The time of maximum pessimism is the best time to buy. John Templeton

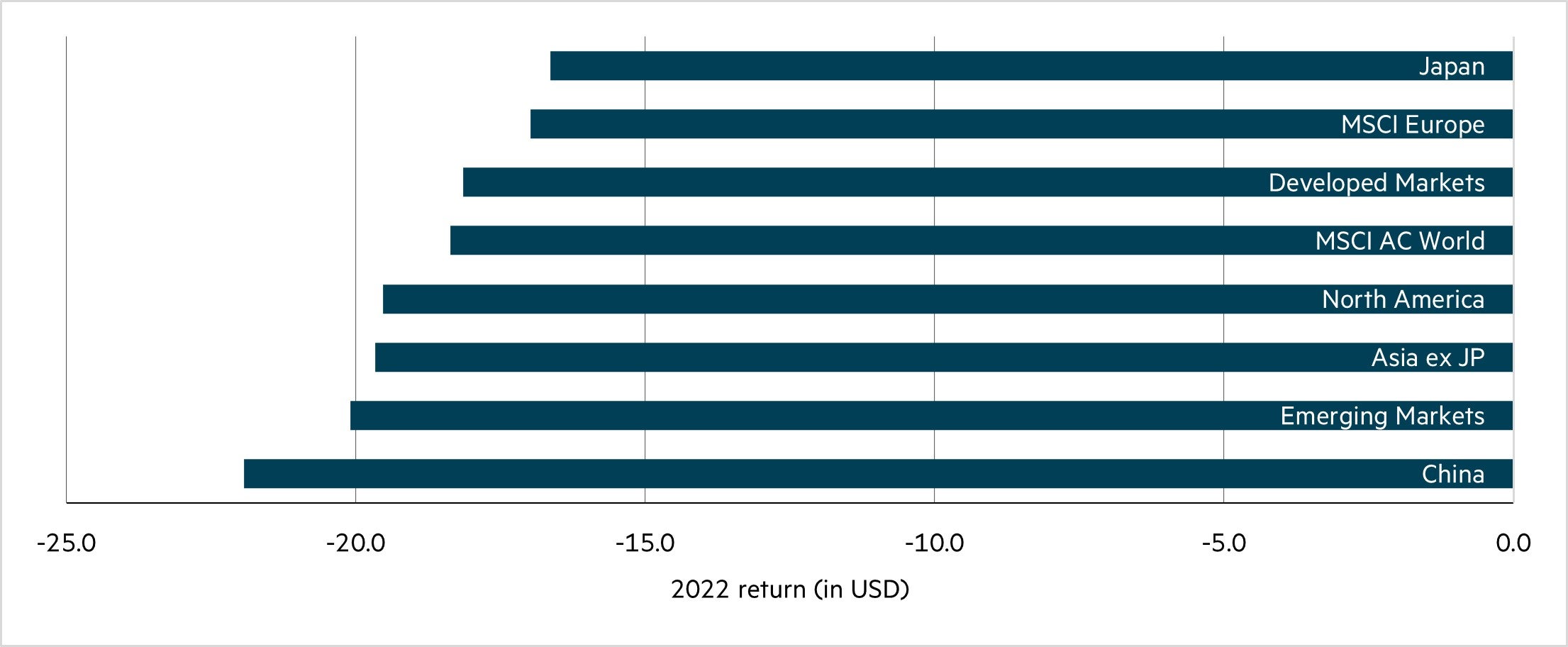

War. Inflation. Geopolitical tensions. In what was a volatile year for global equity markets, the final quarter of 2022 continued this thematic, with Asia close to the centre. The final three months witnessed a bounce in markets, ending the five-quarter run of market declines in the Asian region, primarily due to seeing progress on several issues of investor concern. Despite the bounce, 2022 proved a poor year for equity returns, with the MSCI All Country World Index falling 18.4% in USD terms, its first calendar year decline since 2018 and worst performance since the global financial crisis back in 2008. Unusually, the range of returns in USD terms across regions was narrow, with North America, Europe and Japan all falling by a similar amount. Asia ex-Japan was also in line, falling 19.7% with North Asian markets of China, South Korea and Taiwan declining most within the region.

Regional returns – US dollar returns in 2022

Source: FactSet. Data as at 31 December 2022.

