Viewpoint

- Our process serves to efficiently identify country and industry-level change and expose emerging stock-level opportunities. This has brought Turkey into focus over the past year.

- President Erdogan’s macroeconomic handbook has been unconventional in the least, but recent changes suggest a return to a more traditional approach. Nonetheless, Turkey currently grapples with relatively high inflation and interest rates.

- As contrarian and benchmark unaware investors, sectors within the Turkish economy have become relatively appealing. In particular, we believe hard-discount food retailer BIM is well priced and well insulated from Turkey’s high inflation rate.

In our experience, focusing on change is a key ingredient to investment performance. Few things remain constant, especially in emerging markets, and being able to recognise critical turning points is crucial. This is why we place change at the core of our process.

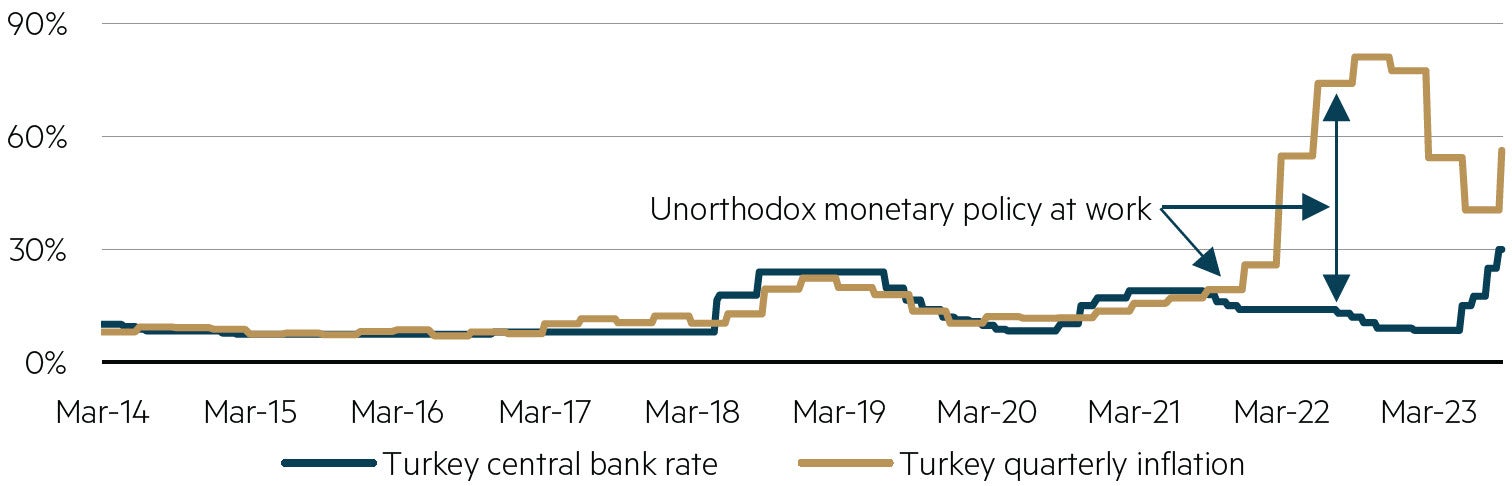

We believe one country undergoing substantial – and surprisingly positive – change in recent months is Turkey. We started to assess Turkey more closely in September 2022 when yearly consumer price inflation hit 81% (see chart below) and it appeared as though President Erdogan was finally losing popularity. Turkey had the potential for change with an election planned for mid-2023.

