Viewpoint

- Real yields have recently reduced and the global economy looks to be slowing which should benefit defensive essential service assets like infrastructure, relative to more economically sensitive asset classes.

- Inflation, while declining and mostly under control, is looking more unpredictable than in the pre-COVID years and we maintain the belief that the embedded inflation pass-throughs in infrastructure will remain a valuable feature of the asset class.

- We continue to favour monopolistic infrastructure assets that are trading at attractive discounts to our internal valuations, protected by regulation, strong contracts and inflation linkage.

The year that was

While rates rose and inflation fell across major developed economies over 2023, the global listed infrastructure sector faced the headwind of rising real rates. In our experience, infrastructure typically performs relatively well when inflation is high (like in 2022) due to the ability of many infrastructure assets to pass on inflation to users of the assets.

Despite the macro environment, 2023 was a year of mostly solid operational performance for our holdings in global listed infrastructure companies and the high level of capital expenditure by asset owners continued as expected.

For the year ending 31 December 2023, the global listed infrastructure sector underperformed global equities, partly due to the hype around artificial intelligence bolstering many large cap global equities, but also the perceived rising interest rate headwinds for infrastructure in the absence of increasing inflation.

Portfolio performance

The Maple-Brown Abbott Global Listed Infrastructure Fund (the Fund) delivered a net return for the year to 31 December 2023 of 7.7% versus the reference index FTSE Global Core Infrastructure 50/50 Index (AUD) return of 1.6%. This caps what we consider to be a strong three year performance period for the Fund as the global economy exited COVID, inflation ran out of control, interest rates subsequently increased and geopolitical instability accelerated. The Fund returned 11.4% p.a. for the three years to 31 December 2023, outperforming the reference index by 3.3%.

Toll roads

Positions in toll roads built early in the post COVID recovery continued to perform strongly over 2023, with large Fund holding Ferrovial returning 38%, Brazilian operator Ecorodovias returning 114% and Vinci returning 27%. The toll roads benefited from originally trading at steep discounts to our internal valuations and a continued traffic recovery along with inflation linked toll increases. Part of this investment thesis has played out and we have reduced our exposure in toll roads to just under 10% compared to 16% at the start of 2023.

UK regulated infrastructure

UK regulated infrastructure performed well over 2023. Our focus in the UK is on inflation linked water utilities, electric network infrastructure assets and renewable energy. Large amounts of investment extending well into the 2030s are needed in UK infrastructure. Investments are being undertaken by our companies to improve wastewater treatment in order to meet government environmental targets and also to decarbonise the energy system in order to meet the UK’s net zero commitments.

Cell towers

European cell towers also performed well with their inflation linked revenues and high prices being paid for tower portfolios in the private infrastructure market. The US cell towers however were weak performers. The robust investment case for cell towers remains largely unchanged and the sector was particularly hard hit by interest rate increases earlier in 2023, so any interest rate relief will help this sector particularly the US companies. We continued buying the towers over 2023 with several opportunities opening up such that we finished the year with a 16% holding in cell towers compared to 13% at the start of the year.

US utilities

Despite US long bond yields finishing the year near where they started, US utilities were relatively weak performers over the year. Due to their nominal return framework with a lagged inflation pass-through, US utilities are one of the more interest rate exposed infrastructure sectors. For us, the attraction of US utilities is that they earn a relatively high regulated rate of return and they are growing rapidly due to the ‘great re-wiring’ of the US electric grid with the rollout of renewable energy technologies which are supported by favourable tax credits.

Electric utilities in particular remain attractive in our view and our internal valuations show several good opportunities. We believe that we have built positions at what we think are attractive prices, such that at the end of 2023 the Fund has a 36% allocation to US utilities.

Read more about how the Fund performed over 2023.

Macroeconomic outlook

Even though geopolitical events loom large in 2024, we believe the macro landscape at the end of 2023 looks more stable for infrastructure assets. Real yields have recently reduced and the global economy looks to be slowing which should benefit defensive essential service assets like infrastructure relative to more economically sensitive asset classes.

Inflation, while declining and mostly under control, is looking more unpredictable than in the pre-COVID years and we maintain the belief that the embedded inflation pass-throughs in infrastructure regulation and contracts will remain a valuable feature of the asset class.

Our long term interest rate assumptions are broadly similar to the current market rates and the decline in long interest rates at the end of 2023 should be a relief for the infrastructure sector.

Portfolio outlook

The market gyrations since COVID have revealed to us a number of infrastructure investment themes and stock opportunities that we think will underpin our investment performance over 2024 and beyond. We continue to favour monopolistic infrastructure assets that are trading at attractive discounts to our internal valuations, protected by regulation and strong contracts with inflation linkage and growth being driven by capital expenditure requirements.

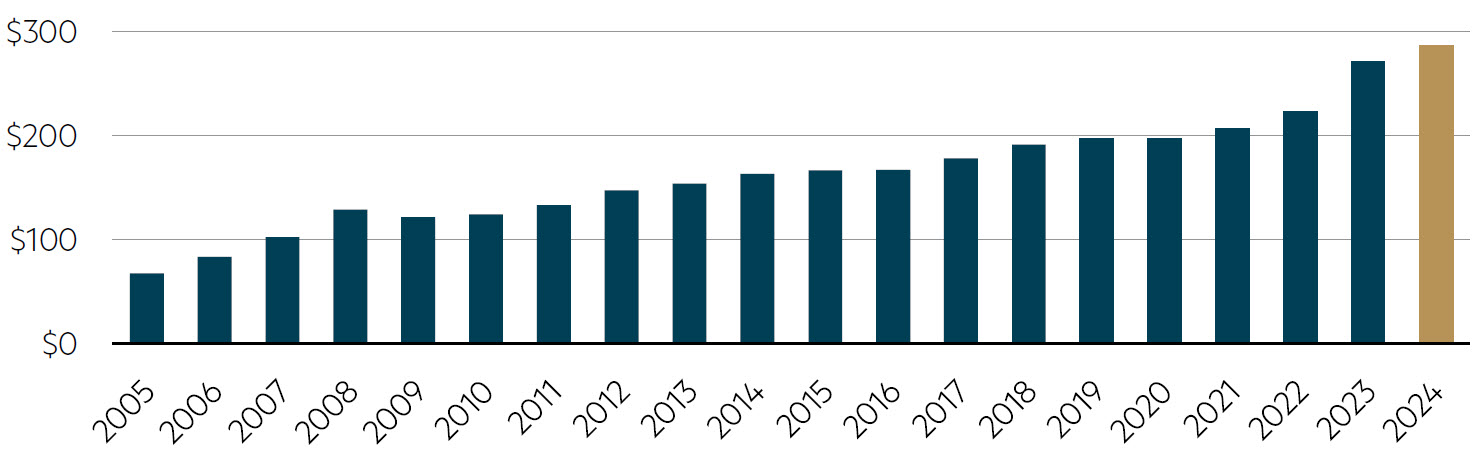

We see substantial organic growth opportunities for global listed infrastructure, predominantly driven by the energy transition but also supported by themes such as water, transport mobility and digitalisation. Indeed, our analysis of aggregate capex for the GLI Focus List highlights a long history of increasing capex opportunities and a material step up in 2023, which we believe can be attributed to an acceleration in the pace of the energy transition thanks to landmark policies such as the US Inflation Reduction Act, RePowerEU, and the EU’s Fit for 55 package of reforms.

Total capex for GLI Focus List (US$bn)

Source: Bloomberg, MBA GLI calculations as at 31 December 2023. Excludes M&A activity.