A new dawn in China?

Events in the Middle Kingdom once again dominated investor attention, beginning in October, with Xi Jinping confirmed as General Secretary of the Communist Party for a third term at the 20th National Congress of the Chinese Communist Party. Markets fell heavily in what can best be described as capitulation, with investors concluding China’s zero-COVID policy was here to stay, while its new leadership were little more than Xi sycophants. China has been in a bear market for the past two years �– peaking in February 2021 and at its low point in October 2022, was down 63% (in USD terms).

Despite the negativity surrounding the announcement of the Politburo Standing Committee, our conclusion is not nearly as damaging as the initial price action would suggest. It is true that the removal of dissenting voices is a regressive step, but we would note that President Xi has dominated the Committee for several years. Meanwhile, we believe the appointees, while loyal to Xi, are competent administrators in their own right with proven track records, with several having run major provinces (e.g. Shanghai, Guangdong, Beijing) or government departments.

The economic development of China has been a global success story over the past 25 years. A major reason behind its success has been the practical approach that authorities have adopted when it comes to policy-making. Whether that is supply side reform that started in 2016, cleaning up the shadow banking system in 2017 or more recently rectifying some of the negative aspects of anti-competitive behaviour among the dominant internet platforms. While we acknowledge they do not get everything right (stock market bubble 2015/16 is a prime example), we believe they have proven to be pragmatic when balancing the economy and its political needs. Economic growth (and the jobs and improving living standards that go with it) is a critical element of the political legitimacy of the Communist Party. Crucially, we are seeing evidence of that pragmatism now, with significant progress on many issues afflicting the market, none more important than the change in its approach to managing COVID-19.

While the longer-term political, economic and social implications of the new leadership team in China will continue to be debated, the political gathering was upstaged barely weeks later by the stunning reversal in China’s zero-COVID policy. The Chinese equity market rebounded sharply in the fourth quarter of 2022 and had its best month in the past 20 years, rallying ~30% in November alone, and continued to rally in December.

Given the unsustainable nature of the policy, we had expected an eventual change, however, China’s COVID-19 pivot has come earlier than anticipated. While we welcome the news from an economic standpoint, the human toll over the coming months is likely to be large, given less effective vaccines as well as lower vaccination rates of the elderly. Government efforts to boost vaccination rates, particularly within this cohort are a positive step, though given the rapid spread of the virus at present, this is likely to be too late for many.

