Viewpoint

- Fundamentally and geopolitically, India is currently in a relatively strong position. But Indian equities look fully priced with little room for disappointment.

- Meanwhile in China, much of the disappointment with the tepid post-pandemic recovery is reflected in equity valuations.

- On a risk-reward basis China looks enticing and we continue to identify opportunities using our long-term, contrarian approach.

With Indian Prime Minister Modi recently completing a state visit to the US, meeting President Biden, addressing a Joint Sitting of US Congress, and even leading a Guinness World Record yoga session, India is having its moment in the sun.

Geopolitically, India finds itself in an enviable position, as a counterweight to China’s influence in Asia it has been courted aggressively by the US, while still buying discounted Russian oil. Economically, inflation has likely peaked (along with interest rates), its balance of payments is in check and foreign direct investment is still climbing.

Indian equity bulls are rarely in short supply

This fervour is also reflected in the Indian equity market, and a recent research trip to the sub-continent revealed that, even by Indian standards, enthusiasm was high. A stable political environment, relatively young population and a potential capex cycle underpinned by the promise of supply chains moving out of China are some of the many reasons to be positive on the fundamentals for India.

Yet it is not fundamentals alone that determine the success of investments. Price is the other key variable in this equation. Pay too much for an asset and it won’t matter how good the fundamentals are – you can still lose money. Successfully weighing up those fundamentals with the prevailing valuations is at the crux of effective investing.

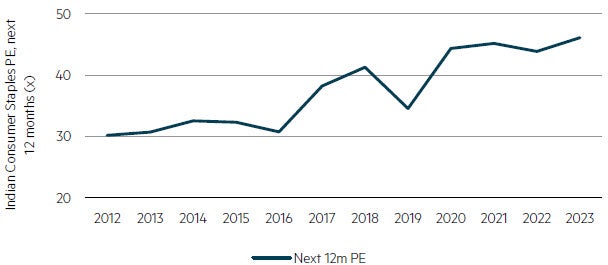

Our experience is that prices matter most when fundamentals appear at their strongest. Yet history is littered with examples where this is not the case. Alibaba in late 2020 is an obvious recent example, when its share price traded above US$300, versus the current price at <US$100*. As it relates to India, we contend that many of the consumer-related companies will, in time, be further examples of this phenomenon. As a cohort, as shown in the chart below, Indian Consumer Staples valuations have expanded by over 40% over the last decade, such that the sector trades on over 45x earnings.

Indian Consumer Staples – pricey by historical measures

Source: FactSet, June 2023.

Over that same period, Earnings Per Share growth has compounded at ~8% in local terms. In USD terms, that figure reduces by one-third to ~5%*. With current starting valuations, despite positive fundamentals, we think the risk is to the downside on many Indian consumer names.

China’s tepid recovery

Meanwhile, the level of enthusiasm for Indian equities is commensurate with the level of bearishness that surrounds Chinese equities at present. After a promising start to the year, the much-heralded China economic recovery has stalled, with economic data releases falling short of expectations. Consumer confidence is one key measure that has flatlined well below its highs. With little in the way of stimulus during the pandemic-induced lockdowns, incomes for many citizens were hit and will take time to recover. Meanwhile there has been little relief from the property measures imposed back in 2020 which has made for a soft market. Yet with the market trading on ~10x forward earnings (contrasting India’s 21.3x)*, much of this pessimism is reflected in prevailing valuations. As the impetus for a greater fiscal response grows, we expect the second half of 2023 will see more progress on China’s thus-far elusive recovery.

As the following chart shows, apart from the capitulation in Chinese equities back in October 2022, the premium investors are willing to pay for Indian equities (relative to China) is close to record levels.

In love with India: MSCI India valuation premium over MSCI China

Source: FactSet, June 2023.

Returning to India, there are areas of the market that continue to look attractive to us. Financials is one such area. The Indian banking sector has been plagued by a long bad debt cycle over much of the 2010’s as a result of the poor lending decisions made years prior. Yet in the intervening period, many loans have been restructured and/or repaid, underwriting has improved and bankruptcy laws have been reformed. With corporate balance sheets in good health and low levels of credit penetration at a retail level, should India’s positive economic cycle continue, its banks will be key beneficiaries – something we believe is not priced into prevailing share prices.

Parting thought

The positive fundamentals of India is a story well told and in many parts of the market, already reflected in prevailing prices. However, if growth, reform or any one of these positive attributes do not live up to investor expectations, we think there is plenty of downside. Contrasting this dynamic is China: Sentiment is weak and anecdotally, many investors have given up on the equity market. As a result, the market is pricing in a lot of bad news. Little consideration is given to what can go right. On a risk-reward basis, as contrarian investors, the China opportunity looks enticing.

* Source: FactSet, June 2023.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 30 June 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.