During a recent trip to Perth, Scotland, we had the privilege of undertaking a site tour of Pitlochry, a hydro generation asset owned and operated by Scottish and Southern Energy (SSE).

Visiting company management and touring infrastructure assets is crucial for our research team. It provides invaluable insights into management practices, highlights potential opportunities and enriches our ESG engagement efforts.

SSE, headquartered in the UK, is a leading utility company that provides electricity generation, transmission, distribution and supply services across the country. The company boasts a diverse energy portfolio, including renewable sources like wind and hydro, alongside conventional thermal power generation. SSE is committed to advancing the transition to a low-carbon economy by expanding its electricity networks infrastructure, renewable energy and flexible generation capacity.

With 1160MW of conventional hydro and 300MW of pumped storage spread across 59 power stations, 74 dams, and 300km of tunnels, SSE maintains the largest fleet of hydro-electric power assets in Scotland. These assets, under SSE’s stewardship for over 80 years, exemplify the company’s long-term commitment to sustainable energy solutions.

The Pitlochry site features two 7.5MW generators and is considered one of SSE’s mid-size hydro power stations. Originally constructed in the 1940s, it continues to operate using the same fundamental technologies and some original equipment, highlighting the enduring nature of these assets. Ongoing maintenance and upgrades are critical to ensure their longevity and continued value to the energy system. For instance, SSE recently repowered its Tummel Bridge hydro power station, replacing turbines installed in 1933 to extend its operational life by at least 40 years.

SSE’s broader hydro portfolio serves as a significant asset within the company, particularly as the UK electricity system increasingly relies on intermittent renewable generation. The flexibility provided by SSE’s hydro capacity, often referred to as ‘Britain’s biggest battery’, is crucial for balancing electricity supply. We see opportunities for SSE to enhance its existing portfolio and invest in new low-carbon hydro assets that contribute to the flexible balancing of the electricity system.

One notable project is SSE’s 1,500MW pumped storage hydro project at Coire Glas in the Scottish Highlands. This project could power three million homes in just five minutes, effectively doubling Great Britain’s current electricity storage capacity. SSE is collaborating with government and regulators to establish a market mechanism supporting long-duration storage projects like Coire Glas, which are essential for securing low-carbon energy supplies in the UK. Pending policy support, SSE aims to finalise its investment decision on the project by late 2025 or early 2026.

Moreover, there’s a growing emphasis on adapting existing hydro assets to climate change. As weather patterns evolve with increased rainfall events and dry spells, greater flexibility and responsiveness in the electricity system become imperative.

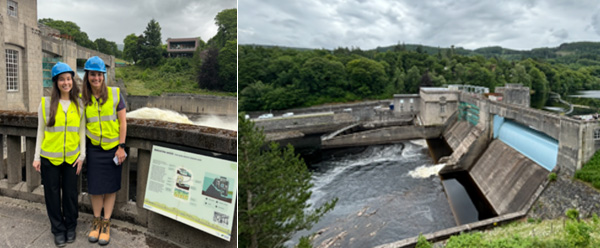

Amelia Campbell (Analyst) and Georgia Hall (ESG Analyst) | The Pitlochry Hydroelectric Power Station

The Pitlochry Hydroelectric Power Station exemplifies how renewable energy projects deliver substantial value through clean energy production, system flexibility, environmental stewardship and educational outreach. If you find yourself in Scotland, don’t miss the Pitlochry Dam visitor centre, open to the public, where you can learn more about renewable energy initiatives by SSE.

Disclaimer

This information is prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, AFSL. 237296 (‘MBA’) as the Responsible Entity of the Maple-Brown Abbott Global Listed Infrastructure Fund (‘Fund’). This article contains general information only, and does not take into account your investment objectives, financial situation or specific needs. Before making a decision whether to acquire, or to continue to hold an investment in the Fund, investors should obtain independent financial advice and consider the current PDS and Target Market Determination (TMD) or any other relevant disclosure document of those products. For the Fund, the PDS, AIB and TMD are available at maple-brownabbott.com/document-library or by calling 1300 097 995. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are not a recommendation to buy, sell or hold, they are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this document. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications not described in this document. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of this information, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on this information. Units in the Fund mentioned in this presentation are issued by MBA. This information is current as of 29 July 2024 and is subject to change at any time without notice. © 2024 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights