Viewpoint

- We find our portfolios in a similar position in 2024 to September 2007 – just before the GFC – with significant positions in defensive stocks. Why? Not because we are taking a prophetic stance on any type of 2024 crash, but because we see valuations in particular pockets of the market as attractive – just as we did back in 2007.

- In the current market we see select stocks, including QBE, ResMed and Coles, being left behind as indices advance to new highs. We believe these stocks – and others – offer relatively attractive valuations and a defensive tilt should economic conditions deteriorate.

- The banking sector is an interesting study in contrarian investing, with the sector being totally out of favour after the May 2023 reporting period. The recent run for the banks is a good illustration of the value to be added by taking valuation supported, contrarian views without being overly anxious regarding catalysts.

The past quarter has been a timely reminder that accurately forecasting market direction over the short, and even medium term is at best an uncertain art, and at worst a total waste of time. Global markets have enjoyed another strong quarter, again largely led by a reasonably select group of tech and momentum driven names. The gold price has reached new highs while bitcoin has similarly scaled the heights. All this has taken place against the background of mixed economic data in major markets. A quick review of economic commentaries highlights that there seems to be equally good reason to expect conditions to remain benign as there are reasons to fear what lies ahead!

As we have suggested for some time, inflation is likely to prove sticky and we continue to see market forecasts of interest rate cuts being pushed further into the future. There is the additional uncertainty of global politics with significant question marks around the leadership of many of the major nations. Notably, there are upcoming elections in several of the countries that allow free elections. What is there to worry about?! None of these uncertainties seem to have impacted the spirits of investors and the MSCI All Countries World Index has added over 20% since late October, noting our market has lagged, with resources struggling for direction as iron ore prices finally succumbed to subdued Chinese conditions.

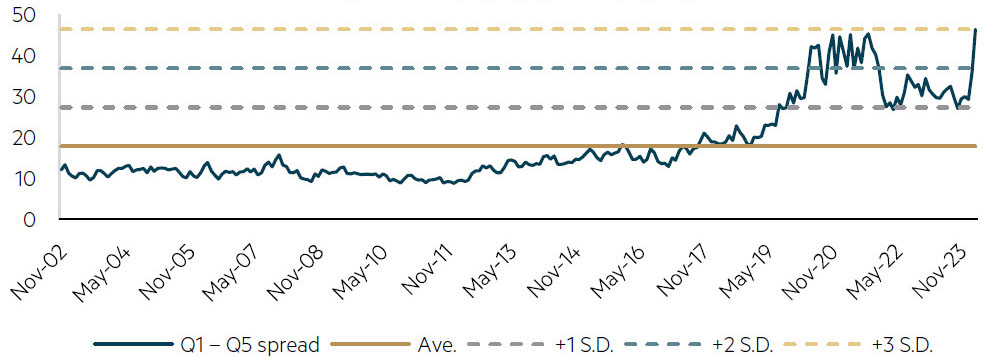

Euphoric market conditions have not benefitted all stocks and we have seen a lack of market breadth, notably in the US, with the Magnificent Seven driving a material part of market returns. Our market has also evidenced some element of herding, largely in the industrial names. As we have highlighted for some time the price earnings multiple spread between the sought after industrial names and the unfavoured names has remained wide by historical standards, and after a period of correction in 2021/22 has tracked back to levels that prevailed at the interest lows in 2020 (albeit exacerbated by some earnings downgrades in some smaller, highly rated stocks that has further expanded multiples). This is an unusual outcome as expectations for a narrowing of the gap were fuelled by the sharp rise in interest rates that commenced in late 2020. Such an increase negatively impacts the valuation of stocks more reliant on future dated growth, and all things being equal would usually flow through to equity prices. The fact that valuations have stretched further in this environment is notable.

Price earnings multiple spread tests highs – Exacerbated by some earnings downgrades

Industrial stocks sorted by 12-month forward P/E – spread of Q1 (high) and Q5 (low)

Source: Goldman Sachs, data to 31 March 2024.

Our contrarian investment approach in Australian Value Equities means our team is always going to be much more focused on stocks that look inexpensive relative to their history, rather than those that are in high demand and trading at premium valuations. At a time of market exuberance, it is often the case that more defensive businesses are ignored by the market as they lack leverage to the positive economic conditions, while those that are benefiting from the conditions are sought after and attract a premium price. We see a good illustration of this as we look back to September 2007, a couple of months before the economic turmoil that was the Global Financial Crisis (GFC) and the associated market crash. At that time our Australian Equity Trust was significantly overweight the defensive names (and had been for some time, which had proven painful). Our portfolio was more than double weighted in Telecommunication stocks and similarly positioned in Consumer Staples (largely the beverage and food companies) – not because we were taking a prescient economic view that the GFC was about to hit, but because valuations were attractive. A review of our investment presentations from that time highlights that we indeed had concerns regarding the sustainability of record high corporate earnings, but that was not the driver of our portfolio positioning, merely an added benefit of the positions that the market was rewarding us to take. The consensus bet at that time favoured Materials, where strong Chinese economic growth was creating an extraordinary boom. Valuations reflected the strong demand for Materials and unsurprisingly our portfolio was 40% underweight the sector.

We find our portfolios in a similar position in 2024 with significant positions in defensive stocks. Once again, we have not taken these positions because we have particular concerns for the economic outlook. Rather these are the types of stocks that have been left behind as the market has advanced to new highs, and quite a few are now offering relatively attractive valuations, as seen in the table below. Although we are not taking a particularly cautious economic perspective, we are of the view that there is the potential for economic conditions to deteriorate relatively quickly and so being well positioned in such stocks could be an added benefit over the medium term.

