Barring a sharp recovery in the final quarter, calendar 2022 looks like being a very difficult year for investors in the Asian region. Although this is true for most global markets and asset classes this year, we are cognisant that Asia has had a particularly difficult time in the past five years. But as we look into next year and beyond, there are many reasons to be optimistic. We expect improved activity resulting from the eventual re-opening of China along with Hong Kong will provide some positive momentum to offset likely further weakness in developed economies. We also see deep value emerging in South Korea, and several markets across the region have shown resilience, including some ASEAN countries and India, in the face of weak sentiment elsewhere.

Difficult period for the Asian region

Investors were offered little respite in the September quarter as regional markets fell for the fifth consecutive quarter and are on track to post a consecutive calendar year decline for the first time since the dot-com bubble burst in 2000/01. Year to date, the region has declined 21.6% in local currency terms (including dividends) broadly in line with the MSCI AC World Index, which has fallen 22% from its record high in January. Currency weakness against the US dollar has also had a meaningful impact on translated returns year to date, depressing already weak returns further when viewed in US dollar terms (as is commonly done). In US dollar terms, the region is poised to deliver its worst annual return since the global financial crisis (GFC) in 2008, having fallen 27.6% year to date. This has been a global phenomenon rather than a regional one with the US dollar appreciating against most major currencies. Indeed, on a relative basis, Asian currencies have typically fared better than many other regions including Europe and Japan which have seen more pronounced devaluations. Although monetary conditions across Asia have tightened in recent months following monetary policy increases (with expectations of more to come), the external vulnerability of Asia to rising US dollar interest rates is less pronounced than in previous cycles such as the taper tantrum in 2013. As noted in previous reports, the region’s economies are generally in a stronger monetary and fiscal position than in previous cycles and are therefore more resilient to capital outflows resulting from rising US interest rates.

