Viewpoint

- Has an early sprint simply moved to a more sustainable pace?

- Signs 2023 will be a better year for Asia

- Unusual bull market if it is already over

China and the broader Asia ex-Japan region started 2023 in a sprint, triggered late last year by China’s U-turn on zero-COVID. The region was up 10% (in USD terms) at its peak by the end of January and up 32% since bottoming in October 2022. Markets have given back most of this gain, with the region broadly flat year to date at the end of February. Hawkish commentary from the US Federal Reserve, rising geopolitical tensions and a US dollar that is no longer falling have injected some risk aversion into investor thinking.

So, is that it? Few would argue about the longer-term arguments for the region’s attraction – rising incomes and a growing middle class, digitisation, urbanisation, increasing health care spending, and the associated opportunities and benefits they bring. They remain valid and will continue to play out for the region over the medium and long term.

In the near term, there are several signs to suggest 2023 will be a better year for Asia both in absolute and relative terms.

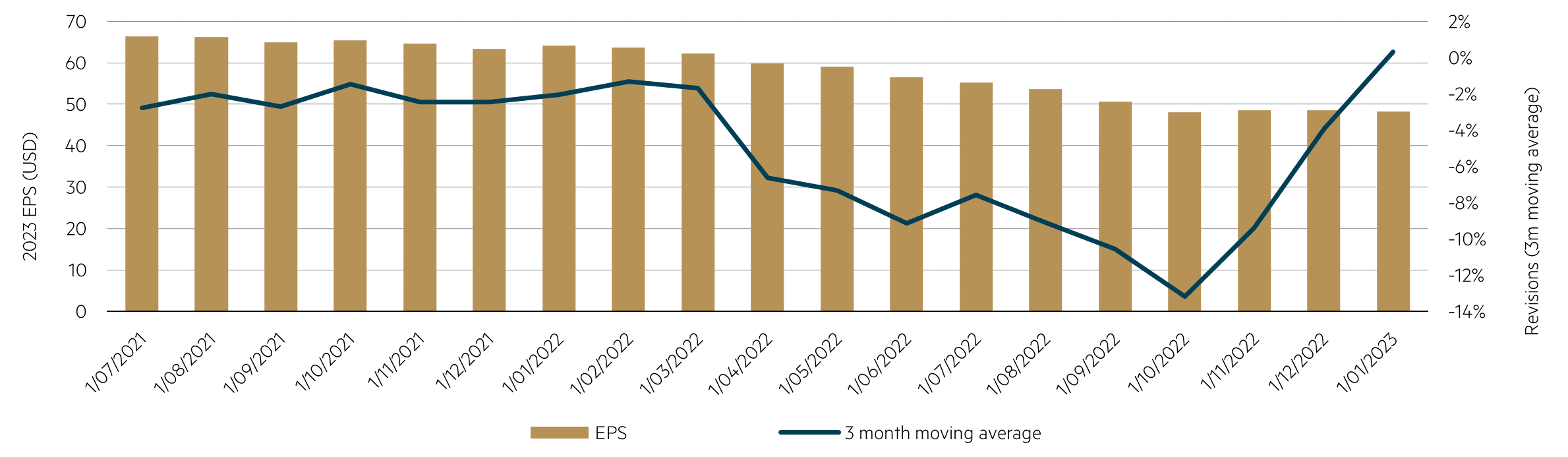

Earnings. After nearly two years of downgrades, forward earnings per share (EPS) revisions for the region inflected in late 2022 and have since turned positive in January. Domestic-orientated companies are likely to see earnings recover assisted by the reopening of China’s economy, though a US/European recession remains a risk to more export-driven companies. More broadly, profitability (as measured by return on equity) across the region remains lower than historical averages, which means even modest rises in revenues and/or margins are likely to drive an earnings recovery.

Asia ex-Japan earnings have turned

Source: FactSet. Data as at 31 January 2023

- Valuations. From crisis levels back in October last year, valuations have increased, though they remain far from egregious. The Asia ex-Japan region trades on 1.6x price/book, a 9% discount from its long-term average. At a company level, we are finding many stocks that trade on valuations close to record lows. As 2023 progresses, earnings will need to continue to recover to see further gains.

- Historical precedent. Work by Morgan Stanley looked at prior bear markets (and subsequent bull market runs).* The most recent bear market in Asia ex-Japan proved the longest in 25 years, lasting 614 days (versus an average of 263 days). If the current bull market had indeed ended in January, it would be the shortest on record (95 days versus an average of 451 days) and one of the smallest (+31% compared with an average of +75%).

- China. At the trough, MSCI China had fallen more than 60% with a series of largely self-inflicted policy decisions that hit large parts of the economy (e.g. regulatory crackdown on internet players, property tightening measures and rolling COVID lockdowns). The good news is that these headwinds have now either eased (in the case of property and regulatory) or become a tailwind (‘revenge spending’ and the re-opening of the economy).

Parting thought

After a challenging period for the Asia ex-Japan region, several factors are aligning for better prospective returns. Volatility may well remain elevated, however we think fundamentals remain sound. From a starting point where valuations are cheap, earnings are recovering and the region is still largely out of favour, Asia ex-Japan markets look attractive for the year ahead.

* ‘Stay the Course – Tailwinds are Stronger than Headwinds’ By Jonathan Garner. 19 February 2023.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at the date of publication and is subject to change at any time without notice. © 2023 Maple-Brown Abbott Limited