Viewpoint

- Similar to the US, concentration of returns has been a key a feature of Asian equity markets in the first half of 2024, with Taiwan (driven by AI-related enthusiasm for TSMC) and India (based on continuing strong fundamentals) the clear country leaders.

- Having witnessed Chinese equities capitulate in early 2024, animal spirits have awakened and driven the market substantially higher. With previous rallies over the past several years ending almost as quickly as they began, the key question for investors now is, is that it?

- With Chinese company earnings starting to grow again, a combination of cheap valuations and strong balance sheets (being used to buy back stock and increase dividends) sets up an attractive backdrop for future returns.

“The biggest risk is not taking any risk”

After a weak start to the 2024 calendar year, Asia ex-Japan equities are now up ~10% in USD in the first six months of the year, its best start in five years.

The concentrated nature of returns has been a feature in the region (as well as globally) in 2024, with just two countries outperforming the MSCI Asia ex-Japan benchmark in the first six months. This is a continuation of trends seen in 2023 – with Taiwan and India driving the region higher. Enthusiasm for artificial intelligence is lifting the Taiwanese market, while despite election wobbles, solid fundamentals are seeing valuations multiples expand to propel Indian equities higher.

1H 2024 country returns: Only Taiwan and India ahead of the benchmark

Source: FactSet. Data to June 2024.

This is also evident at a stock level, with just ~31% of stocks outperforming the index.

Stock returns have been concentrated in Asia ex-Japan

Past performance is not a reliable indicator of future performance Source: Jefferies. Data as at June 2024.

History tells us that these periods of concentrated returns do not last forever and while the Maple-Brown Abbott Asian Investment Trust has benefitted from owning some of these strongly performing companies, we can point to many more that despite solid fundamentals, have suffered from a derating over the past few years. Should earnings and free cashflow continue to grow as we expect, it is implausible that these companies will continue to trade at prevailing levels.

China and the second wave of buyers

Having witnessed Chinese equities capitulate in early 2024, animal spirits have awakened and driven the market substantially higher. From the low recorded in January, MSCI China rallied more than 30%. The index has seen some consolidation such that it is now up ~20% from the lows and ~5% calendar year to date. The key question for investors now is, is that it?

Previous rallies over the past several years have ended almost as quickly as they began – the most recent one being China’s emergence from COVID lockdowns in late 2022. After a fast start in November the rally petered out by February as lockdowns and property restrictions (as well as a lack of government cash handouts to consumers) proved more damaging to the economy than initially thought.

One common pushback we encounter when talking about any sustainable rally in China is, after the initial rally, who is the incremental buyer that will drive share prices higher?

It is perhaps a statement of the obvious that institutional demand for allocating capital to China has waned in recent years. Geopolitics, a weakening economy and a poorly performing equity market have all contributed to investors looking elsewhere. The rise of Emerging Markets ex-China mandates (primarily out of the US) offer evidence of this trend. Flow data we have seen point to investors being underweight China and anecdotally, sentiment remains poor.

Yet behind this narrative lies a contrasting reality. While institutions have been generally slow to capitalize on buying good businesses at low valuations, Chinese companies themselves have been buying their own shares in large volumes since the end of 2023.

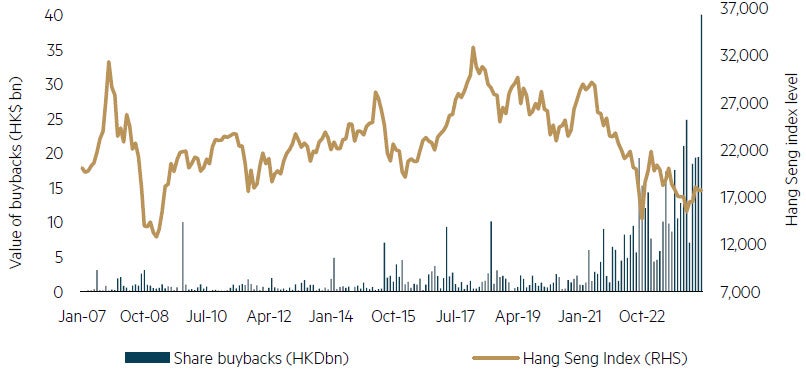

Insider buying has long been considered a positive sign of higher equity prices, given the informational advantage that company management teams possess. With net cash balances sheets and rising free cashflow generation, we are observing companies increase both dividends and share buybacks in 2024. In Hong Kong, a record amount of value was bought back in June, some HK$41billion (US$5bn), some 60% above the previous record set back in January this year.

