products) represent 40% of GDP.*** What is more interesting from an investment point of view, is the direction of change. We believe the clear winners will be domestic consumption, driven by a growing labour force and rising incomes, as well as the banks that will see growing demand for loans to fund this development.

Saudi Arabia today – young, growing and ready for change

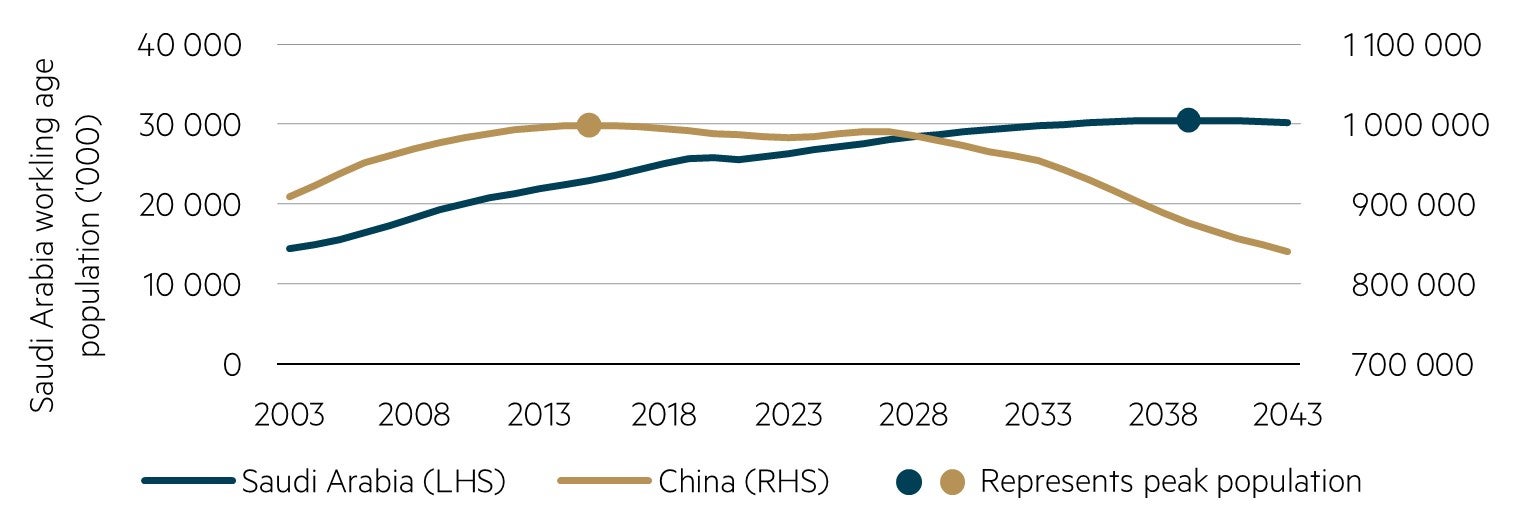

First, it is worth as few comments on what Saudi Arabia is today. Saudi Arabia has a population of 36 million and with a median age around 30 years^ it is young, especially compared to developed markets, Eastern Europe or North Asia. Additionally, fertility rates are still high, leading to natural population growth and a demographic dividend as the workforce continues to grow as shown in Chart 1. Vision 2030 with its investment and social reforms is set to further boost the benefits of that young demography and support future growth for decades to come.

Chart 1: Working age population growth

Source: United Nations Population Division (2022). World Population Prospects 2022, Online Edition.

A simple metric we often monitor for the development of a country is the penetration of cars per 1,000 people. On this measure, Saudi Arabia at 156,^^ is behind neighbouring United Arab Emirates at 354 and Brazil at 366 and even China at 226. Despite Saudi Arabia having twice the GDP per capita of Brazil or China. Speaking to locals on the ground, they described Riyadh today as similar to Dubai 20 years ago.

Chart 2: Spot the difference, Riyadh vs Dubai February 2023. Vision 2030 aims to double Riyadh population from 7m to 15m residents

Source: John Moorhead, February 2023

Social change and reforms to unlock the potential

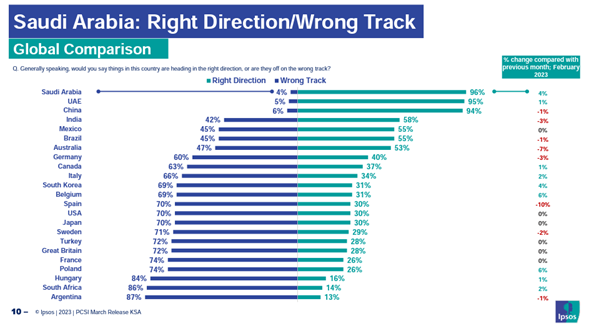

Secondly, social change is happening. It is true that Saudi Arabia has a chequered history on human rights. Yet it is hard to overstate the social changes that are taking place today. Crown Prince Mohammed bin Salman introduced the Vision 2030 reform plan in April 2016 after the country was effectively closed for nearly 40 years. One of the first moves was to strip the Committee of Promotion of Virtue and Prevention of Vice (also known as the “religious police”) of many of its powers. Since then, Saudi Arabia has seen its first public music concerts in 25 years, a prohibition on cinemas was lifted and the ban on gender mixing was eased. These changes have been embraced by the local population. From the outside, this may appear as the beginning of an opening towards a more liberal society. From the domestic economy view however, these changes bring a huge boost from the increased ability to spend on services and consumption. Consumption at 65% of GDP^^^ in Saudi Arabia today leaves plenty of room for growth towards developed market levels closer to 80%.

