“Bull markets are born on pessimism, grown on scepticism, mature on optimism, and die on euphoria.”

John Templeton

Managing Asian equities for 20 years, we have witnessed various bouts of pessimism and euphoria across markets, sectors and individual stocks. The pessimism towards China equities in the first half of 2022 was among the most extreme we have seen. A weakening economy, strict COVID-19 lockdowns as well as an unwillingness to call out Russian military aggression in Ukraine saw many investors exit China (and the broader region). After performing strongly in the immediate aftermath of the COVID induced fall in 2020, the MSCI China benchmark has fallen 55% in USD from peak to trough over the past 18 months. Yet an interesting thing happened over the June quarter. As global equities rolled over, the Chinese market rallied. Indeed, it was one of the few major markets to post positive returns over the quarter. Since bottoming in mid-March, MSCI China has risen 25%. What are the prospects for a sustained bull market in China?

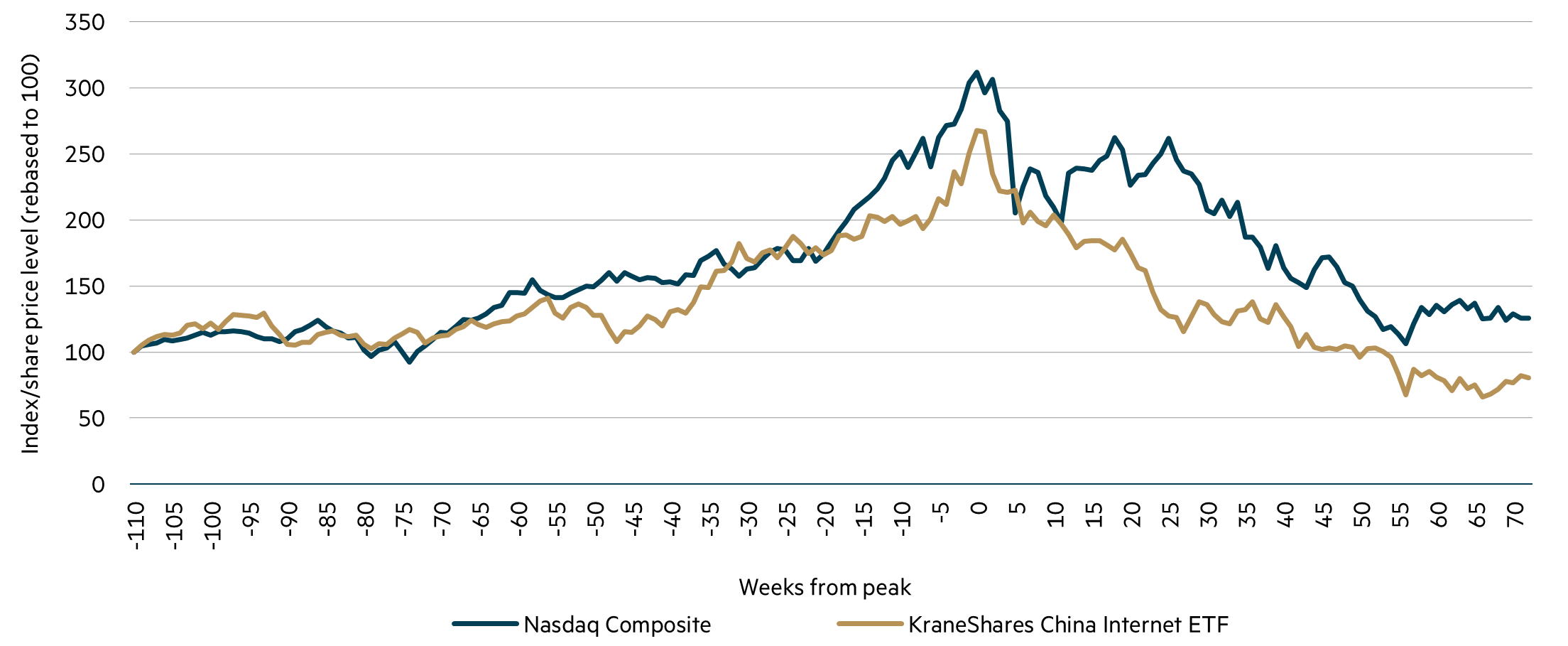

Discussions around Chinese equities invariably lead to questions around the outlook for its internet companies. Having been widely considered as unstoppable a mere 18 months ago, the regulatory crackdown since then has seen prices fall to a level that was arguably inconceivable just a couple of years ago. Share prices for this cohort of stocks has seen them collapse 80% from peak to trough, drawing parallels with the US ‘tech wreck’ some 20 years ago.

China Internet* 2019–22 vs Nasdaq Composite 1999–2001

* China internet price is proxied using KraneShares China Internet ETF which includes both US and Hong Kong listed Chinese internet stocks. Source: FactSet, Bloomberg. May 2022

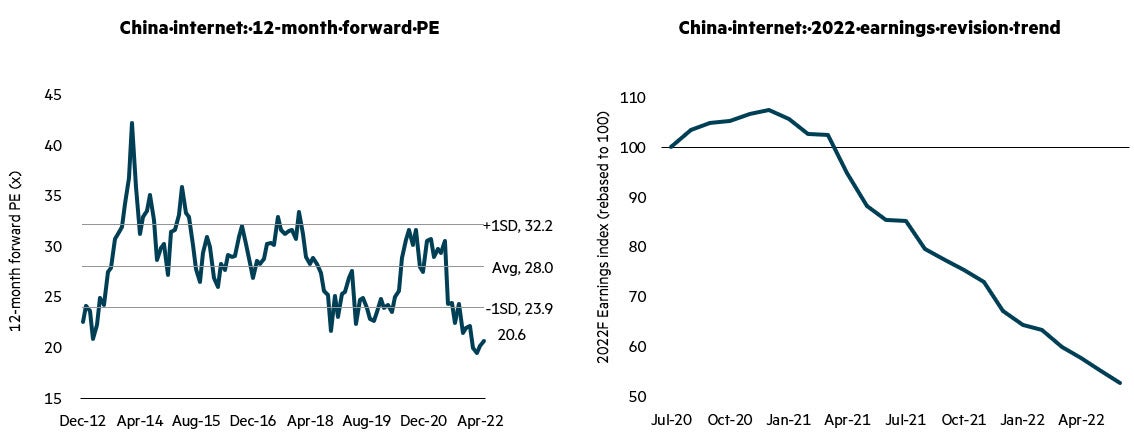