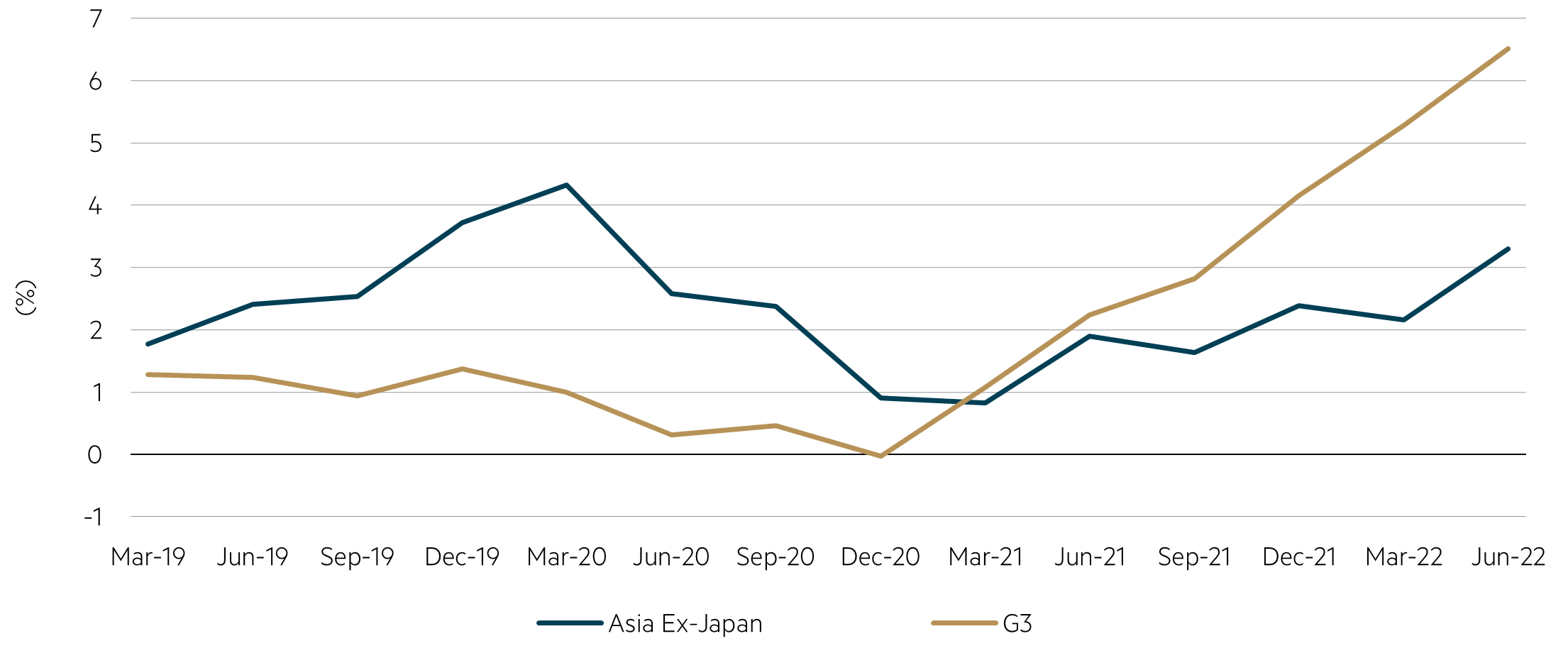

CPI Core Inflation (YoY)

Source: Bloomberg, data to 30 June 2022.

Regionally, investor sentiment is likely to remain beholden to global developments, specifically the impacts of the abrupt US monetary tightening underway and the ongoing war in Ukraine. As has been widely covered, the US Federal Reserve (Fed) adopted an increasingly hawkish tone over the quarter as marked by both the pace and magnitude of its policy adjustments, highlighting the extent to which the Fed has found itself ‘behind the curve’ in its quest to curb inflation. Since June, there have been three consecutive 75 basis point increases (the last time a 75bp increase occurred was in November 1994), leaving the target federal funds rate at 3.25% from 0.25% in March, its highest level since the beginning of 2008. With forward guidance implying a further 125 bps of monetary tightening over the next year, it is expected that investor scrutiny will remain high towards markets and businesses and their ability to digest an increase in the cost of funds. Although such a backdrop is likely to result in elevated volatility, our value-based strategies should ultimately benefit from the eventual recalibration of discount rates used to value cash flows to more ‘normalised’ levels. ‘The bubble of everything’ is deflating as the impact of monetary easing by central banks on asset prices in most asset classes over the past decade is being progressively unwound.