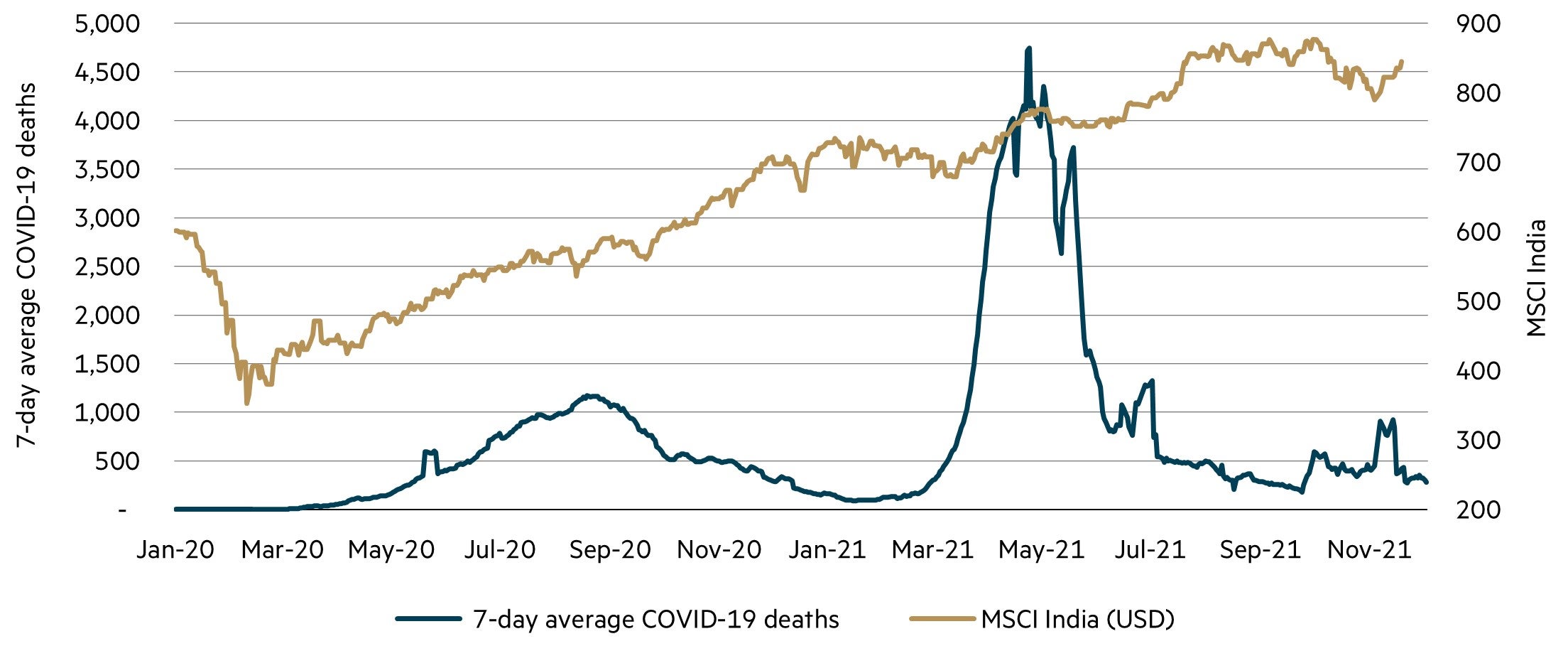

Virtually all countries have gone through a COVID-19 reopening phase, and while acknowledging there are differences, there are useful precedents. The virus is spreading rapidly, and herd immunity is likely to be reached over the coming months. This will bring further volatility and negative headlines around rising deaths, yet the experience from other countries is that equity markets tend to look through this. India in 2021 is a good example. The country suffered from a brutal (Delta) wave in the middle of 2021, yet the equity market continued to rise, given the economic recovery likely to take place (versus costs to the economy of harsh lockdowns).

2021–21 Indian equity market performance and COVID-19

Source: PRS Legislative Research, FactSet as at December 2021.

Elsewhere, there has been progress on other issues overhanging the Chinese market. We have noted the headwinds in previous reports, including the regulatory crackdown on internet platforms, US audit inspections and property market restrictions.

On the regulatory crackdown, the remaining investigations into internet platforms Didi and Full Truck Alliance concluded mid-year, while online gaming licencing continues to ramp up, with more than 100 games approved in December. Also, during the month, US authorities announced they had secured complete access to inspect and investigate the audit papers of US listed Chinese companies, essentially removing any near-term risk of those companies delisting.*** Meanwhile, government efforts to stabilise the property market have ramped up, cutting interest rates and purchase restrictions as well as extending credit, aimed at completing stalled projects and restoring confidence.

We have been increasing the portfolio’s exposure to China over 2022, as valuations have improved. Many world class companies continue to trade at substantial discounts to our assessment of intrinsic value. One key feature of 2022 was the increasing emergence of another significant buyer of Chinese equities – the companies themselves. Rising corporate buybacks in China have been notable, both from the private sector as well as increasingly from state owned enterprises. Reported data for 2022 is hard to come by given different reporting requirements of buybacks, but, anecdotally, all six Chinese internet-related companies owned in the portfolio are buying back stock, as are state owned enterprises CNOOC, Sinopec and China Mobile. Given the strength of balance sheets, free cashflow generation and prevailing valuations, it is a welcome development and an excellent use of capital.

From pessimism to optimism in 2023 and beyond?

Echoing the opening quote, we are enthusiastic about prospective equity returns for the region in the coming year ahead. After two consecutive years of markets falling, and a decade of subpar returns, there are several factors that suggest an inflection point is near and better returns are ahead.

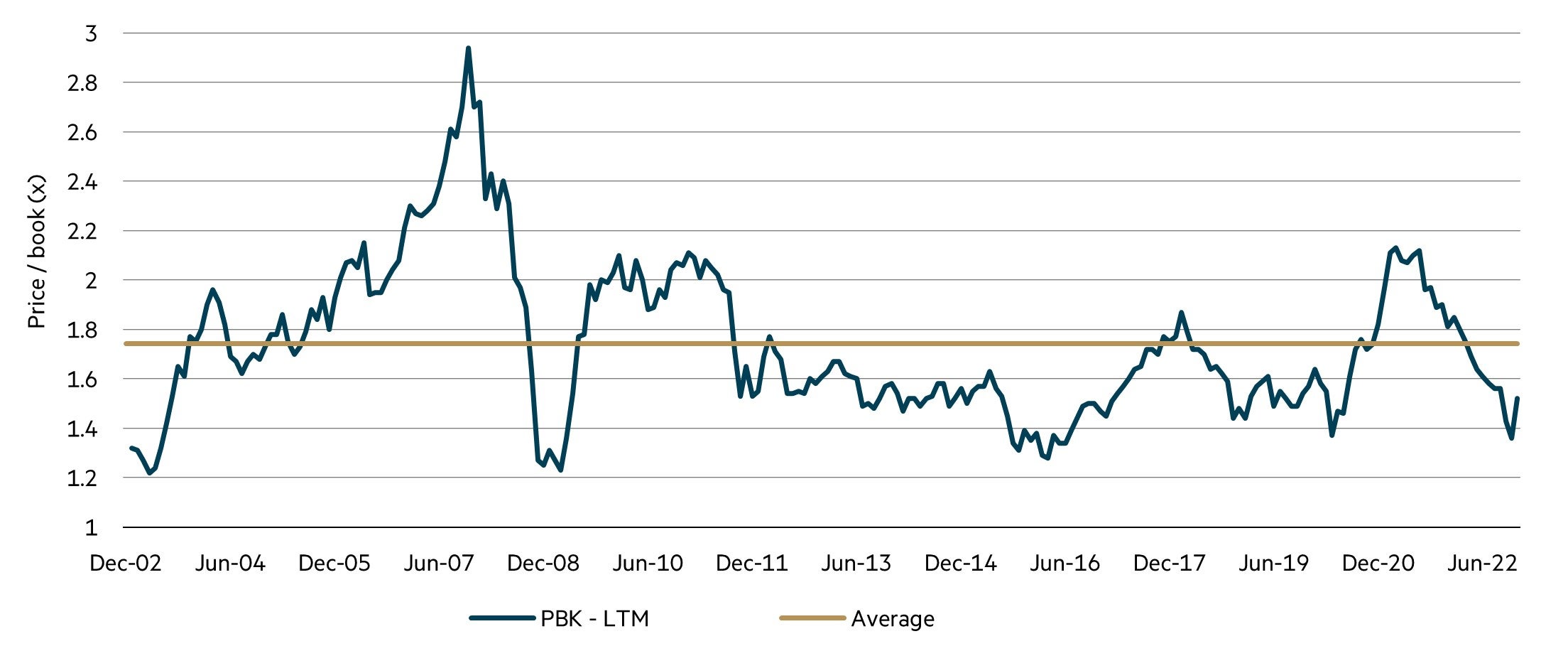

Firstly, starting valuations are low. At a fundamental level, the return of any asset is a function of the initial price paid, its subsequent operational performance and its exit price. Put simply, pay too much for an asset and it does not matter what its subsequent operational performance is, one can still incur a loss (as many investors in US loss-making technology stocks have painfully discovered over the past 12 months). At a company level, many stocks in the region are overly discounted relative to their fundamentals. As the chart shows, aggregate valuations are very close to crisis levels (without any major crisis).