This price fall has been via a combination of earnings downgrades and lower valuation multiples ascribed to earnings. Revenue growth has slowed with the broader economy while investments in new ventures (such as grocery ecommerce, public cloud infrastructure, fintech) kept apace.

Data to 31 May 2022 (left) Data to 30 June 2022 (right) Source: Jefferies

We have been net buyers of this segment of the market, with several stocks being sold off indiscriminately to levels that belie their quality and opportunity for longer-term growth. Moreover, there have been several signs that suggest the worst of the regulatory crackdown is now over. Most telling was in April, where China’s quarterly Politburo meeting chaired by President Xi adopted a more positive tone, calling for the rectifications for the platform economy to be completed. Online game licencing also recommenced in April, having been suspended since July last year. Meanwhile, the long-running data security investigations into US-listed Chinese companies Full Truck Alliance and Kanzhun (Boss Zhipin) were concluded late in the quarter.

To be clear, we are not expecting a rollback of the regulations that have been implemented. Rather we believe the worst has now passed and it’s unlikely there will be any new strict measures. Together with the more transparent regulatory process, over time this will offer greater confidence in the outlook for the sector. We continue to assert that the goal of Chinese regulators has not been to permanently damage the earnings power of its internet giants but rather to clean up some of the less desirable elements of the platform economy (something Western governments continue to grapple with today). Many of these companies will assist in China’s strategic priorities like the development of artificial intelligence, greater semiconductor independence and the digitisation of industry as well as serve as a counterbalance to the US internet giants.

Earnings have yet to bottom in the sector and we expect this to be the next key milestone for a gradual recovery. The weakness in the broader economy has delayed this signpost and, more recently, there have been reports of companies including Tencent and Alibaba scaling back their investment teams to insulate their bottom lines.** At the same time, they have taken advantage of depressed share prices and increased buyback activity, an encouraging sign as to management’s confidence in the longer-term outlook.

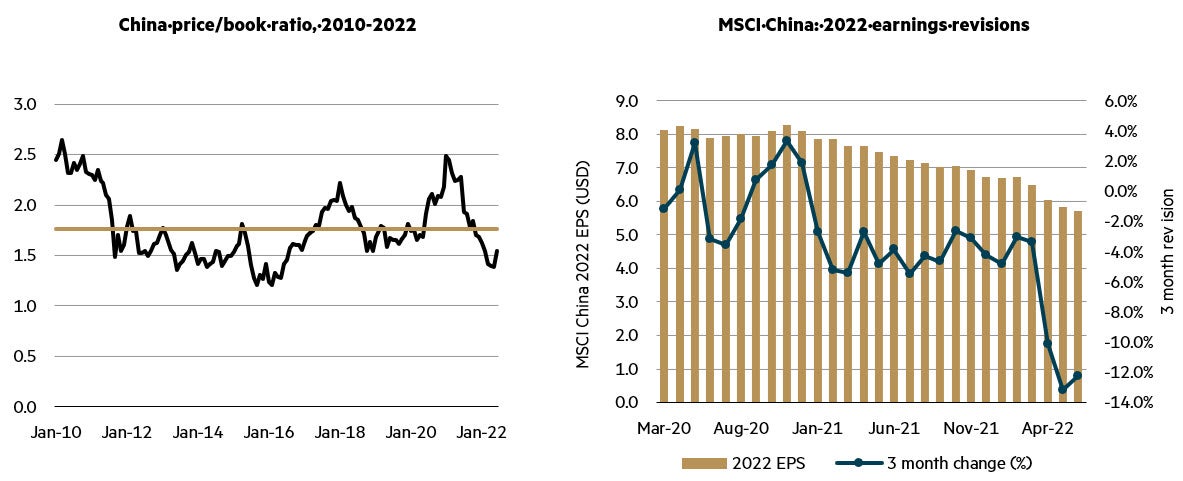

While this commentary has focused on China’s internet companies, much of it is relevant to the broader market. Company earnings have experienced downgrades as a sluggish economy was then impacted by lockdowns (and commensurate supply chain issues). Valuations have also come down to levels that look attractive at an aggregate level.

Source: UBS, Jefferies, Data to 30 June 2022

Encouragingly, leading indicators point to bottoming out in economic activity, with earnings revisions likely to bottom in the second half of 2022. Further city-wide lockdowns may delay the earnings recovery; however, our base case assumption is that any such lockdowns will be more targeted going forward. The recent halving of time required in quarantine for international travellers (from 21 days to 10) was a welcome development and signals the authorities are cognisant of the risks to the economy that its dynamic zero-COVID policy brings. The 20th Party Congress is set be held in the second half of 2022 where President Xi is likely to seek an unprecedented third term in office. History suggests that in the lead up to this five-yearly event, authorities will seek to boost the economy.