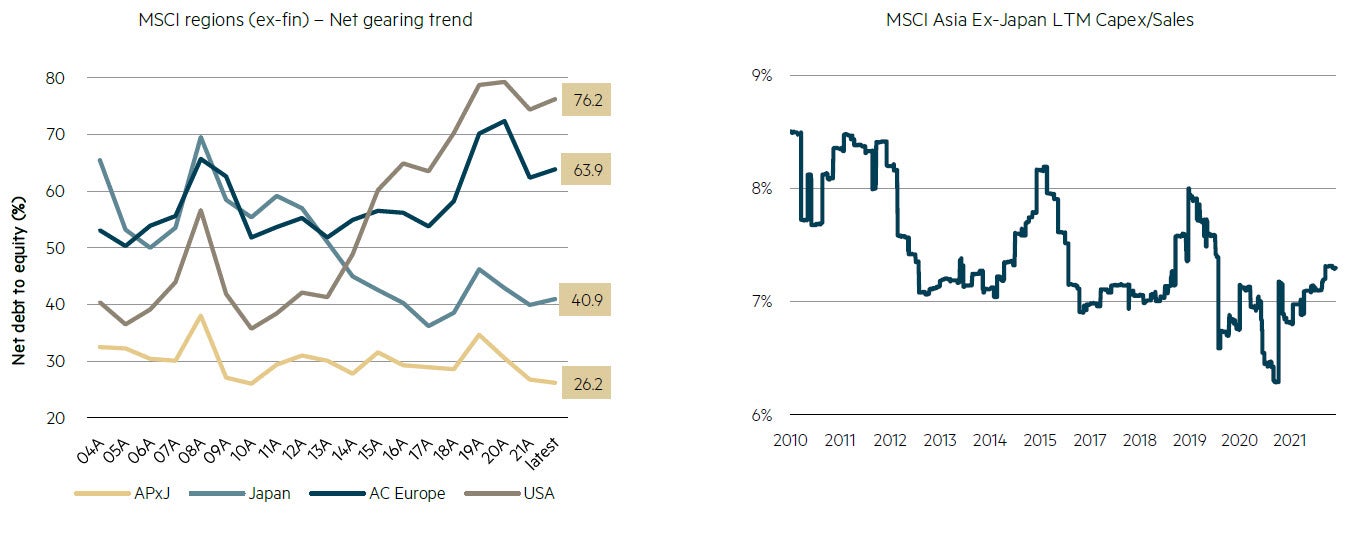

Strong balance sheets and an improving free cash flow position remain supportive for Asia

Among the pessimism pervading markets, it should not be forgotten that Asia retains a strong foundation from which to weather the current bear market. As interest rates around the globe (with the notable exception of China) are expected to rise further over the balance of this year and potentially next, Asian balance sheets remain robust in both absolute and relative terms. Coupled with this, we continue to see better capital discipline from a range of companies across the region as evidenced by a decline in capex to sales and a corresponding increase in free cash flow generation better able to support dividends and other capital management initiatives such as buybacks.

Asia supported by strong balance sheets and capital discipline

Left – Source: FactSet, Jefferies, data to 30 September 2022 | Right – Source: Bloomberg, data to 30 September 2022.

China continues to be weighed by COVID-19 suppression and property weakness

Discussion points regarding China remain dominated by its COVID-19 suppression policy and the fragile state of the domestic property market, a sector reckoned by many to be among the single most important variables to global growth. As the 20th Party Congress confirmed the retention of Xi Jinping as President, investors are now likely to gain some clarity regarding his medium-term intentions on the timeline surrounding China’s emergence from its current COVID-restricted state, including the status of a locally developed mRNA vaccine and a likely roadmap for economic recovery.

