Few things rattle investment markets more than a banking crisis, particularly when it unfolds as dramatically as a bank run played out in the public domain. In decades gone by, a headline like “Local Bank Fails as US Rate Hikes Hit” is what one might expect to see in the Manilla Times or Jakarta Post. Not in the San Francisco Chronicle. Or the New Zurich Times. The collapse of Silicon Valley Bank (SVB) followed by Signature Bank (a New York based crypto lender) and the venerable Credit Suisse have caused investors to question whether such failures are the portend to wider contagion and another financial crisis. Fear was elevated with financial stocks across the globe suffering steep declines.

As is often the case with bank failures, the causes differ while the symptoms are the same, namely a collapse in confidence, and this certainly appears to be the case in this instance. The unique characteristics and nature of the business models employed by SVB and the other failed institutions have led most analysts to conclude that ultimately these failures were idiosyncratic in nature, and provide an unlikely template for the broader sector. Indeed, a casual review of SVB’s fourth quarter results highlighted a range of adverse operating trends such as declining net interest margins (suggesting a possible asset liability mismatch) and a highly concentrated deposit base that suggest its ‘sudden’ collapse may have been more ‘gradual’ than first thought.

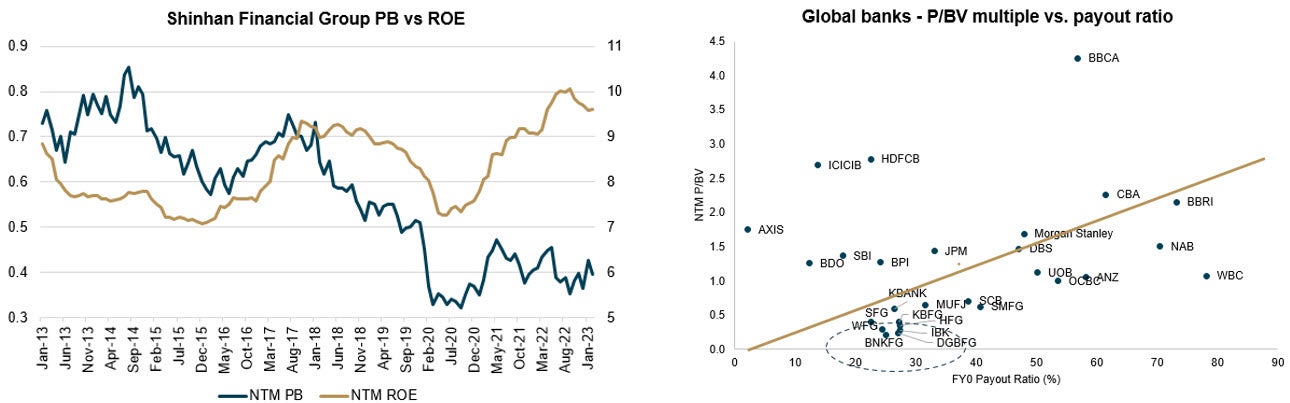

We have written previously regarding our positive posture on several banks and banking markets across the region. Although the portfolio retains an “underweight” exposure towards banks versus the benchmark, we continue to see upside for clients in several banks and non-bank institutions across India, Indonesia, Hong Kong and more recently in South Korea. While no two banks or banking markets are the same, holistically our holdings can be summarised as fitting broadly into one of two categories. The first category includes recovery stories that offer deeply discounted valuations with improving operating metrics, such as Standard Chartered and Shinhan Bank. Both stocks trade at a steep discount to their historic levels despite retaining stronger capital buffers, improved capital management policies and growing profitability metrics.

Korean Financials – a disconnect between profitability and valuation

Source: FactSet, MBA.

The second cohort of portfolio holdings are banks that operate in markets where we see strong structural tailwinds likely to support accretive earnings growth for many years to come. Stocks in this cohort include Bank Rakyat (Indonesia’s largest micro lender), State Bank of India, Housing Development Finance Corporation (India’s largest mortgage lender) and Bank of the Philippine Islands. As well as also being strongly capitalised with diversified and stable deposit franchises, these holdings are conservatively managed and very reasonably priced relative to their future growth potential.

While we assess the risks of broader sector contagion resulting from recent financial sector issues on both sides of the Atlantic as low, there are inevitable second and third order impacts that may weigh on markets in the medium term. Such impacts may include higher funding costs and potentially slower growth (as credit becomes further constricted). There are both positives and negatives to consider here. A ‘knock on’ effect of weaker sentiment and slower credit growth would be negative, though likely result in a tempering of monetary tightening by the US Federal Reserve and other central banks and be positive for Asia and the broader emerging market cohort. At a stock level, we remain confident that the business models and risk management frameworks adopted by our portfolio holdings are both prudent and sustainable.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 30 March 2023 and is subject to change at any time without notice.

© 2023 Maple-Brown Abbott Limited