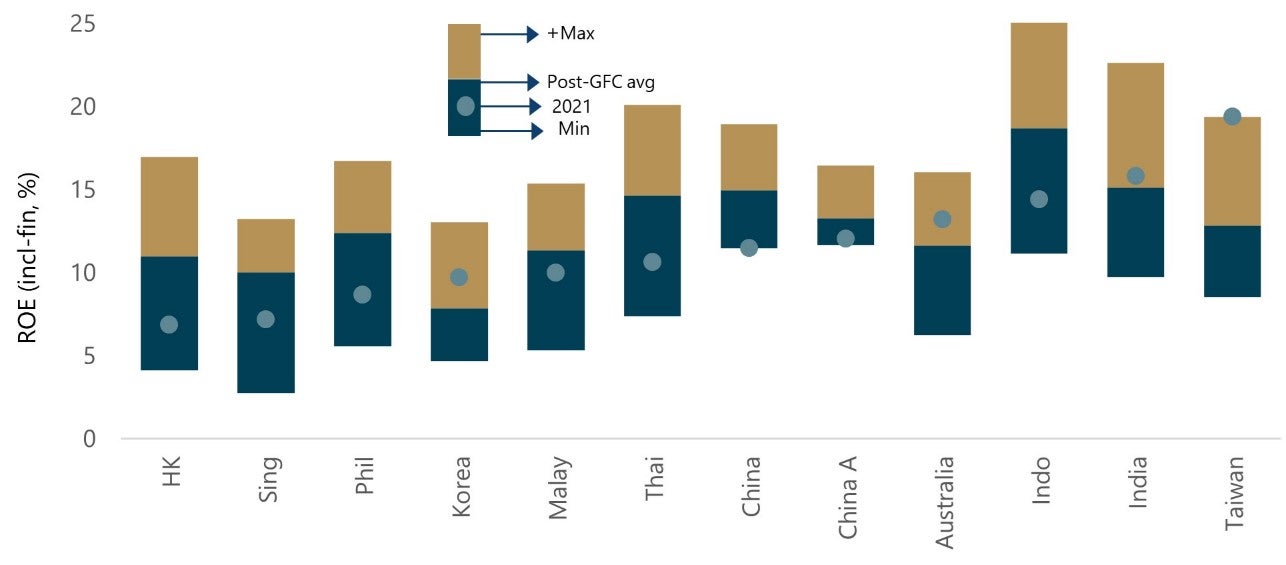

Looking at the recent profitability of China through a longer-term lens, it is low relative to its history. The following chart looks at the return on equity (ROE) of the region since the global financial crisis, as well as what was achieved in 2021. China’s ROE (both for Hong Kong and mainland listed companies) was at the bottom of its range, suggesting that with an improving cycle, one does not need to make heroic assumptions around profitability to see higher profits in future. This contrasts to a market like Taiwan (a key underweight of the portfolio), where ROE is at a historical high after a big cycle. It has benefited from the global shortage in semiconductors, a key export, which has given them some pricing power, as well as the boost in IT spending from the rise in ‘working from home’.