The history of Erdonomics

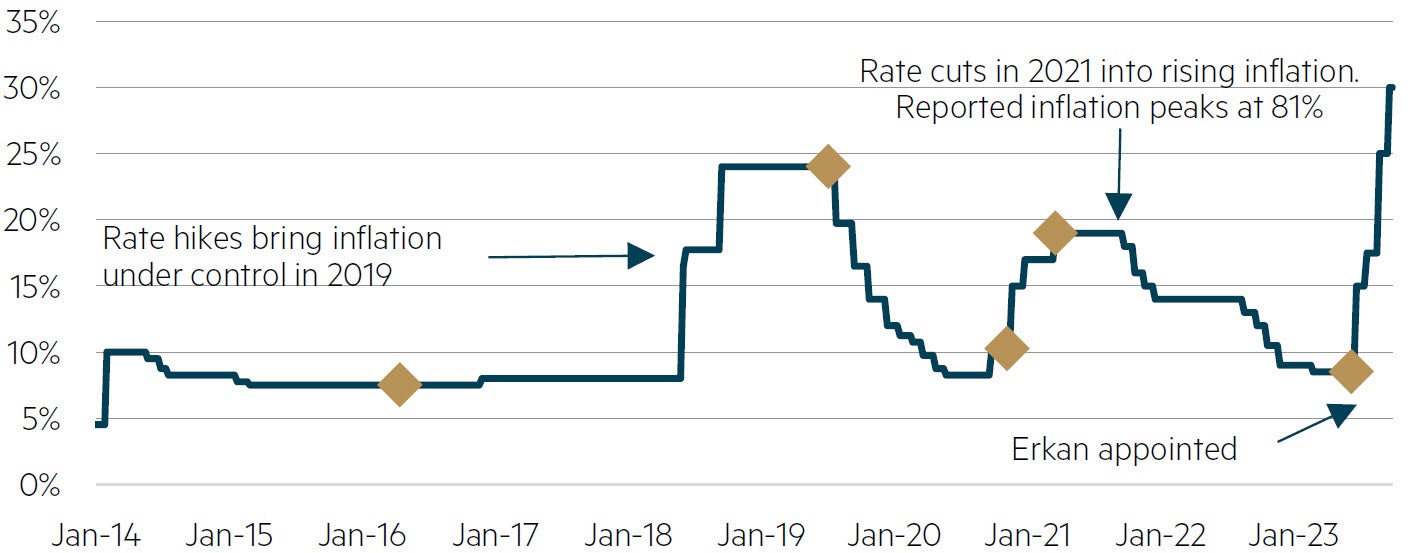

For background, Recep Tayyip Erdogan, commonly referred to as RTE, was Mayor of Istanbul from 1994-1998, Prime Minister of Turkey from 2003 to 2014 and President since 2014. He has been immensely popular, especially with conservative Islamics in Turkey’s heartland. However, over time he became increasingly authoritative. This lead to Erdogan consolidating economic decision making and diminishing the independence of the central bank. That allowed him to pressure policy makers to maintain low interest rates to stimulate growth, even as inflation began to pick up, which can be seen in the chart below. Historically, Erdogan has expressed his unorthodox belief that higher interest rates actually cause inflation. A combination of high inflation, unorthodox economic policies and low foreign exchange reserves led to significant currency depreciation, and an unfavourable risk-reward tradeoff.

Turkey quarterly inflation – the effects of Erdonomics

Source: FactSet, 30 September 2023

From late 2022, we could see the potential for change out of the 2023 presidential election. Inflation exceeded a whopping 80%, consumer sentiment had plummeted and the opposition CHP National Alliance had maintained a lead in the polls for over 12 months*. To our and the market’s surprise, Erdogan managed to turn this result in his direction after a tight first round of voting. The second surprise, however, was far more important: In June, Erdogan made a series of orthodox appointments to senior economic positions. The first was Mehmet Simsek as Finance Minister, who was previously Finance Minister between 2009 to 2015 and Deputy Prime Minister from 2015 to 2018 – both periods of conventional and market-friendly policies. The second was appointing Dr Hafize Gaye Erkan, a former co-CEO and President of First Republic Bank and Goldman Sachs alumni, as the governor of the central bank. Interest rates were increased for the first time since 2021 (when the central bank governor of the time was removed by Erdogan). In one move, interest rates were raised from 8.5% to 15.0%. Markets had some doubt that Erdogan would allow this to continue, but rates have since been increased to 30%.

