Viewpoint

- Winning stocks within the Australian bourse have to date largely been those appearing to offer a more ‘certain’ outcome

- It is clear to us that investors are ‘hiding’ in a select group of what are perceived to be ‘safe’ or defensive stocks. Valuation is no more than a secondary consideration

- In our view the market is overly complacent with respect to the likely earnings trajectory and we believe the strength evidenced by the market to date is going to be tested.

Over the past year we have become increasingly aware that seminal changes in investment markets were underway, driven by a break-out in inflation not seen for decades and the necessary response of central banks globally. The reset of long-term interest rates in light of these two factors has – and in our view will continue to – impact investment markets. The past few months have, in some ways, been a testing one for this thesis. On reflection however, what has tested this thesis is not so much the economic developments but rather the unexpected response of markets to those developments. In our minds that is a very different matter.

We expect to see rising tensions between fiscal and monetary policy in many economies, including our own, and in recent months the Reserve Bank has come under increasing scrutiny. Market forecasts of global interest rates have consistently undershot actual outcomes and rates are not declining at the pace the market had initially expected. Indeed, recent comments by the Federal Reserve Chair that the fight against inflation “has a long way to go”* seems to warn against complacency. This background hardly seems conducive to leading stock markets finding strength, but that has been the case, hence our comment regarding the unexpected outcomes of markets.

Poor breadth puts all eyes on earnings

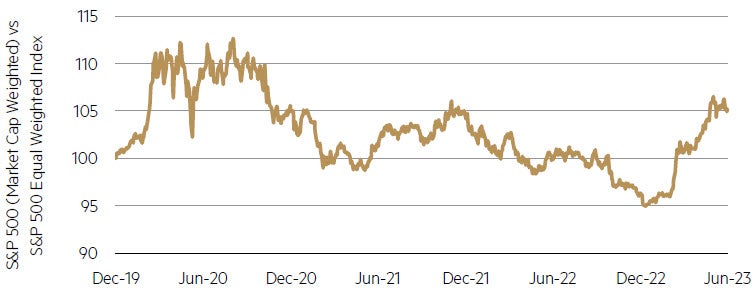

One of the most unusual features of the US market over the past few quarters has been the extremely narrow breadth, with most of the market gain being driven by a small group of large capitalisation tech stocks such as Apple, Microsoft and NVIDIA. The chart highlights the sharp outperformance of the S&P 500 Index (market capitalisation weighted) over the S&P 500 Equal Weight Index, illustrating the poor breadth of the market. This was similarly the case during COVID which was followed by a sharp reversal.

S&P 500 (Market Cap Weighted) vs S&P 500 Equal Weight Index

Source: Bloomberg, data from 1 Jan 2020 to 30 June 2023.

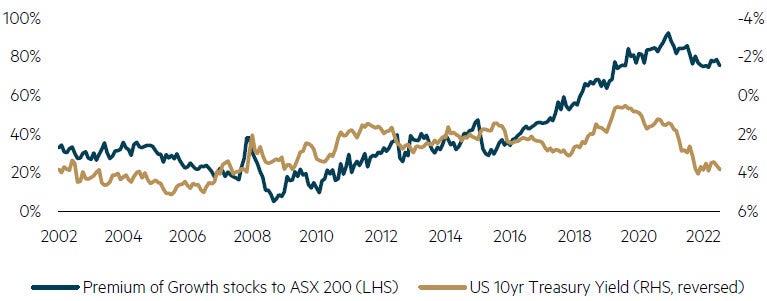

While the Australian market has lagged global markets, we have observed that Australia too has seen a small group of stocks providing most of the market upside over the calendar year. Given the Australian market has limited exposure to tech stocks, the winning stocks have largely been those that in our opinion appear to offer a more ‘certain’ outcome in an economy increasingly under pressure from inflation and interest rates. These stocks, largely falling into the growth stock category, enjoyed extended premium ratings well before this latest period of strength, and the premiums have expanded further at a time when interest rates have continued to increase. This is a highly unusual outcome.

Australia Growth PE Premium versus US 10-year Treasury Yield

Source: Goldman Sachs, data to 30 June 2023.

Valuation a secondary consideration

As we meet with market participants it is abundantly clear that investors are ‘hiding’ (to use a technical term!) in a select group of what are perceived to be ‘safe’ or defensive stocks. Valuation is no more than a secondary consideration based on a view that a group of stocks, overpriced at first glance, might look more like fair value once earnings downgrades flow through the rest of the market. In our view, this is always a risky strategy as a defensive business is often not a defensive stock, particularly when trading at a significant valuation premium. The downgrade to CSL’s market consensus earnings numbers during June is a particularly interesting case study. CSL is indeed a defensive business given its healthcare exposure, but in providing earnings guidance for FY24 that was below market expectations, it succumbed to a combination of currency moves, challenging operating conditions and overly bullish analyst forecasts. A review of market consensus numbers highlights that forecast USD earnings have declined in excess of 10% over the FY24 and FY25 years. Interestingly, the stock has fallen by less than the earnings downgrades, thus enjoying a small rating upgrade despite already trading at an elevated valuation! This is a rare outcome. We have often written about the premium rating the market attributes to this stock given a view that significant annual earnings growth is all but assured. This downgrade has clearly not shaken market confidence in CSL but also illustrates the market’s current obsession with apparently defensive stocks, even when circumstances suggest some element of caution be exercised towards these stocks.

It is, however, not difficult to understand why (at least conceptually) the market is so focused on defensive attributes. The past quarter has seen a raft of earnings downgrades begin to flow through some segments of our market (notably consumer discretionary) as the impacts of higher interest rates begin to be felt by Australian consumers. Until recently the consumer has been protected by a range of factors including savings buffers built up during COVID and low fixed rate mortgages signed during interest rate lows. However, these benefits are waning and there are also signs of the broader economy slowing. The long-awaited repricing of commercial property is underway and other unlisted assets are reportedly also facing some valuation fallout from higher interest rates. The upcoming reporting season is thus likely to be one of the more interesting ones for some time as management teams reflect on what the FY23/24 financial year might look like. In our view the market is overly complacent with respect to the likely earnings trajectory (both domestically and in the US) and we believe the strength evidenced by the market to date is going to be tested. Investments with defensive attributes thus have appeal, except as already noted valuations generally look excessive. In addition, as we have seen with CSL, earnings expectations for many of these stocks are likely to prove overly optimistic and the market may not treat these other premium-rated companies as favourably when that becomes evident.

Parting thought

History teaches us that valuation is never a secondary consideration for long and we remain of the view that the better valued part of the market is going to be the preferred place to invest through this uncertain time, notwithstanding earnings uncertainty. In this latter regard we note a recent White Paper from GMO which concludes (using comprehensive US data) that “the common assumption that value is destined to underperform in a recession simply does not fit the historical data.”**

* Jerome Powell’s testimony before the House Financial Services Committee, 21 June 2023.

** Value Does Just Fine In Recessions, Ben Inker, GMO White Paper June 2023.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 30 June 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.