Share buybacks on the Hong Kong Stock Exchange

Source: Wind, HSBC. Data to June 2024.

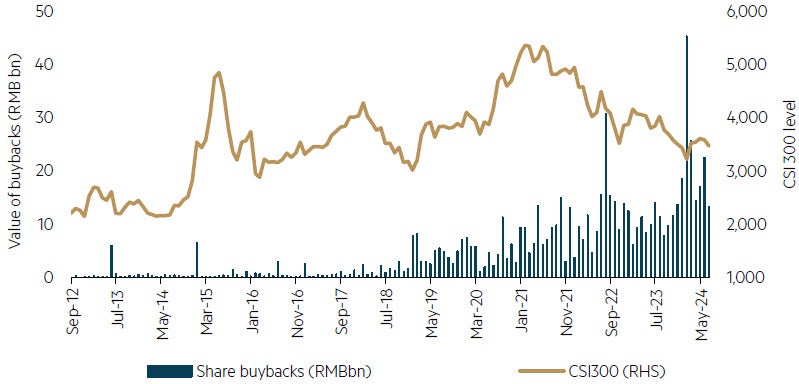

Share buybacks increasing on Mainland Exchanges

Source: Wind, HSBC. Data to June 2024.

This dynamic is true at both private companies as well as State Owned Enterprises (SOE). Recent measures introduced to measure management performance for centrally owned SOEs have included return on equity as well as share price performance. The State Council also recently introduced a ’Nine-Point Guideline’ for capital markets, focusing on tightening up listing requirements and investor protections as well as encouraging share buybacks and dividends.

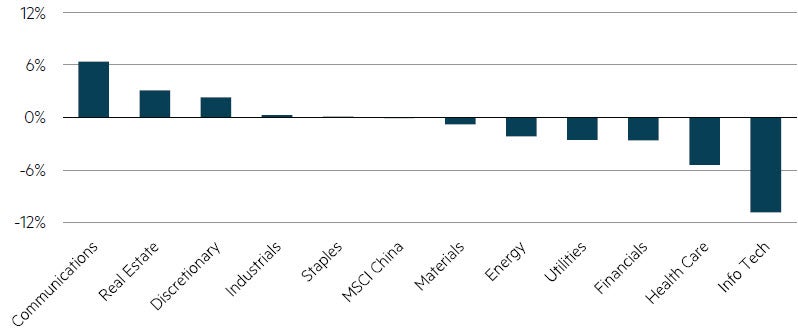

Meanwhile, at an aggregate level, we believe fundamentals are improving. Earnings per share revisions have stopped falling, while at a sector level, Communication Services, Consumer Discretionary and Industrials are starting to see upgrades.

MSCI China: Earnings declines bottoming out

Source: FactSet. Data to June 2024.

MSCI China: 3 month EPS Revisions by GICS Sector

Source: FactSet. Data to June 2024.

Policy support for the economy has increased in 2024 and China’s Third Plenum will be another important signpost in its economic recovery and ongoing reform program. While the prospect of large-scale stimulus is low, the policy direction is clear: help support and grow the economy.

Parting thought

The role of an investor is not to take zero risk but rather accept it when the payoff looks commensurately asymmetric. In other words, buy when the risk-reward pay off looks attractive. After a three-year bear market, Chinese equities appear to have found a bottom. With earnings now starting to grow again (at an aggregate level) a combination of cheap valuations and strong balance sheets being used to buy back stock and increase dividends sets up an attractive backdrop for future returns.

Disclaimer

This information is prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, AFSL. 237296 (‘MBA’) as the Responsible Entity of the Maple-Brown Abbott Asian Investment Trust ARSN 102 593 457 (‘Fund’). This article contains general information only, and does not take into account your investment objectives, financial situation or specific needs.

Before making a decision whether to acquire, or to continue to hold an investment in the Fund, investors should obtain independent financial advice and consider the current Product Disclosure Statement and Target Market Determination (TMD) or any other relevant disclosure document which are available at maple-brownabbott.com/document-library or by calling 1300 097 995.

Any views expressed on individual stocks or other investments, or any forecasts or estimates, are not a recommendation to buy, sell or hold, they are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this document. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications not described in this document. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of this information, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on this information. This information is current as of 29 July 2024 and is subject to change at any time without notice.

© 2024 Maple-Brown Abbott Limited.