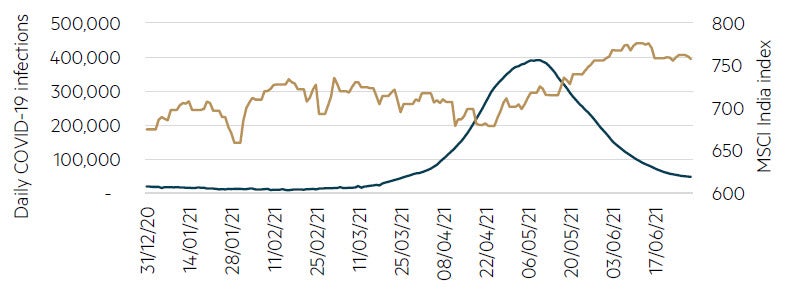

The world watched in horror as India made headlines as the human tragedy around its second wave of COVID-19 unfolded in the second quarter of 2021. With hundreds of thousands of new daily infections, a hospital system under strain and mobility in major cities stalled, one might have expected the equity market to look vulnerable. Yet in sharp contrast, the market rallied and was among the top performers within Asia ex-Japan for both the June quarter (third best with +6.9% in USD) and the first six months of the calendar year (second best +12.2%). As an illustration, bellwether financial stock State Bank of India rose ~13% in USD terms over the quarter and was up over 50% in the first half 2021.

Figure 1: Daily COVID-19 infections in India versus MSCI India

Source: Bloomberg, MBA

Meeting challenges head on

What was different this time that allowed India to defy expectations? Our recent conversations with corporates have given us an understanding of how this second wave differed from the first (March to May 2020). From the outset, lessons from the initial harsh lockdown in 2020 were heeded and no strict national lockdown was implemented (though many states introduced curbs to activity). Second, a large part of the population was able to switch to working from home (if they weren’t already doing so) with much greater ease and business processes such as loan applications had also been established in an online environment so a far larger amount of commerce could continue to transact.

Within the banking sector, several companies indicated that loan repayments remained high in April and May (the most recent data available) and credit quality was sound. Moreover, excess provisioning from FY20 is likely to provide some additional buffer to address new non-performing loans. Clearly there is going to be some impact in the very near term, but more importantly, the longer-term dynamics remain unchanged.

India’s attractive fundamentals

It isn’t just the country’s adaptability to conditions around COVID-19 that has made India attractive. From a fundamental viewpoint, its young population, emerging middle class and long-term growth potential offer an alluring mix for investors. To achieve this, ongoing reforms to the economy are paramount and the re-election of Prime Minister Modi in 2019 with an increased majority was a key positive development. Progress on this front has been made, though on balance, slower than initial expectations (COVID-19 interruptions notwithstanding).

As India emerges from this period, it will be crucial to continue on this path, as will its ambitious plans to develop its manufacturing sector, ‘Make in India’, into a world class industry. The recent expansionary federal budget in February was an encouraging sign that the government is set to maintain this pro-growth/reform agenda.

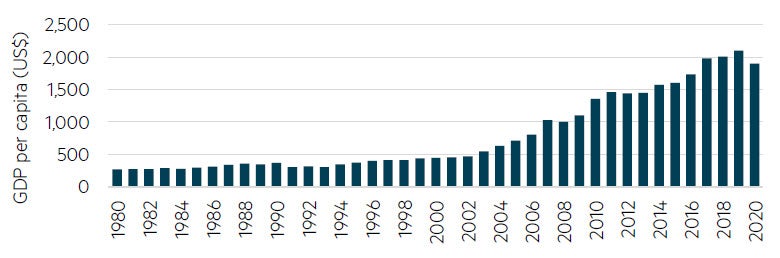

As figure 2 indicates, India’s development has not been a short-term phenomenon, with the origins of economic reform beginning in the early 1990s. GDP per capita rose four-fold over the past 20 years, and while COVID-19 has had a significant impact on growth, the strong positive fundamentals remain in place. As it recovers from this episode, we expect these traits to act as a tailwind for its economic performance.

Figure 2: Indian GDP per capita, 1980–2020

Source: World Bank

Valuations rise but value remains across certain industries

This positive outlook is not lost on the market, and our views have been tempered by prevailing valuations, which are above historic averages. Yet while aggregate valuations remain elevated, at a company level we continue to see decent value across a range of industries, most notably in the financial sector. The earnings outlook in many of these companies is bright as they recover from what has been a long bad debt cycle that pre-dated COVID-19. For example, at its recent earnings results, State Bank of India announced it was targeting a return on equity of 15% in the medium term, which compares very favourably to its five-year average of just 3%. Meanwhile, from our analysis we believe Reliance Industries is another company that is set to grow earnings handsomely over the coming years. With its origins in chemicals and oil refining, it has established leading positions in retail and telecommunications in India over the past decade and, in many ways, can be viewed as a proxy for the broader Indian economy.

Consumer-facing businesses including telecom and retail now account for 50% of EBITDA. These new segments have long runways for growth (particularly in telecoms where prices are rising from extremely low levels), while its traditional operations remain among the lowest cost producers globally. The obvious near-term risk is a third wave of COVID-19 derailing the economic recovery, though India’s vaccination program continues to ramp up (now averaging over five million per day) with ~20% of the population having at least one vaccine shot.

India is a good example of what makes investing ‘simple, but not easy’ and why it is imperative to focus on the long-term and maintain valuation discipline.

Disclaimer

This material was prepared by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (MBA). MBA is also registered as an investment advisor with the United States Securities and Exchange Commission under the Investment Advisers Act of 1940. This information is intended solely for professional and institutional investors and is provided for information purposes only. This material is not intended for, and is not suitable for, retail clients and does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any investor’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This material does not constitute an offer or solicitation by anyone in any jurisdiction.

This material is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this material does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material. This information is current as at 31 July 2021 and is subject to change at any time without notice.