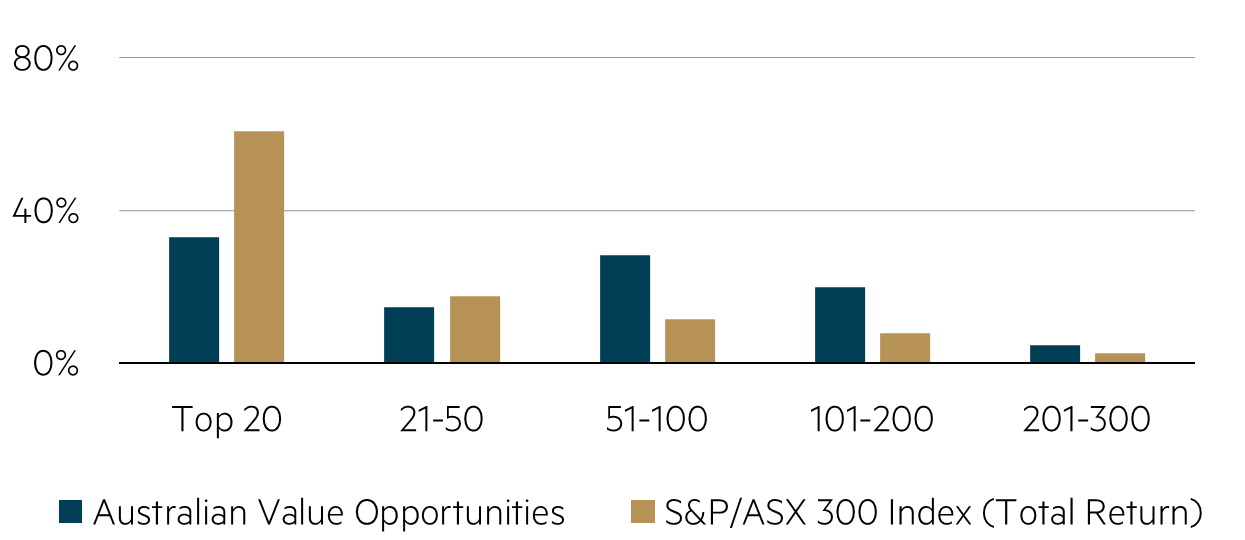

With many companies and sectors looking expensive from a valuation perspective, the question we often get is where are the opportunities in Australian equities?

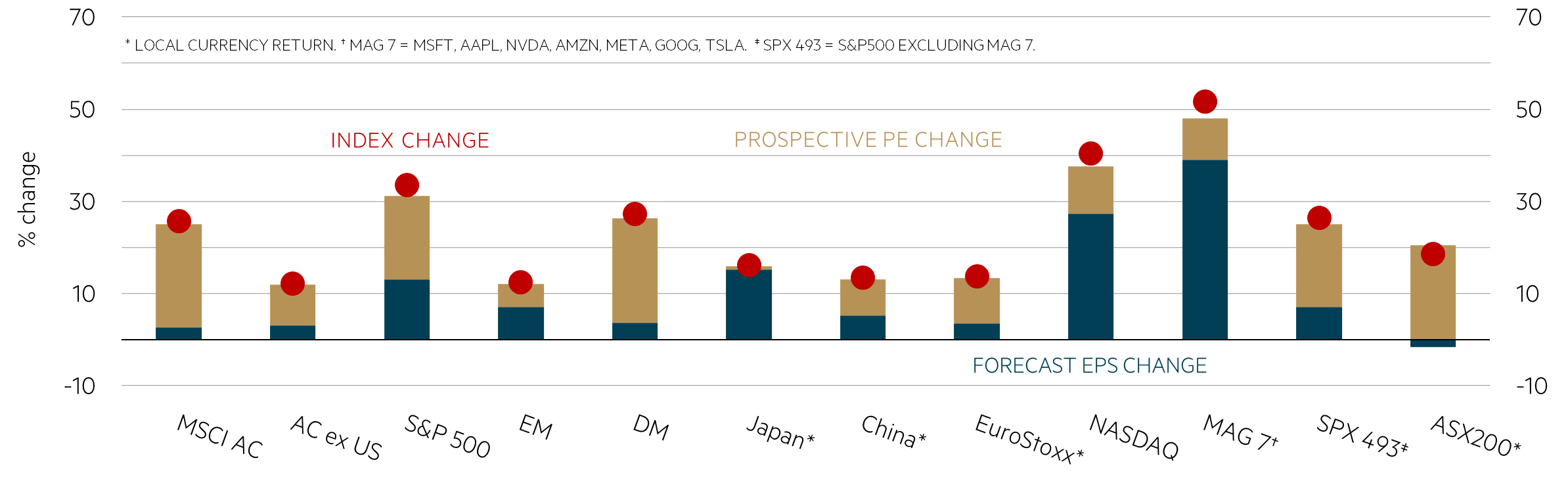

The Australian equity market produced a slightly higher than average total return of 11% in 2024 when compared to a 10-year return of 8.5%. However, that number hides a huge difference across sectors. The “haves” were led by the technology sector which produced a total return of roughly 50%, followed by financials which were up over 30%. On the flipside, the energy and materials (led by resources) sectors both produced double digit negative returns. Interestingly, the 2024 returns were generally driven by a price earnings (PE) multiple re-rating rather than earnings growth. The chart below highlights this: