Viewpoint

- In parts of Latin America, consumer use of financial products has accelerated in recent years. The pace varies markedly between countries, with Brazilians being rapid adopters and Mexicans relative laggards.

- New instant payment ecosystems are central to consumer take-up, supported by central banks and in some cases legislated use.

- Many think the Brazilian experience will open Mexican industries to similar, substantial disruption. But are the precedents valid and the narratives as attractive as they seem?

One widely-understood case for investing in Latin America is the huge opportunity to serve a big ‘unbanked’ population. We also recognise this opportunity, however we appreciate each country is in a different stage of banking technology adoption, consumer attitudes vary and each country has it owns peculiarities. An interesting comparative case study to highlight country-level idiosyncrasies is Brazil and Mexico, which together make up more than half of Latin America’s GDP.

In the last five years Brazil has experienced a huge boom in new players disrupting market incumbents, including in banking. Brazil has seen double-digital bank account ownership growth since 2017, with the country experiencing the fastest bank account growth rate across both emerging and developed economies*. Brazilian bank relationships have now reached an incredible level of one billion accounts (almost five times the population) and 200 million issued credit cards (almost double the employed population)**.

On the flipside, Mexico is still in the earlier phases of relationships with financial institutions, with only 37% of Mexicans having a bank account*** and almost 90% of Mexicans having no access to a credit card****.

Pix versus CoDi: adoption variations

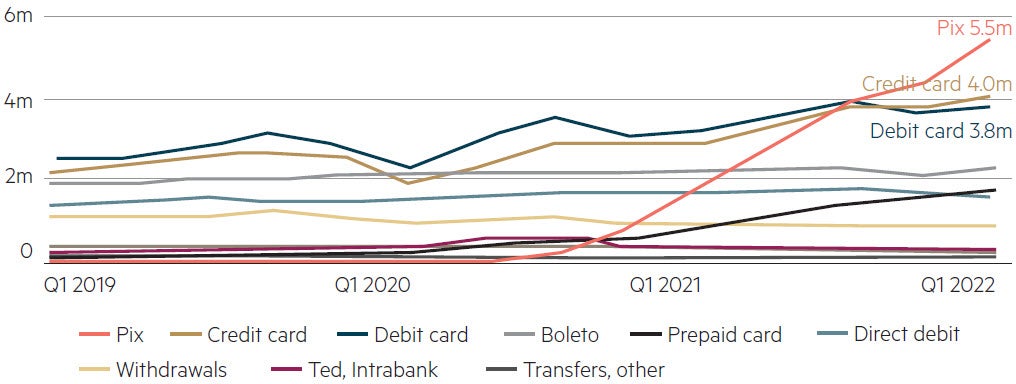

An important tool driving the increase in banking relationships in Brazil has been the rollout of Pix, the free instant payment ecosystem introduced by the Central Bank of Brazil at the end of 2020. Pix became a mandatory requirement for all banks and quickly and materially disrupted the costly and inefficient legacy payment options commonly available.

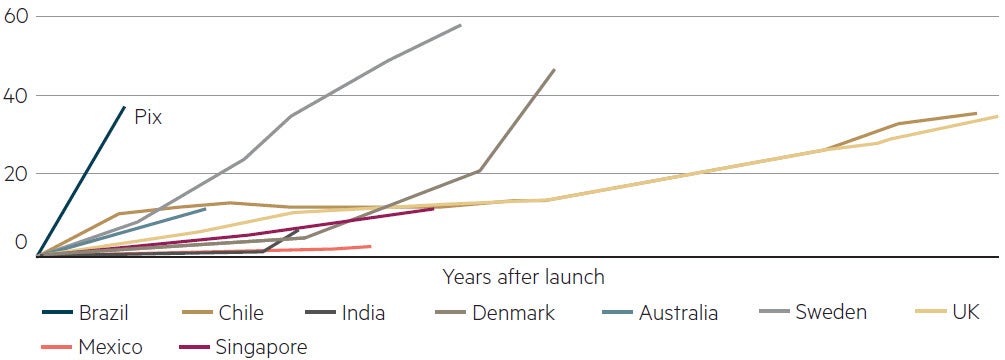

During our recent visit to Brazil we were impressed by how popular Pix has become for many use cases, including payments in the informal sector. Pix transactions have surpassed those of all other financial instruments – including debit and credit cards – with over 140 million individuals (or 80% of the Brazilian adult population) having either made or received a Pix transaction, being the steepest adoption curve of its kind^.

Transactions per capita

Source: Bank for International Settlements

Payment transactions (#)

Source: Central Bank of Brazil

Reflecting the extent of change, Pix has facilitated more Brazilians entering the digital payment system, with almost one in two Pix users making no peer-to-peer digital transfer in 12 months prior to the Pix rollout. Similar to the US – where Venmo has become a verb – Pix has become the payment partner of choice for all Brazilians and this has had direct and indirect implication in many sectors of the Brazilian economy.

In 2019, only one year prior to Brazil, Mexico introduced a similar payment system called CoDi. Compared to Brazil the adoption level of CoDi has been much lower and the impact very limited. Among the many reasons for the relatively slow take-up, the most influential has been the crucial role of the Central Bank of Brazil in being both a cheap infrastructure provider for fintechs at the same time as being the enforcement agent driving mandatory bank adoption.

Should Brazil’s disruption experience be expected in Mexico?

In our view, Brazil is fertile territory for disruption. On top of being a big market with high consumption levels, Brazil has a number of inefficient incumbents and regulators pushing for innovation. Brazilians typically are early adopters in tech and mobile first, with Brazilians:

- spending roughly 10 hours per day on the phone^^

- ranked the second highest country for time spent per day using the internet^^

- ranked the third highest time spent per day using social media.^^^

Mexico shares similar digital consumption patterns to Brazil, albeit at lower levels^^,^^^.

Through our company visits there was a notable view in Brazil that the current Mexican market is very similar to Brazil five or six years ago, being a huge market with inefficient players, prone to substantial disruption.

Not surprisingly, we learnt of a number of well-known companies thriving in Brazil that have aggressively entered various Mexican markets over the last two years. Industry disruption by successful Brazilian firms stretch from more obvious and large players such as Mercado Libre (ecommerce) and Nubank (digital bank) to Localiza (rental car operator) and Smartfit (gym chain operator).

Tempting narratives, but as always in emerging markets, caution is required

Despite a number of opportunities presenting as constructive, we maintain a cautious view on some narratives and analyse each stock on a bottom-up basis. As we noted, with each Brazilian now having five bank accounts on average, the growth in account openings becomes meaningless and principality (or the source of the primary account balance) is paramount, meaning many fintechs still materially lag incumbents. For example, Nubank, arguably the biggest fintech disruptor in Latin America, has only a U$8^^^^ ARPAC (average revenue per active client) – which is roughly one fifth of Brazilian incumbent banks+.

Ultimately, Brazil’s banking relationship pile-on is coming at a cost: revolving credit card portfolios have surged, growing 40% in the last twelve months++ with a record delinquency of 50%+++ – the highest ever registered. Additionally, the rapidly increase in loans to individuals has made family indebtedness to GDP in Brazil grow from 23% to 30% in ten years – a record high++++.

Parting thought

With Brazil’s equity market valuations at record lows and Mexico gaining relevance within global emerging market portfolios due to its ‘Nearshoring’ thematic, we see many exciting investments opportunities across different sectors of traditional and new economies. However, as the above case studies highlight, tasty macro-level narratives require careful assessment at the industry and company level. We continue to believe that experience, active management and bottom-up research counts when seeking out contrarian opportunities – but also to avoid investment pitfalls.

* The Brazilian Report, June 2022

** Central Bank of Brazil

*** Expanding Access for Mexico’s Poor, World Bank, April 2021

**** Financial Inclusion Report 2020–21

^ BIS, March 2022

^^ Statista, June 2023

^^^ Insider Intelligence, April 2021

^^^^ Nu Q1 2023 earnings presentation, May 2023

+ Nubank management comments during the IPO process

++ Central Bank of Brazil, June 2023

+++ Central Bank of Brazil, June 2023

++++Globo.com, January 2023

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 18 August 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.