Viewpoint

- Improving corporate governance is at the heart of Japan’s equity market renaissance, with a similar theme now enveloping the South Korean corporate sector in the form of their new “Corporate Value-Up Program”.

- Contributing to the regional theme, recent regulatory reforms introduced for Chinese state owned enterprises are having a positive effect on capital allocation.

- We believe these reforms will be a multi-year tailwind, and with Korean and Chinese equities trading at deeply discounted valuations, such positive developments are far from priced in.

Japan’s equity market is currently experiencing a renaissance. After a multi-decade period of stagnation following the burst of the bubble economy during the late-1980s, its equity market recently hit new highs. The MSCI Japan index was up ~29% in 2023 and another ~14% YTD to 29 February 2024 (in local currency terms)*.

Improving corporate governance is at the heart of the move. We see similar encouraging moves in neighbouring countries that could drive further upside.

Japan taking the lead – Korea to follow?

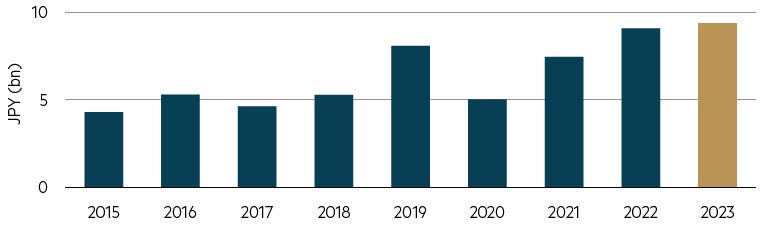

Building on the introduction of Japan’s Stewardship Code in 2014 and Corporate Governance Code in 2015, the Tokyo Stock Exchange (TSE) took more direct initiatives from early 2023, resulting in a directive that listed companies are compelled to disclose plans to improve profitability and company valuations. The intention is improve capital allocation and overall valuations and we believe the result are clear: corporate Japan is responding, and share prices are rising.

TOPIX: annual share buyback amount

Source: Daiwa Securities, January 2024.

A welcome contagion

South Korea and Japan have an intertwined (and complicated) history, and their respective economic development models share many commonalities: strong government support, export-oriented growth and the development of large conglomerates (Korea: chaebol / Japan: keiretsu) involving multiple industries and cross-holdings.

More specifically, they have long been competitors in many industries (e.g. automobiles, ship building and semiconductors), so what is happening in their respective economies (and companies) is relevant and closely monitored.

With that background, it was perhaps less of a surprise to seasoned watchers of these markets to see South Korea’s Financial Services Commission (FSC) announce details of a “Corporate Value-Up Program”, a plan similar to Japan’s aimed at addressing the discount that many Korean companies trade at relative to their international peers. Attainment of ‘Value-Up’ is to be sought via several avenues:

- Encouraging Voluntary Improvement: The program emphasizes fostering a ‘virtuous cycle’ where companies voluntarily improve their value through measures like increased shareholder returns, optimized capital structures and enhanced corporate governance.

- Tax Incentives: The FSC plans to offer various tax benefits to incentivise companies to participate in the program and implement value-enhancing initiatives.

- Transparency and Information Disclosure: The program encourages listed companies to develop and disclose their "corporate value enhancement plans" outlining their efforts to improve corporate value. This aims to increase transparency and build investor confidence.

- Index and ETF Creation: The government plans to create a dedicated index and an exchange-traded fund (ETF) for companies actively participating in the program, offering investors a targeted investment vehicle.

The potential for value-add is even larger than in Japan, with the entire Korean market valued at ~1.0 price-to-book and some ~69% of all companies currently listed trading below book value (versus ~47% in Japan)**.

| Market | Japan | South Korea | China |

| Total market cap (US$ bn) | 6,752 | 1,940 | 7,399 |

| Global market cap ranking | 3rd | 11th | 2nd |

| # stocks with market cap >US$1bn | 698 | 212 | 1,477 |

| Price/book (x) | 1.5 | 1.0 | 1.1 |

| Return on equity (%) | 9.1 | 6.1 | 11.5 |

| 12m forward price/earnings (x) | 15.1 | 10.2 | 8.2 |

| Dividend yield (%) | 2.1 | 2.2 | 3.1 |

Source: FactSet, World Bank, MSCI, 31 January 2024.

It is early days in Korea's path to closing the discount and important details around tax breaks and other incentives remain outstanding. Attracting participation from key companies (especially chaebols) as well as developing a robust monitoring framework to ensure genuine improvement will be central to the success of the program. Yet with Japan’s precedent, it will be increasingly difficult for management teams across corporate Korea to resist the growing shareholder pressure.

China beating its own path on corporate reform

Meanwhile in China, recent regulatory reforms introduced for state owned enterprises (SOEs) are having a positive effect on capital allocation and driving this cohort’s share prices higher. The first signs of reform started in January 2023, when the state assets regulator (SASAC***) announced the introduction of Return-on-Equity as a metric for management performance. Many of these companies have excess cash on balance sheet, depressing return on equity. The easiest way for management teams to hit these targets is to pay out more of this cash. China Mobile is a good example here, where after its most recent results it increased its payout ratio, as well as resumed share buybacks. Furthermore, in January 2024 SASAC announced that SOE management teams should pay more attention to their market value (i.e. share price) and it will also be added to their performance metrics.

Where to next?

After countless meetings with management teams over the last 20 years, we welcome these changes as they represent an unlocking of value that has been frustratingly obvious. Cynical market participants in the region may point to previous false dawns and rounds of reforms which failed to deliver meaningful value uplift. Yet incremental actions by regulators in Japan, Korea and China suggest there is little room for retreat. We believe this will be a multi-year investment theme as we understand that corporate attitudes and behaviour changes will take time. At present however, both Korea and China trade at deeply discounted valuations, and these positive developments are far from priced in. As 2024 unfolds, we think investors will start to recognise this disconnect and send equity prices higher.

Parting thought

Our long-term focus, patience and experience serves us well in recognising the steady and growing tailwind that corporate governance reform will have on select Asian equities. We expect to build this emerging theme in to our portfolios over time.

* FactSet.

** Jeffries.

*** State-Owned Assets Supervision and Administration Commission.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, AFSL 237296 (“MBA”). This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. Past performance is not a reliable indicator of future performance. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. This information is current at 8 March 2024 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2024 Maple-Brown Abbott Limited.