Viewpoint

- New legislation, particularly the Inflation Reduction Act of 2022 (IRA) in the US, is set to radically disrupt traditional supply chains, with winners (and losers) still to play out.

- The investment opportunity set spans well beyond US borders. We see investment opportunities in Asia, notably the battery supply and auto-manufacturing sectors.

- With the IRA enacted, regions such as the EU and individual governments are responding in order to retain existing competitive advantages while retaining a focus on environmental goals.

What is the IRA?

Today’s investing environment is witness to a world where government policy can have outsized impacts on both corporate behaviour and profits. We believe the recently passed IRA, with its US$369 billion in funding for Energy Security and Climate Change programs*, has real world impacts across multiple industries both today and for many years to come.

Although further details on the implementation of legislation are yet to be announced, the IRA’s purpose is to incentivise investment in domestic manufacturing of clean energy technology and develop critical domestic supply – or from free-trade partners. This appears to be working too: according to the White House there has been over US$45b in battery investment announced since the enactment of the IRA alone**. While it is too early to tell whether this will have the intended result, there are plenty of implications, opportunities and risks for companies in Asian and emerging markets.

US incentives = Asian opportunity

Some Asian and emerging market companies may be uniquely placed within battery supply and auto manufacturing chains to benefit from US-domiciled incentives. Investable sectors and stocks vary by region, an example being the Critical Minerals Act and Uyghur Forced Labor Prevention Act (UFLPA), which create some barriers for Chinese manufacturers. Accordingly, we believe a number of non-Chinese battery manufacturers with diversified supply chains will benefit most, including Korea’s LG Energy Solutions, Japan’s Panasonic and the US’ Tesla. Companies such as Kia, Hyundai and Mobis can also receive direct incentives if they manufacture in the US and meet certain criteria.

Notwithstanding the intent of the IRA, and not to mention China is a massive market already, Chinese companies are also trying to leverage opportunities arising from the IRA. We have seen leading Chinese solar manufacturers announce the establishment of production plants in the US, and China’s CATL recently announced a licensing deal with Ford. The rulings are still unclear, but it is arguable that CATL’s technology has reached a certain level of maturity as Ford is lobbying the US government to licence its technology.

Case study: EV manufacturing and sales

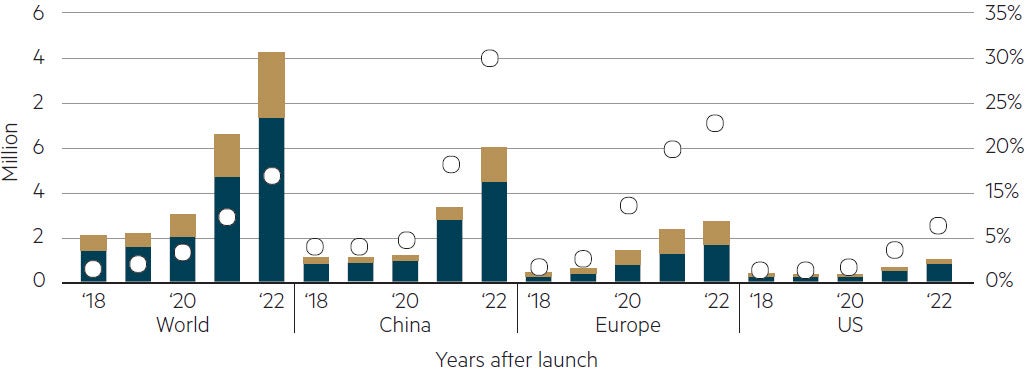

Last year, global car sales exceeded 80 million***, with electric car sales exceeding 10 million. While China contributed 60% of electric cars sold globally, EV sales ex-China are also growing. EV sales currently make up around 15% of total sales globally, but this is still at an early adoption phase. As the chart below shows, the world’s adoption of EVs have been accelerating, driven by all major regions. The US currently lags the EU and China in terms of EVs sold and penetration of total new car sales, however with the incentives provided by the IRA, the US is likely to attract an outsized share of investment to further accelerate growth in this area.

Global EV sales trend. Columns = volume, LHS. Dots = Sales share, RHS

Source: IEA, April 2023****

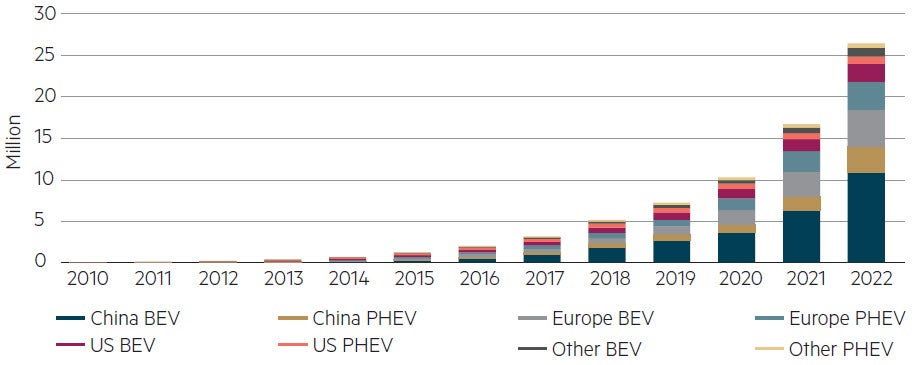

Global electric car stock, 2020–2022

Source: IEA, April 2023****

Beyond the IRA – other governments ramp up subsidies

EV market dynamics are an example of how the new US legislative environment is pushing other parts of the world to retain existing competitive advantages and participate in growth sectors. In June 2023 the EU committed over €100 billion and enacted the Green Deal Industrial Plan to entice EU firms to stay in the EU for manufacturing.^ Further detailed policies will be up to individual EU-member states to develop, with Germany the most advanced, approving a €200 billion budget (2024-27) to accelerate energy transition and electrify their economy.

In general, European policies will likely be more nuanced towards Chinese manufacturers and as a result we expect to see Chinese manufacturers attempt to capture market share in the EU market by bringing in competitive products and technologies. Europe is also keen to develop its own supply chains due to its need for technology development, jobs and energy security. EU manufacturers with technological advantages and large-scale utilities tailored towards a more resilient grid will most likely benefit from an increasingly competitive upstream. As more countries look to re-shore production, Asian companies will be looking to take advantage of new regional-level regulations.

Parting thought

Ultimately, navigating changing regulatory environments impacting capital allocation is part of what we do. In our view, it is a true win-win scenario when policies drive towards a more sustainable future, and we can help deliver investor returns – as well as a more liveable planet. We continue to believe that experience, active management and bottom-up research counts when seeking out emerging opportunities – but also to avoid investment pitfalls.

* https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_one_page_summary.pdf

** https://www.whitehouse.gov/cleanenergy/clean-energy-updates/2023/03/31/treasury-releases-guidance-to-drive-investment-in-critical-minerals-battery-supply-chains-in-america/

*** OICA, February 2023

**** https://www.iea.org/data-and-statistics/charts/electric-car-registrations-and-sales-share-in-china-united-states-and-europe-2018-2022

^ https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/green-deal-industrial-plan_en

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 21 August 2023 and is subject to change at any time without notice. You can access MBA’s Financial Services Guide here for further information about any financial services or products which MBA may provide. © 2023 Maple-Brown Abbott Limited.