Price/book valuation of MSCI AC Asia ex-Japan, 2002–2022

Source: FactSet. Data as at 31 December 2022

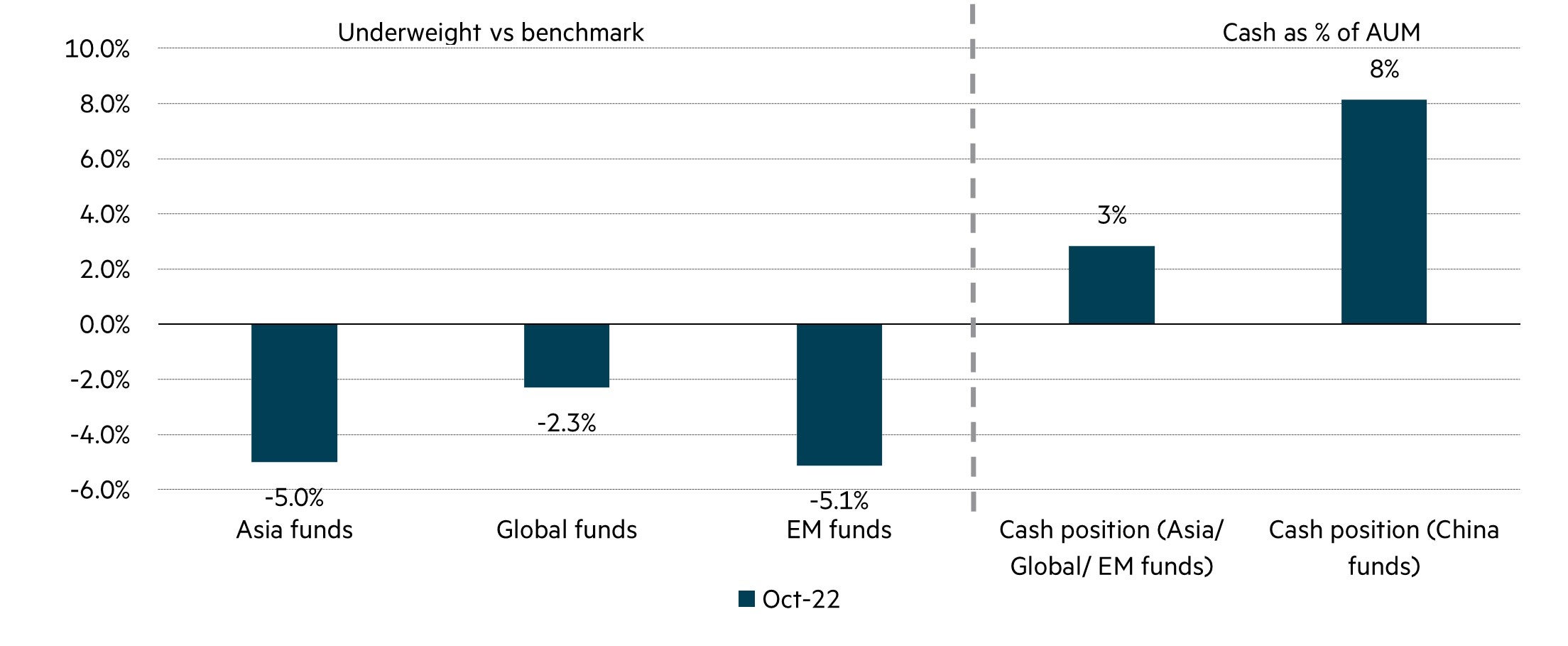

Secondly, ownership of the region is low, indicating there are more potential buyers. As noted earlier, the severe sell-off in late October in Chinese equities pointed to capitulation, with many investors giving up on the region. The chart below, while specific to China, suggests that the region is under-owned relative to its benchmark weighting.