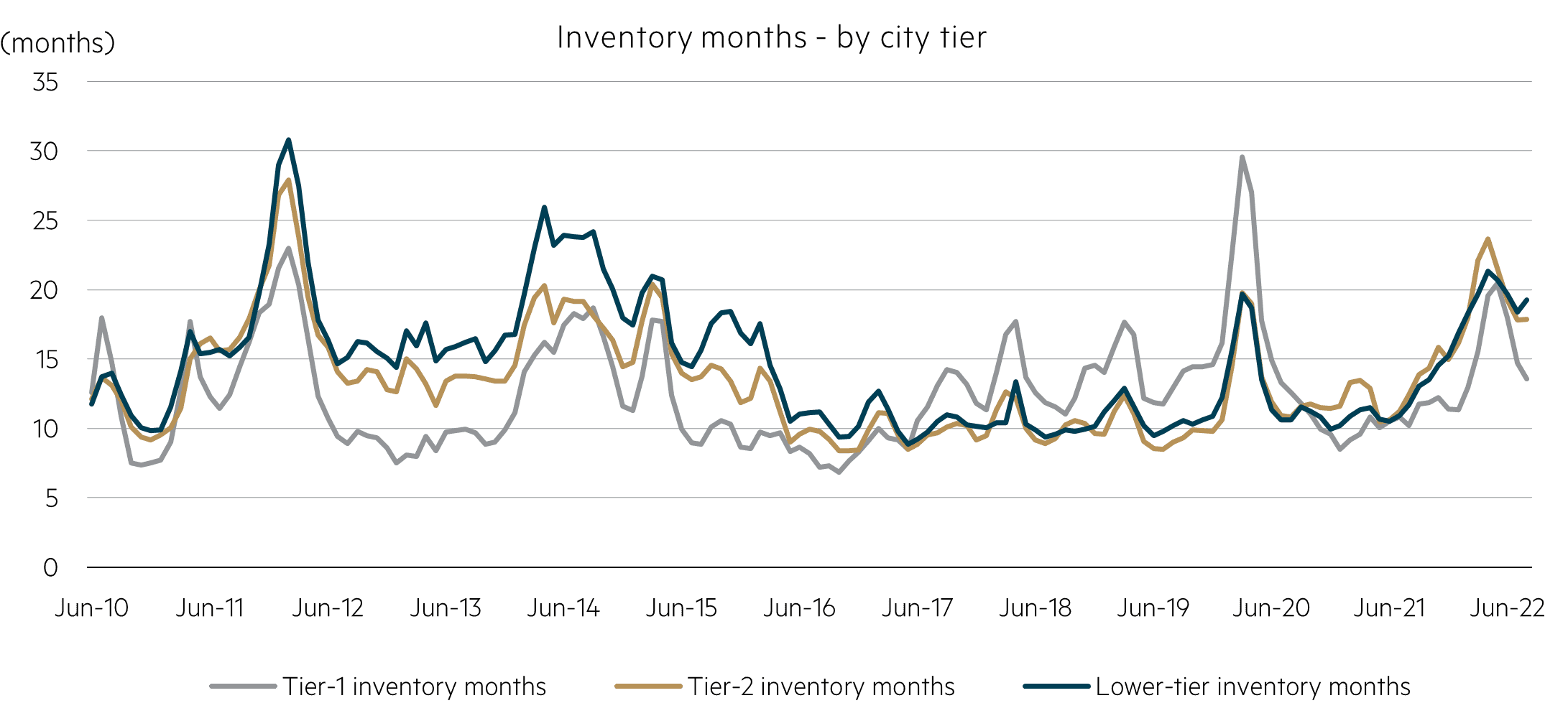

The property sector, which has seen a 38% year-to-date contraction in terms of new commencements (gross floor area) and a 30% decline in the value of residential sales, has left several developers in a perilous position and remains a key source for concern for investors looking at China. While such risks are not to be trivialised, we do not believe the current state of the Chinese property sector is analogous to the US sub-prime housing bust of 2008 as has been suggested by some. At an aggregate economy-wide level, our analysis suggests the direct exposure of potential credit defaults is manageable in the context of the banking system. Also, there is little evidence of speculative excess among property investors who typically retain quite conservative loan-to-value ratios in accordance with government policies, nor is there evidence of a material deterioration in terms of unsold inventory relative to prior cycles as shown in the following chart.

Chinese property market

Source: UBS, data to 31 August 2022.

Even so, we are minimally exposed to mainland property companies and their creditors, preferring less leveraged exposures with similarly depressed valuations. We think it is entirely likely that China will pursue a more modest growth trajectory relative to its recent history with a greater focus on achieving a more sustainable (i.e. less debt-reliant) growth model focused more on developing internal consumption consistent with the tenants of dual circulation and one that focuses more on value-add and tertiary industries. This is likely to have notable effects on relative asset class returns over the months and years ahead.

Progress on ending the impasse between US and Chinese regulators on access to audit papers

In a rare example of positive accord between the two countries, significant progress was made during the quarter to end the decade-old dispute between US and Chinese regulators that had served to threaten the foreign listing on US exchanges for more than 200 Chinese companies. Tacit agreement between the China Securities Regulatory Commission (CSRC) and the US audit authority, the Public Company Accounting Oversight Board (PCAOB), appears to have been reached, with the first batch of inspections of unredacted Chinese audit papers by the PCAOB underway. Although most of the companies at risk of a potential de-listing have already secured secondary listings in Hong Kong or elsewhere, a successful resolution of this long-running issue would be a welcome endorsement of China’s relevance towards the world’s largest equity market in the US. Also overshadowed during the quarter was the commencement in trading of eligible exchange traded funds (ETFs) in the Stock Connect scheme linking Hong Kong and China’s equity markets. This development has been many years in the making and is a further positive enhancement to the widely endorsed Stock Connect program. The portfolio holds the Hong Kong-listed lines of several Chinese internet companies including NetEase and Baidu, which continue to look very depressed relative to their longer-term prospects. As noted last quarter, the regulatory crackdown that has hit the sector is fading, with NetEase receiving approval for its first online game in over a year. Meanwhile, Baidu continues to make progress in its autonomous driving ambitions, gaining regulatory approval for commercial driverless taxis in Chongqing and Wuhan.