Turkey central bank rep rate – dots represent a change in central bank governor

Source: FactSet, Wikipedia, 30 September 2023

The Turkish equity market has seen a rally from extreme lows that saw valuations drop to 3.7x forward consensus earnings**. In recent months we have been monitoring the market for contrarian opportunities based off the very low valuations combined with potential for positive change. One new addition to the Maple-Brown Abbott Global Emerging Markets Equity Fund during the September quarter was BIM, the discount grocery retailer in Turkey.

BIM – outpacing Turkey’s 60% inflation rate

BIM is Turkey’s largest food retailer and the pioneer of Turkey’s hard-discount model. BIM was founded in 1995 with the company going public in 2005. It currently has ~10,000 stores in the hard discount and value-oriented supermarket format in Turkey and ~1,000 stores in Morocco and Egypt, which contribute 6% of revenue. Due to its strict focus on maximizing value to customers, it has an average store size of ~300 sqm with 850-900 SKUs of which 65% is private labels. For comparison, a typical supermarket in Australia would carry 12,000-20,000 SKUs and generate around 30% of sales from private labels. BIM’s material contribution from private labels allows it to have up to a 40% price gap on offerings versus other brands***.

BIM was built to replicate the Aldi business model in Turkey with the founders hiring a former Aldi board member to build out the business locally. The strategy is essentially to keep costs at a minimum while maintaining decent service. Advertising is kept to a minimum, with the company preferring customers to recognise BIM for its affordable prices. This business model is known for being highly cash generative and BIM has consistently operated with high levels of operating cash return on capital – over 40% in 2022.