MSCI Asia ex-Japan: Return on equity peak-to-trough since 2010

Source: Jefferies, Data to 31 May 2022

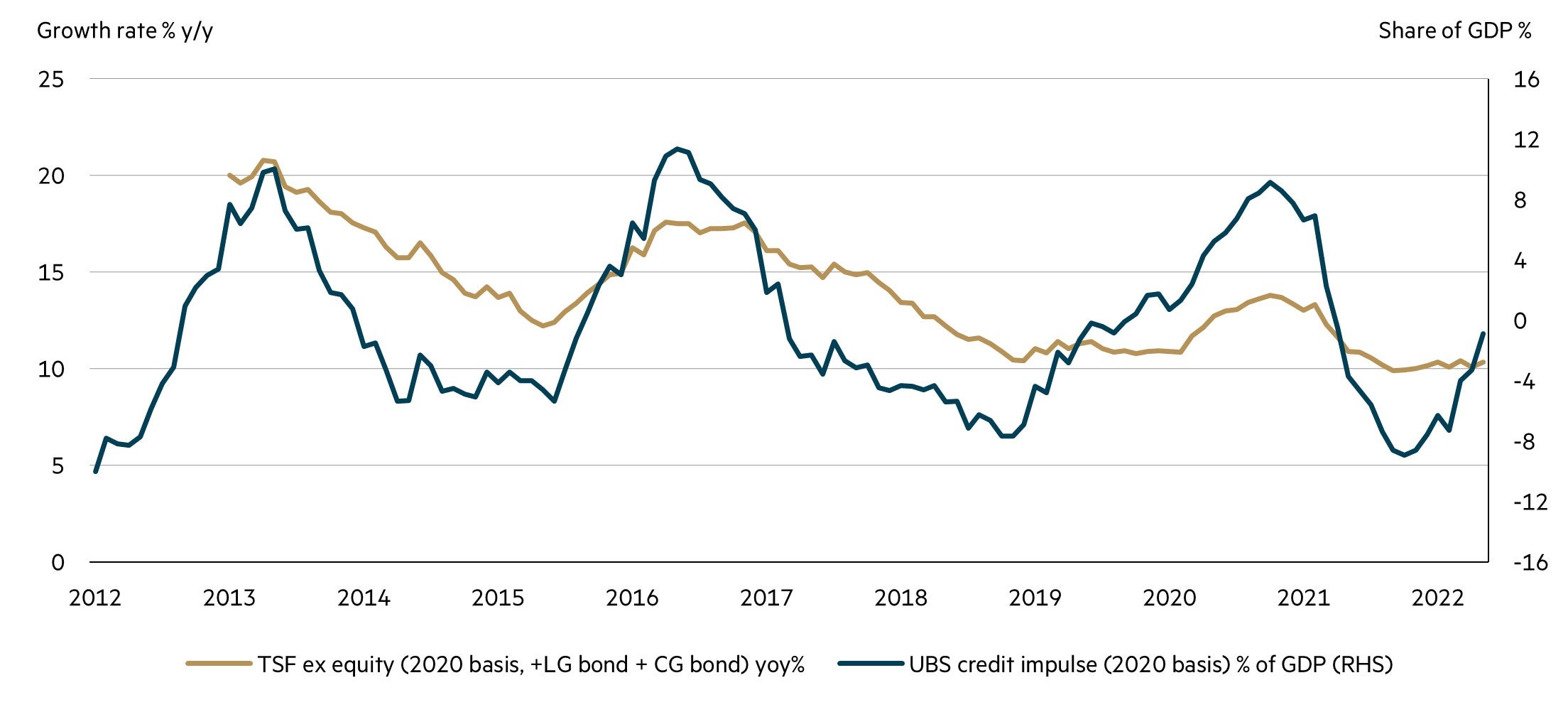

What could kickstart China’s earnings cycle? Perhaps most obviously, greater fiscal stimulus, and there is evidence that this is starting to accelerate. In May, China’s State Council released a set of 33 measures covering a wide range of mechanisms aimed at supporting businesses impacted by COVID-19. On the monetary side, mortgage rates were cut again in May, while restrictions on house purchases eased in many cities. China’s credit impulse has turned up recently, indicating that credit is flowing again into the economy.

China’s credit impulse turning up

Source: CEIC, UBS China Economics Team, Data to 31 May 2022

Further modifications to China’s COVID-19 strategy would also boost confidence and encourage consumer spending, including the adoption of mRNA vaccine technology. China is currently developing its own mRNA vaccines, some of which are already in clinical trials. The leading contender, ARCoV, made by Suzhou-based biotechnology start-up Abogen Biosciences, released promising results in May, with phase III trials currently underway.

As the opening quote suggests, negative sentiment is a key factor in better prospective equity market returns. This is because it often corresponds with low starting valuations as well as a generally low level of earnings (or profitability). While it is too early to definitively conclude that China is at the start of a new bull market, several of the pieces of the puzzle are present that have the makings of a stronger equity market ahead. A better earnings outlook is the final component that remains elusive for now, yet with the economy seemingly past its worst point and starting to reopen and more fiscal stimulus likely, earnings have significant upside potential from the current low levels of profitability. China remains the largest overweight in the portfolio, holding a diversified range of companies with robust business models trading at discounted valuations. It is well placed to benefit from this dynamic over the coming period.

** Reported by Pingwest in ‘Alibaba becomes the latest Big Tech to cut back strategic investment team' on 15 July 2022

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information.