Viewpoint

- The iron ore market has reacted in anticipation of a resumption of strong economic activity in China

- Steel demand data will soon reflect the extent to which this is justified

- After a period of austerity, iron ore producers are again pursuing growth

Our recent meetings with the management teams of Australia’s large iron ore producers have allowed us to gain insights into the fascinating dilemma emerging in the global iron ore market. Right now, market forces remain finely balanced.

On one hand, China’s abrupt change in COVID policy sets the stage for a substantial pickup in steel demand. Will China kick-start an economy slowed by recent lockdowns in the same way they have in the past – through steel-intensive infrastructure spending? Or will they be more resolute around their longer-term desire to transition the economy to one based more on services, allowing primary industries like steel to slow? Will policy settings support a substantial resumption in property development? Or is the goal simply to complete projects halted by the cash flow issues seen last year?

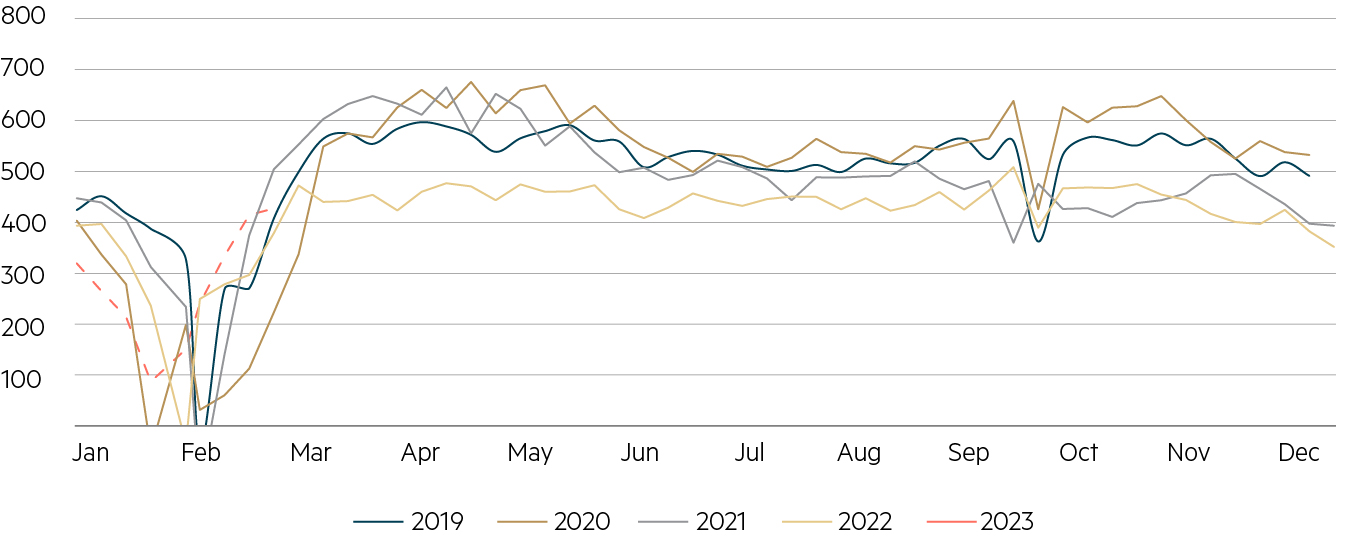

Mixed signals early in 2023 leaves us waiting for demand data: The iron ore market has already reflected the trader’s view – surging from around US$85/tonne late last year to around US$130/tonne now. However, the data does not show much of a pickup in steel demand. This probably is not surprising since seasonal demand has historically only increased after Chinese New Year. Chart 1 is a good example of the inconclusive data to date. Are we about to see a surge in demand, pushing consumption above COVID-impacted years? Will it level out at more normal levels? Or will 2023 be another disappointing year like 2022?

Weekly Long Steel Demand

Source: Morgan Stanley, March 2023.

As we exited February the mood in China seemed increasingly optimistic, with PMI data indicating that the manufacturing industry was expecting increased activity. This contrasts to the conversations we had with Chinese steel participants late last year, which indicated caution. The policy sessions in early March implied to us a slightly weaker than consensus appetitive for growth and stimulus, more in line with the views of the steel producers. So the market is left to contemplate conflicting sentiment while we wait for the hard data.