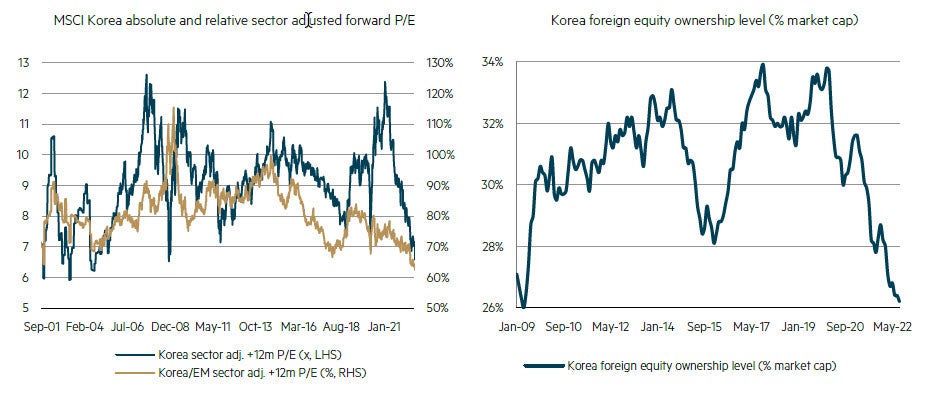

Deep value opportunity emerging in Korea

The slowdown in China has been particularly impactful for South Korea given China accounts for more than a quarter of its total exports. Sentiment has been further depressed given the weak Japanese yen, which has compromised the Bank of Korea’s flexibility in responding to nascent inflationary pressures and to support the won given the competitive overlap between Korea and Japan. Consequently, capital outflows have caused the won to be among the worst performing currencies in the region, plumbing levels not seen since the GFC. The recently installed government led by President Yoon Suk-yeol is expected to adopt a more ‘pro-economy’ stance than the former administration and has proposed a number of reforms aimed at reducing taxes and improving labour market flexibility designed to combat the negative impacts of a weaker global economy. With foreign ownership levels at their lowest levels since 2009 and the market trading at crises valuation levels, we are becoming increasingly attracted to this contrarian opportunity. On the three occasions the Korean market has suffered a calendar year decline of 40% or more (in USD terms), investors have recouped their losses within the following 12 months on each occasion*.

Contrarian opportunity emerging in South Korea

Left – Source: CLSA, MSCI, IBES, data to 30 September 2022 | Right – Source: CLSA, Korea Financial Supervisory Service, data to 31 August 2022.

Pockets of resilience across the region

Within the region several markets (and sectors) have been able to defy the weak sentiment discussed elsewhere and have remained relatively defensive in what is shaping to be the worst year for Asian equities since the GFC. In testament to the better structural position that many countries find themselves in compared to that period, it is encouraging to see a number of the ASEAN markets, particularly Indonesia, which is benefiting from higher commodity prices, as well as Singapore, Thailand and Malaysia, all outperforming over the quarter and year to date.