Chart 3: Saudi Arabia consumer confidence embracing the change

Source: IPSOS PCSI March 2023 Release.

Reforms help. While in Saudi Arabia we joined a conversation with Dr Hala Al Tuwaijri, President of the Saudi Human Rights Commission discussing gender empowerment in the kingdom. In it she noted that the recent gender equality laws lead to the World Bank Women, Business and the Law 2023 report scoring Saudi Arabia 100/100 with regards to laws affecting women’s pay, pension and constraints on women starting a business. There are of course, still areas for improvement such as constraints related to marriage and divorce for women that are not equal to men.

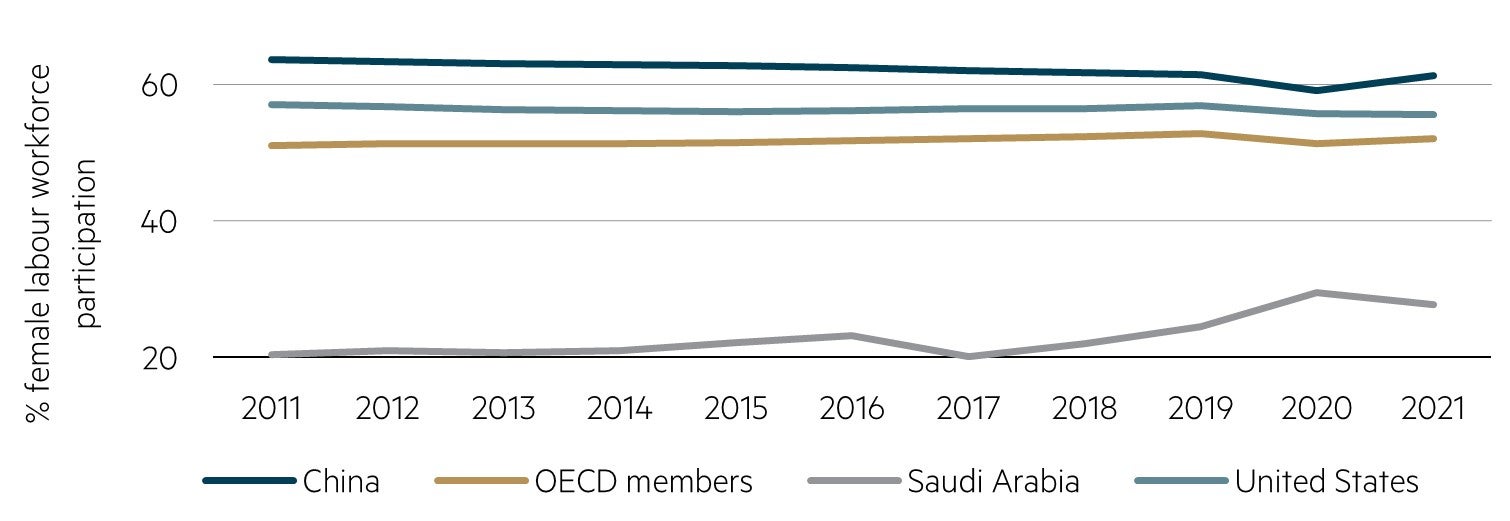

Those reforms around women’s rights are perhaps the most eye catching to international investors. As already mentioned, social mixing has been relaxed, benefiting restaurants and consumption. Additionally, since 2018 an official ban on women driving was removed and modifications were made to the “guardianship” system that allows women to obtain a passport, travel abroad and importantly, work and start a business without approval from their male guardian. Similar to the social reforms from the outside, these changes appear to be moving the culture to towards a more liberalised view of the world. But there is of course the economic boost that comes from this. Allowing women to drive increases their ability to find employment, which is an additional benefit to the economy. One target of Vision 2030 is to increase female labour workforce participation to 30%, which by some measures was already met in 2022. We note this remains well below other emerging markets, offering ample opportunity for further upside. Using World Bank data, we estimate that should female labour participation rates continue their current trend, it could grow the total workforce by 20%, creating three million new incomes driving consumption.

Chart 4: Female labour force participation rate. Saudi Arabia taking off after Vision 2030

Source: World Bank female labour force participation rate (ILO estimates), March 2023

Parting thought

Given its present contribution to GDP, to truly diversify away from oil will be challenging. Yet as investors, we focus on the direction of change when looking for the next opportunities. There are many other focus areas for reforms that we have not touched on here, such as the desire to increase private participation in the hospital system or boosting international tourism. These will also play out over the next decade. We continue to search for the best opportunities that will benefit from this change and be the winners of tomorrow.

* Copley Fund Research, Saudi Arabia Active GEM Fund Ownership Report 31st March 2023

** “The Future of Saudi Arabia” Morgan Stanley, 15 December 2022

*** General Authority for Statistics, Kingdom of Saudi Arabia 2022 accounts

^ United Nations, Department of Economic and Social Affairs, Population Division (2022)

^^ Helgi Library “Passenger Cars Per 1,000 People rose 1.59% to 156 vehicles in Saudi Arabia in 2019”, November 2020

^^^ General Authority for Statistics, Kingdom of Saudi Arabia 2022 accounts

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 30 March 2023 and is subject to change at any time without notice.

© 2023 Maple-Brown Abbott Limited