Viewpoint

- Equity markets finished 2023 somewhat ‘drunk’ on the US Federal Reserve’s dovish pivot on the likely direction of US monetary policy.

- As we look ahead, we observe significant uncertainty around the macroeconomic outlook, including for interest rates, inflation and growth.

- We believe the potential gains of 2024 have been pulled forward into 2023, and thus the market returns in 2024 will at best prove tepid.

Economic review1

The Australian equity market had a very strong final quarter of 2023, with the S&P/ASX 300 Total Return Index rising 8.4%. Global equity markets rallied, supported by a dovish pivot from the US Federal Reserve, whereby it suggested that rates had likely peaked and revealed expectations of multiple rate cuts in 2024.

Late in the year markets swung back to the notion of central bank rates peaking as inflation continued to moderate. At the December meeting, US Federal Reserve officials signalled no further rate hikes in its base case stating that tightening was “likely at or near its peak for this tightening cycle”. The European Central Bank and Bank of England also opted to keep rates on hold during the quarter. US GDP growth was strong at 1.2% for the September quarter while GDP was slightly negative across key European economies and the UK. Meanwhile economic activity struggled in Japan with GDP falling -0.7% as strong inflation impacted consumer demand.

The hangover?

In most Western countries Christmas is generally a time of joy and connection. This allows us to face the New Year with a sense of optimism – before diaries begin to fill, holidays come to an end and post-Christmas credit card bills arrive! Often this latter change may cause us to reflect on the prospects for the year in a more sobering manner. Similarly, investment markets ended 2023 in a buoyant mood with Santa having come early, in mid-December when the US Federal Reserve decided not to raise rates, but more importantly to tout a dovish pivot regarding the likely direction of US monetary policy in 2024. This pivot set off a sharp reaction in interest rates in many major markets, with the US 2-year Treasury Note falling ~50bps while the 10-year fell ~40bps.

We believe the sharp fall in interest rates boosted a broad range of investment markets and we have seen a reversal of fortune for almost all the asset classes that reflected negative returns during 2022. Importantly though, we have observed that investors had decided much earlier than this Fed announcement that interest rates had peaked, and that inflation would be tamed without any notable impact on the economy. Over the past year investor sentiment has moved on from concerns regarding the risk of a hard landing, to a likely soft landing and now it seems to be a consensus position of almost no landing at all. After the strong recent gains in markets the S&P500 has exceeded many of the target levels that strategists had recently set for end 2024 and we will likely see revisions of those targets!

While many stock markets ended the year on a positive note, the US market has been the key driver of global returns during 2023, sweeping all before it. As has been extensively reported, most of the US market return was generated by the seven large tech names (Apple, Microsoft, etc). Thus, although market returns look healthy, market breadth was poor until late in the period. The Australian market lagged the US market considerably given that banks, resources and defensive names did not keep pace with returns in high-flying global sectors.

Growth stocks remain stretched

Australian growth stocks performed well late in the year and most of the popular names outperformed, adding to the cumulative outperformance enjoyed since the outbreak of COVID. Growth stocks did incredibly well through the COVID period as long bond rates fell below 1%, uplifting valuations. As with key tech names in the US, our leading growth stocks have generally advanced their valuation premiums further since February 2020 as reflected in the table below, notwithstanding that long bond rates are some 300bps higher. The way in which the market, and growth stocks in particular, have shaken off the impact of higher interest rates has been a remarkable feature of the past few years.

Most growth favourites have outperformed since COVID, with valuations often expanding

Growth stocks relative to S&P/ASX 300

| Company Name | Total Relative Return % (Feb 2020 to Dec 2023) | P/E Relative (Feb 2020) | P/E Relative (Dec 2023) |

|---|---|---|---|

| WiseTech Global | 367 | 3.36 | 4.72 |

| Carsales.com | 88 | 1.58 | 1.93 |

| James Hardie Industries PLC | 73 | 1.20 | 1.35 |

| Technology One | 70 | 2.53 | 2.44 |

| REA Group | 56 | 2.16 | 2.78 |

| Goodman Group | 43 | 1.46 | 1.37 |

| NextDC | 39 | n/a | n/a |

| Altium | 23 | 2.63 | 2.63 |

| Macquarie Group | 21 | 0.92 | 1.01 |

| Xero | 16 | 10.52 | 4.82 |

| Cochlear | 15 | 2.36 | 2.96 |

| Seek | 1 | 2.75 | 2.22 |

| Domino’s Pizza | -23 | 1.71 | 1.91 |

| Resmed | -29 | 2.07 | 1.35 |

| CSL | -39 | 2.27 | 1.79 |

Source: MBA, FactSet. Valuation metrics are ‘Next Twelve Month’ consensus estimates.

In our view the key consideration facing markets in 2024 is whether the exuberance of the latter part of 2023 (in particular) can be sustained. Market direction is likely to be very dependent on economic outcomes. The US was expected to have a recession in 2023, and instead enjoyed a solid year of economic growth (a reminder of how economic forecasting is fraught with uncertainty). This has led to optimism regarding the economic outlook for 2024, underpinning corporate earnings forecasts and the market, and reflected in the underperformance of many defensive stocks and sectors (other than healthcare).

What could possibly go wrong?

What might the equivalent of the credit card bill that spoils the post-Christmas goodwill be? Firstly, the outlook for inflation and hence interest rates is central to outcomes. The inflation journey has proven to be largely unpredictable given the unique role that COVID played in the disruption of supply chains and goods inflation has now largely reversed. The resulting decline in the inflation rate has by no means removed the prospect of inflation remaining at undesirably high levels. Reigning in wages growth and related services inflation is likely to prove more challenging (notably in Australia), and if so, would clearly impact the pace of monetary easing that the market is counting on.

The second risk (and clearly linked to the first) is around economic growth and the almost ’no landing’ scenario now largely embedded in forecasts. The last twelve months highlighted how difficult economic forecasting is and 2024 may well prove similarly chastening for forecasters. COVID ensured we have a set of economic circumstances unlike perhaps any we have seen before and thus it is important not to rely overly on past outcomes as we seek insights. Nevertheless, it is worth noting there were expectations of a ’soft landing’ in the US around the time of the early 1990s recession, the 2000s recession and the GFC. In the latter case, in late 2007, the “Federal Reserve Bank of Dallas concluded that the United States should manage to make it through the subprime mortgage crisis without a downturn”.2 In all three instances recessions eventuated, albeit not always deep. It hardly needs to be noted that the overwhelming risk is that economic conditions turn out worse than expected – the best-case scenario seems largely priced into markets.

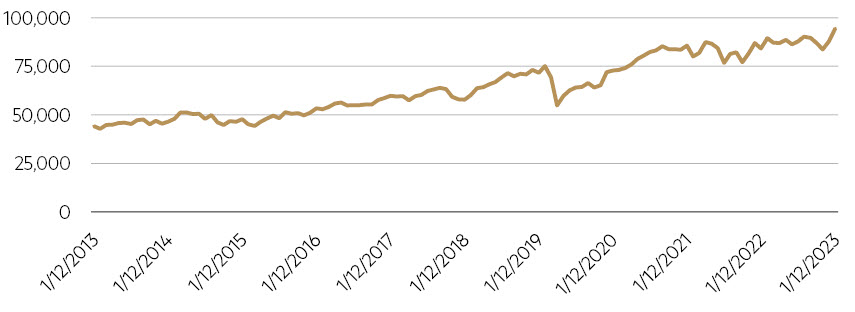

Market at record highs after Fed pivot

Source: FactSet, data from 31 Dec 2013 to 31 Dec 2023.

We bid farewell to 2023 with many developed world market indices at or near record highs. The Australian market (S&P/ASX 300 Total Return Index) similarly finished the year at a record high, supported by the price action of our largest stocks, BHP and Commonwealth Bank. Valuations of many key sectors and stocks are stretched and generally assume sustained earnings growth.

Parting thought

It is difficult for us to conclude anything other than most (all?) of the potential gains of 2024 have been pulled forward into 2023, and thus the market returns in 2024 will at best prove tepid, if not disappointing. If that is the case then it is also likely that the stocks that have propelled markets to highs will disappoint, which should support the performance of contrarian, value managers such as Maple-Brown Abbott.

1 GDP data is based on June quarter-on-quarter growth rates.

2 “Soft Landing Optimism Is Everywhere. That’s Happened Before”. Jeanna Smialek, The New Your Times 27 July 2023.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 31 January 2024 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2024 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

Of Burritos and (inedible) Chips

The tale of two research trips: AI fizz in the US meets gloom across the ditch