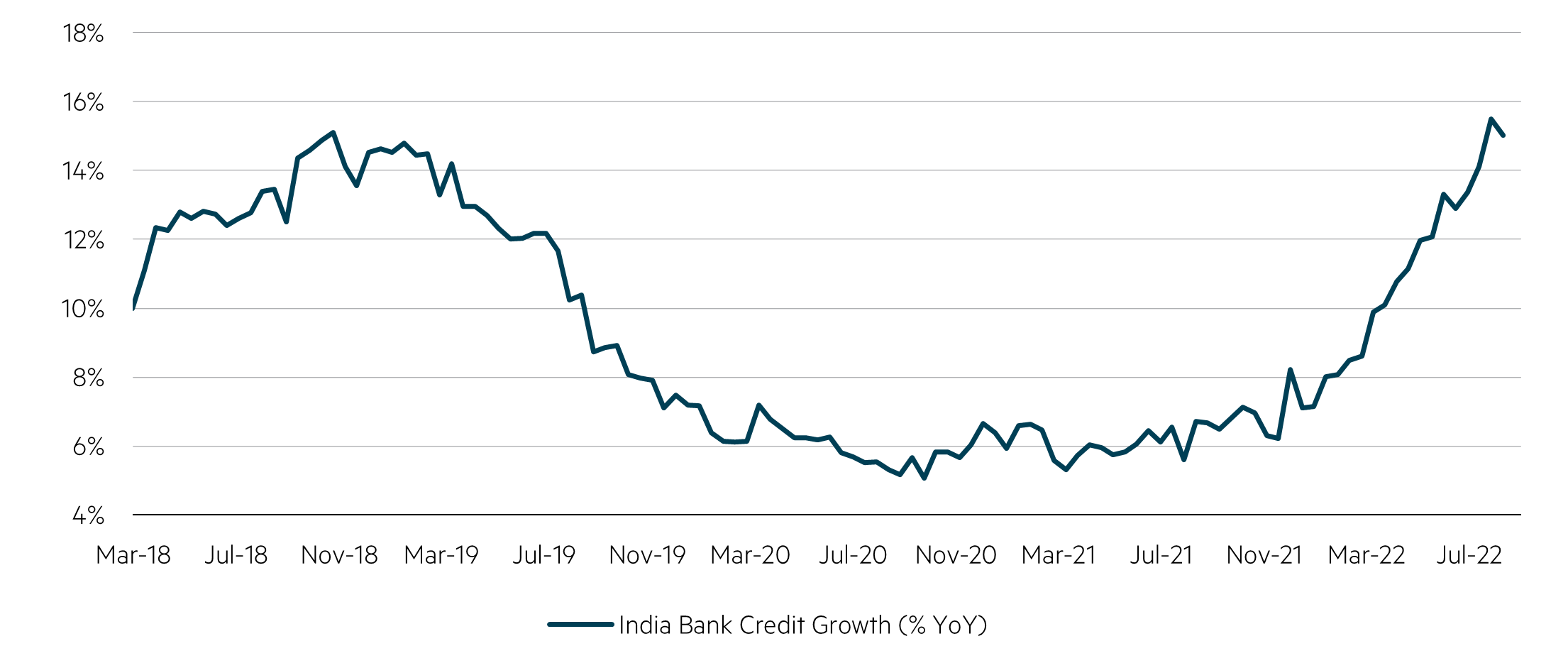

Perhaps even more surprising has been the strong relative performance of India during this period. India has long been somewhat compromised in prior periods of US dollar strength as capital flight puts pressure on both its current account and budget deficit given their heavy reliance on imported oil and other commodities typically priced in US dollars. Although the country is by no means immune to these developments, both the Modi Government and the Reserve Bank of India have done a strong job in recent years in bolstering the resilience of the Indian economy to such shocks. After many years of ‘underdelivering’ against its huge potential, the country appears to be delivering now and is on track to be among the most prosperous economies across the globe this year. A critical component of a sustained recovery absent from prior cycles has been the ability of the nation’s banks (both private and public) to efficiently allocate credit to the most productive areas of the economy. After several years of restructuring and investment, India’s banking system appears to be fulfilling its potential with credit growth returning to levels required to sustain nominal GDP growth above 10%.

Indian economy proving resilient

Source: Jefferies, data to 30 September 2022.

Although the overall Indian market is looking relatively expensive, the portfolio has benefited from an overweight exposure to Indian banks in recent times having accumulated positions during the COVID downturn. Despite their strong performance of late, we continue to see significant scope for the sector to generate healthy profit growth as the economy continues to develop.

In conclusion: A case for Asia

We have been investing in the Asian region through many market cycles and believe there is much to be optimistic about. With the supportive backdrop of the robust balance sheet and free cash flow position, we retain our strong conviction in the region’s upside potential and long-term growth. With portfolio valuations looking as attractive as any time in the past decade, we believe it is a matter of remaining patient.

Author

Geoff Bazzan

* Based on MSCI Korea in USD since 31/12/1987 as sourced from FactSet

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information.