As discussed in the GLI Climate Change Report, growth opportunities related to the energy transition are particularly strong across electric utilities and contracted renewables. This is due to the substantial investment required to transform electric generation fleets from fossil fuels to renewables, upgrade and build new network infrastructure to serve an increasingly complex grid and meet increased load requirements being driven by electrification. We are already seeing signs of this expected strong electricity growth emerging. For example in early January 2024 the PJM region of the US released its annual electricity demand forecasts, which forecast a 2.4% annual growth in electricity usage over the next decade. This was a very significant increase from the 0.8% per annum growth that it forecast just 12 months ago for the coming decade, and compares to virtually no growth in the prior decade.1

The higher interest rate environment that in our view looks to be with us for the foreseeable future means we are paying extra attention to the health of the balance sheets of infrastructure companies. Potential red flags are excessive debt funding requirements for growth and the refinancing of debt maturities. Much of the higher interest rates can be passed through by the regulated infrastructure companies (typically electric, water and gas utilities) which make up approximately 50% of the Fund.

Our approach to ESG

Given the inherent nature of infrastructure being involved in important political and environmental issues such as the need to decarbonise the energy system and do it in a way that is affordable, the ESG analysis of risks and opportunities for companies remains one of the cornerstones of our investment process. The embedded ESG analysts in our investment team are closely involved in portfolio company engagements and produce climate sensitivity valuation scenarios and analysis that sits alongside our traditional financial and valuation analysis.

Active engagement is an important pillar of our overall strategy to mitigate ESG risks and enhance value for investors. Through constructive dialogue we believe we can influence positive outcomes and potentially enhance the sustainability of our clients’ returns. We also see engagement with companies as a powerful tool to uncover ESG risks and opportunities that hide beneath the surface, helping us to build a portfolio that is aimed to be more resilient to ESG risks and positively exposed to ESG opportunities such as climate risks, decarbonisation and modern slavery.

To highlight our ESG analysis work we are pleased to share our latest Engagement & Stewardship Report which details our FY23 engagement strategy, priority topics, a selection of company case studies and our proxy voting efforts.

Parting thought

There is much to think about in geopolitics and macroeconomics over 2024 and it is unlikely to be a stable year on that front. Our focus remains on the active management of a portfolio of quality assets with inflation-linked cashflows and what we consider to be an attractive rate of return on the significant amount of capital that needs to be invested in infrastructure networks.

1 PJM Load Forecast Report 2024.

Disclaimer

This information is issued by Maple-Brown Abbott Limited ABN 73 001 208 564, Australian Financial Services Licence No. 237296 (“Maple-Brown Abbott”). It does not constitute advice of any kind and should not be relied upon as such. This information is intended to provide general information only, and does not have regard to an investor’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This document does not constitute an offer or solicitation by anyone in any jurisdiction. This information is confidential and the recipient agrees not to release or reveal it to any third party. The information in this factsheet is for wholesale investors only and is not intended for retail investors (as defined by the Corporations Act 2001 (Cth)). The information in this document is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law.

Total return is based on the movement in net asset value per unit plus distributions and is before tax and after all fees and charges. Imputation credits and foreign income tax offsets are not included in the performance figures.

Past performance is not a reliable indicator of future performance. An investment in the Maple-Brown Abbott Global Listed Infrastructure Fund (“Fund”) does not represent an investment in, deposit with or other liability of Maple-Brown Abbott, and is subject to investment risk including possible delays in repayment and loss of income and principal invested. Neither Maple-Brown Abbott, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the income tax or other taxation consequences of, any investment. Any comments about individual stocks or other investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this paper does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither Maple-Brown Abbott, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this material. Units in the Fund are issued by Maple-Brown Abbott. Before making a decision whether to acquire, or to continue to hold an investment in the Fund, investors should obtain and consider the current Product Disclosure Statement for the Fund available at maple-brownabbott.com or by calling 02 8226 6200. This information is current as at 12 January 2024 and is subject to change at any time without notice. © 2024 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

Of Burritos and (inedible) Chips

The tale of two research trips: AI fizz in the US meets gloom across the ditch