Regional and global fund positioning in China as at 31 October 2022

Source: Bloomberg, FactSet, UBS

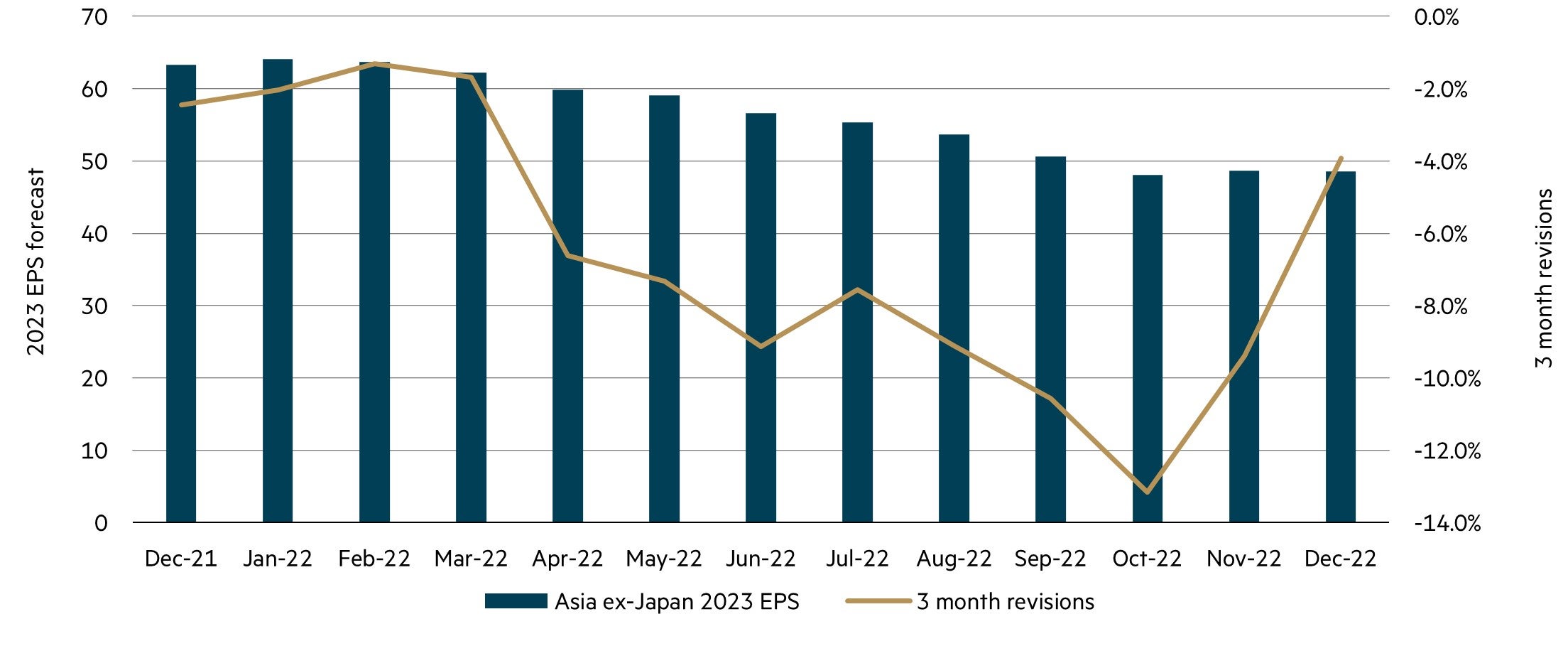

Thirdly, earnings are likely to begin to recover in 2023. Given the slowdown in China’s economy, the broader region has seen significant downgrades to earnings. A closer examination of earnings reveals that the downward three-month revisions have slowed considerably, suggesting a bottom is approaching. Given the starting points of profitability, China emerging from its COVID-19-induced downturn and the property market likely stabilising, there are reasons to be optimistic about future earnings growth. The first half of 2023 is likely to remain under some pressure as China reopens, but the recovery trend will continue.

Asia ex-Japan 2023 EPS – bottoming out

Source: FactSet Data as at 31 December 2022.