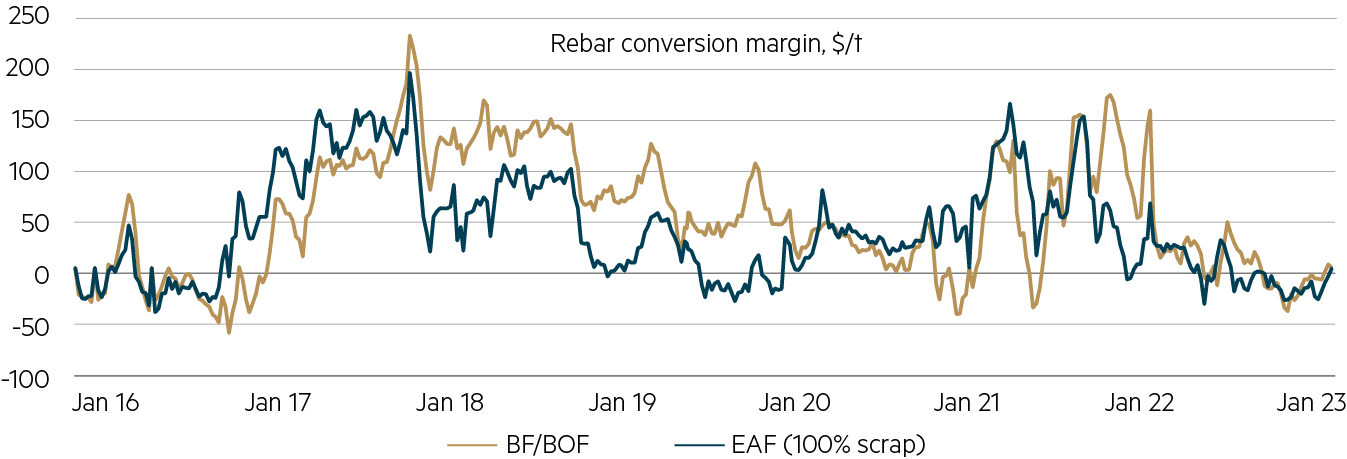

Chinese steel producers may not be able to pay high iron ore prices: Perhaps the best illustration of the balance is the profit margin of the Chinese steel producers, indicated by Chart 2 below. They are barely profitable and have been in that state for several months now. So, either the surge in demand needs to come through soon – lifting steel prices and therefore profits – or they can no longer afford to pay US$130/tonne for iron ore.

Profitability of Chinese steel mills

Source: Mysteel, Macquarie Strategy, March 2023.

While our meetings and calls with the management teams at BHP, Rio Tinto and Fortescue could only shed limited light on the Chinese sentiment, we did engage in some detailed discussion about the supply response to these high iron ore prices. This is the other main uncertainty for the market. We have noted for some time that capital expenditure from large producers has been constrained. Shareholders pushed for ‘austerity’ following weak markets in 2015-16, and miners pursued cash flow generation over growth. This created some inflexibility in supply. This era of austerity is waning now, and there is increased appetite for growth from the miners and their investors.

Most say iron ore prices will stabilise at lower levels: After a period of poor operational performance, Rio has had a very strong final quarter of production in the Pilbara and look to have started 2023 just as strong. They are pushing forward with their Chinese partners on a new production basin in Guinea, which could add significant volumes to the market in the long run. BHP is increasingly positive about their ability to meet their long-term volume goals in the Pilbara, and Fortescue has taken steps to build a mine in Gabon. Most in the market would say that long-term iron ore prices will stabilise well below the values we are seeing now as this supply response takes hold. However, commentators have been saying something similar for a number of years now, and every month prices hold up, the Pilbara producers generate extraordinary margins.

Parting thought

In this context, we currently feel it is prudent to be underweight iron ore. Among the producers, Rio Tinto remains attractively valued, with its low-cost, long-life assets producing strong cash flows in a range of future scenarios. Combined with its strong balance sheet, this could create a strong opportunity for capital returns. We are also attracted to Rio’s strong position in low carbon Canadian aluminium production and their ample pipeline of growth opportunities in copper and iron ore.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current at 10 March 2023 and is subject to change at any time without notice. © 2023 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

Of Burritos and (inedible) Chips

The tale of two research trips: AI fizz in the US meets gloom across the ditch