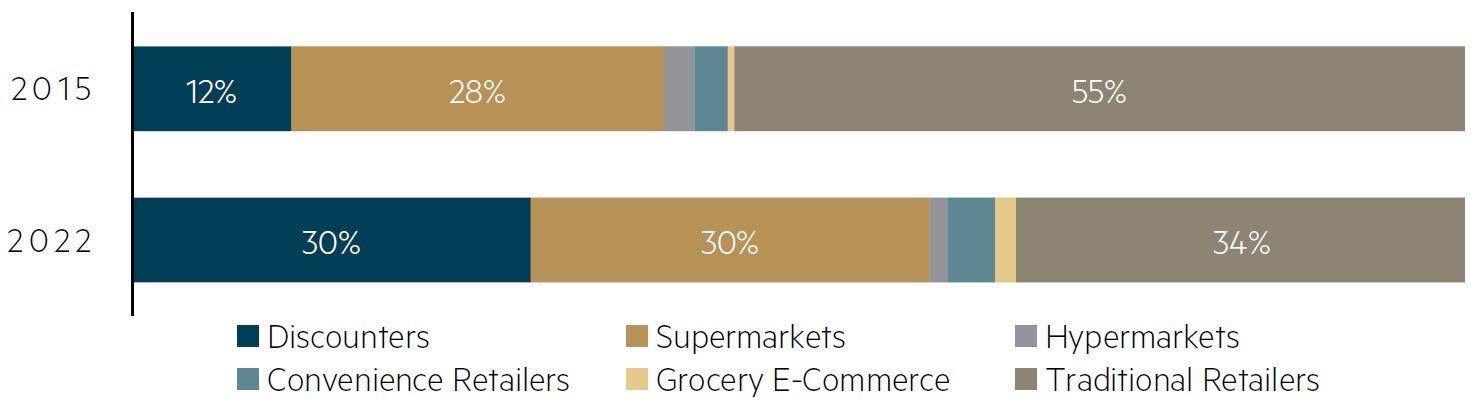

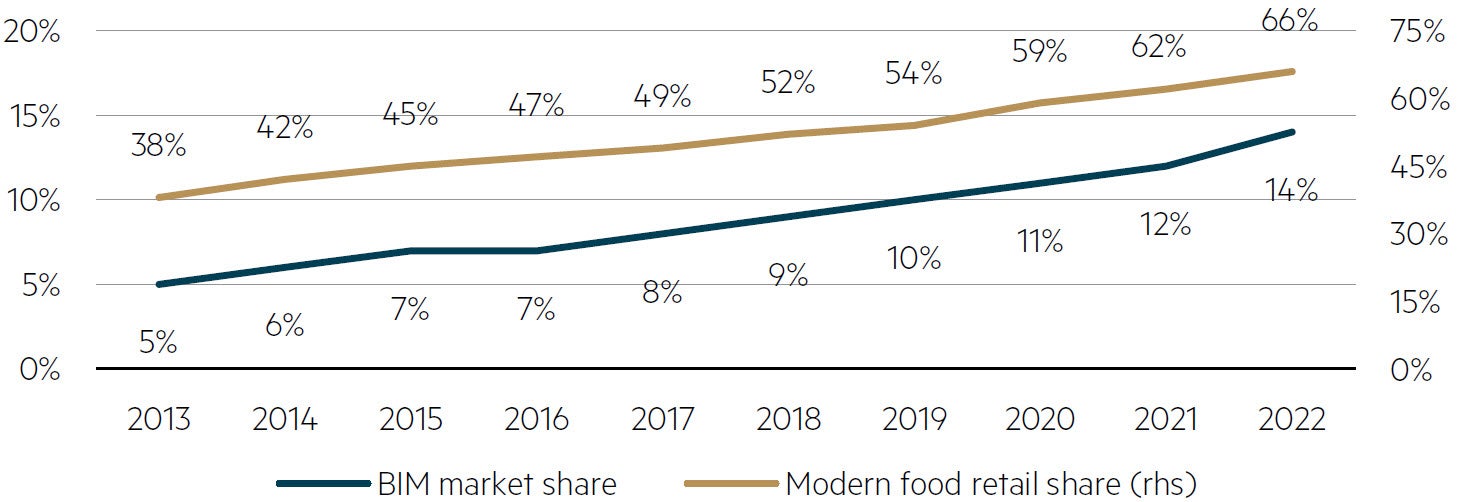

Off the back of challenges faced by the Turkish economy in the last decade, retailers following the discounter model were provided a strong runway of growth as inflation soared and consumer disposable income declined. The market share for discounters, which includes BIM, increased from 12% in 2015 to over 30% today. BIM almost tripled its market share from 5% in 2015 to 14% in 2022. In our view, the franchise has managed to outpace inflationary pressures because of its ability to pass on price hikes to consumers and its value proposition which has helped drive both higher traffic, and a larger basket size. It has also been able to consistently maintain EBITDA margins at 6%^ led by scale in its business model, bringing operating leverage and improved profitability. Its limited SKUs also gives it bargaining power among suppliers meaning it can enjoy lower than average cost of goods.

Turkish food retail – discounters taking share and BIM growing faster within this segment

Turkish food retail market breakdown

Source: Euromonitor, HSBC, 12 June 2023

BIM Market share

Source: Euromonitor, HSBC, 12 June 2023

Despite this in-built inflation protected business model, we have seen BIM derate from more than 30x consensus forward PE in 2013 to hit a low of 6.4x in the middle of 2023. It is currently trading at a consensus forward PE of 10.5x which we think still overly discounts concerns regarding Turkish macro and increased competition.

We like BIM because, in our view, it is one of the best positioned retailers in Turkey due to its growth profile and value proposition, which provides us a natural hedge against the country’s inherent risks. Our analysis shows it has no debt on its balance sheet, a dividend yield of 5%, with an expectation that it grows earnings per share at 41% pa over the next three years.

Parting thought

Our process and experience in dealing with myriad changes across the emerging markets spectrum allows us to efficiently assess the impacts of change across economies small and large. In the case of Turkey, a smaller member of emerging market group, unorthodox macroeconomic policies – whether you subscribe to them or not – can serve up attractive bottom-up opportunities.

* Turkish Statistical Institute, December 2022.

** FactSet, June 2023.

*** Maple-Brown Abbott research.

^ BIM financial statements and broker reports.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 31 October 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.