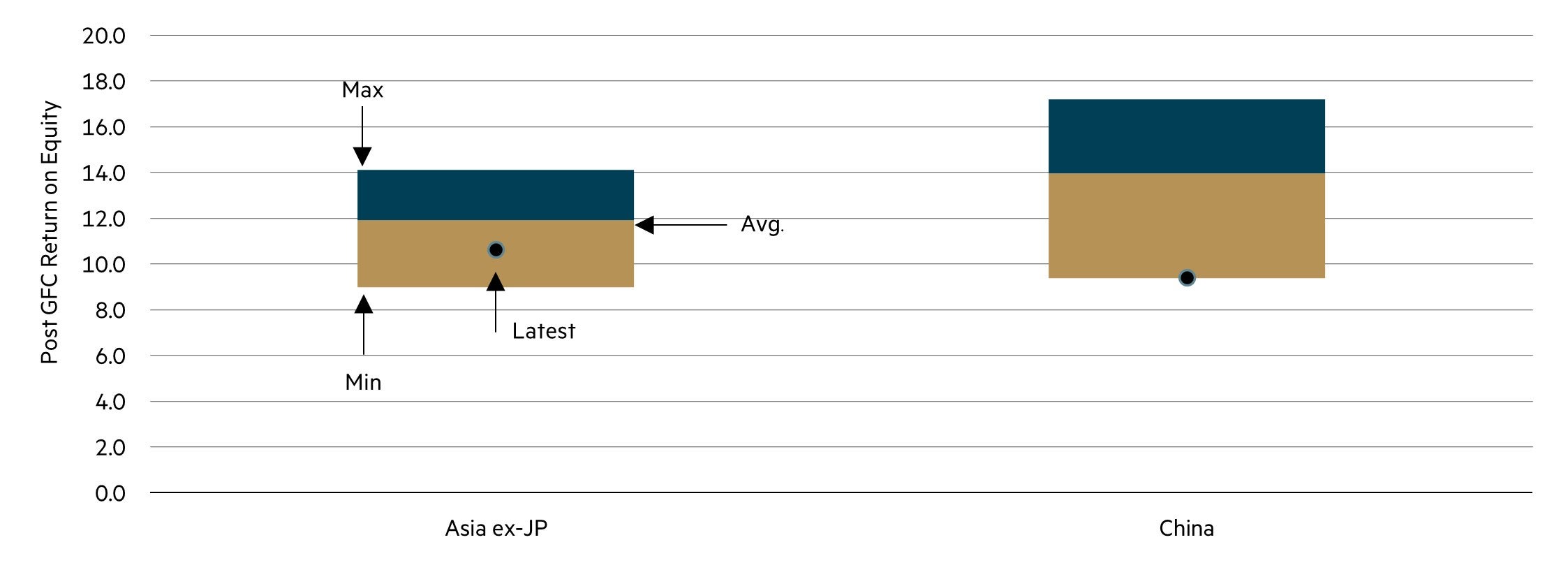

From a longer-term perspective, current profitability is low relative to history by the return on equity for the region and China as shown in the chart. Given the damage to the economy done in China in 2022, a reversion to longer-term average profitability should be a tailwind to regional earnings over the coming years. Moreover, beyond the near term, investors should not need to make heroic assumptions around profitability for earnings to continue to rise beyond the ‘re-opening’ of China.

Post-GFC return on equity, Asia ex-Japan and China

Source: FactSet Data as at 31 December 2022.

Has the market bottomed?

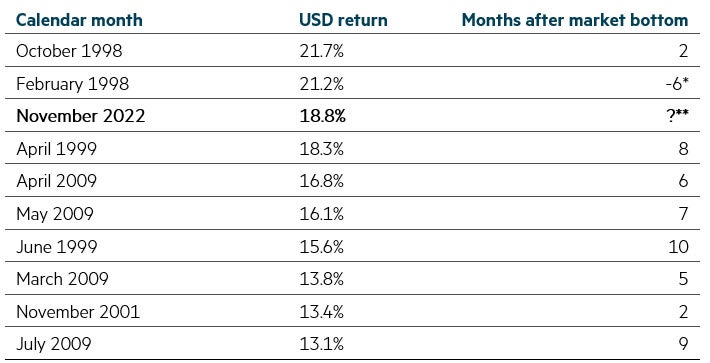

While it is too early to make that definitive call, there are some historical precedents that are encouraging. The bounce seen in the month of November 2022 was the third best in the past 25 years, rising 18.8% in USD terms, with the only months ahead of it recorded around the market bottom back in 1998. Of the other top 10 best months over that period, eight were recorded within 12 months of a major market bottom.

MSCI Asia ex-Japan: Best performing calendar months over past 25 years

* Bear market rally in February 1998, with the market not bottoming until August 1998 (6 months later) **Market bottom not known Source: FactSet. Data as at 31 December 2022

Suffering from a severe bear market, China has featured heavily in our commentary for much of the year, as we have extolled the positive longer-term fundamentals of the market. Having been exceptionally undervalued, it is also pleasing to see the market bounce, with some evidence to suggest it has bottomed. Despite the rise, improving near-term fundamentals and cheap valuations across the broader region are still present and we believe this provides a solid backdrop for a sustainable rally.

*** Earlier in the year, these companies were placed on the list of issuers, which under the Holding Foreign Companies Accountable Act, meant they had three years to become compliant (by offering the regulators full access to their audit papers) or be delisted from US exchanges.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current as at 31 December 2022 and is subject to change at any time without notice. © 2023 Maple-Brown Abbott Limited.