Valuation differentials widen again – Defensive stocks lag the market

| Expensive versus history | 10 year | Current | Premium/Discount | ~Standard deviation |

|---|---|---|---|---|

| CAR Group Limited | 1.48 | 1.82 | 23% | +2 |

| Cochlear Limited | 2.27 | 2.61 | 15% | +1 |

| Commonwealth Bank of Australia | 0.91 | 1.10 | 21% | +2 |

| Goodman Group | 1.17 | 1.48 | 26% | +2 |

| Macquarie Group, Ltd. | 0.87 | 0.91 | 5% | +1 |

| National Australia Bank Limited | 0.72 | 0.79 | 10% | +1 |

| REA Group Ltd | 2.01 | 2.35 | 17% | +1 |

| Wesfarmers Limited | 1.20 | 1.44 | 20% | +2 |

| WiseTech Global Ltd. | 4.12 | 4.57 | 11% | +1 |

| Cheap versus history | 10 year | Current | Premium/Discount | ~Standard deviation |

|---|---|---|---|---|

| Amcor |

0.761 |

0.67 | -12% | -1 |

| Aristocrat Leisure Limited | 1.22 | 0.96 | -21% | -2 |

| Brambles Limited | 1.12 | 0.91 | -19% | -1 |

| Coles Group Ltd. |

1.121 |

1.05 | -6% | -1 |

| CSL Limited | 1.74 | 1.39 | -20% | -1 |

| QBE Insurance Group Limited | 0.77 | 0.52 | -32% | -1 |

| ResMed Inc | 1.60 | 1.24 | -23% | -1 |

| Treasury Wine Estates Limited | 1.39 | 1.04 | -25% | -1 |

| Woolworths Group Ltd | 1.25 | 1.13 | -10% | -1 |

1 Refers to 5-year average.

Source: FactSet, MBA, data to 31 March 2024.

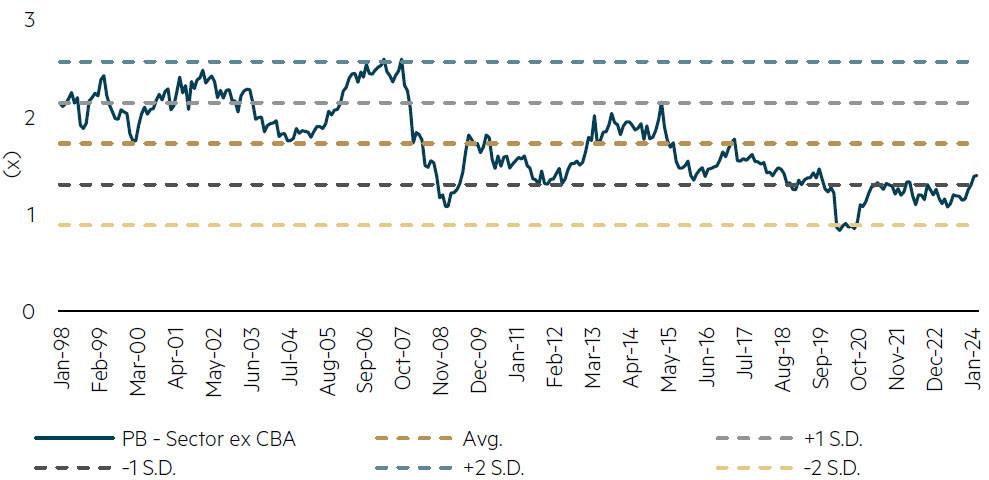

Resource stocks played a key role in driving the market to new highs in 2007, at a time when many of the defensive stocks were lagging. In the current market, resource stock prices have generally been under a little pressure over the past year (especially relative to the market) and have not played the same role. Rather, many of the larger industrial names have seen the market to record highs, assisted more recently by the banking sector after a particularly weak period in the first half of 2023. The banking sector is an interesting study in contrarian investing in and of itself, with the sector being totally out of favour after the May 2023 reporting period, the price to book multiple (excluding CBA) being close to all-time lows.

Bank valuations rebound from near historic lows – Still look inexpensive, albeit with lower ROEs

Banks sector price to book (excluding CBA)

Our positive positioning in the banks has benefitted investment performance relative to many managers who have been significantly underweight the sector. There has been much debate as to the catalyst for the turnaround in performance that we have seen and as always it is difficult to be sure. One of the more credible views is that global investor demand has played a material part as investors reduced their positions in China and looked for larger, liquid stocks in the region. Whatever the reason, it is a good illustration of the value to be added by taking valuation supported, contrarian views without being overly anxious regarding catalysts (including economic forecasts). After their recent run some of the banks look to be reasonably fully priced but we are still able to find some value in the sector.

Parting thought

There are signs of excess in many investment markets, including significant overvaluation in many parts of the stock market. History teaches us that this does not necessarily herald a correction, but in our view a large dose of caution is warranted. There are pockets of value to be found but they are often associated with idiosyncratic company risk. Beyond that, we have been pleased with the opportunities provided by stock pricing in the more defensive segments of the market.

Disclaimer

This article is issued by Maple-Brown Abbott Limited ABN 73 001 208 564, AFSL 237296 (‘MBA’) as the Responsible Entity of the MBA Australian Equity Trust (ARSN 091 136 266) (‘Fund’). This article contains general information only, and does not take into account your investment objectives, financial situation or specific needs. Before making any investment decision, you should seek independent financial advice and obtain and consider the current Product Disclosure Statement, Additional Information Booklet and Target Market Determination (TMD) or any other relevant disclosure document available at maple-brownabbott.com/document-library or by calling 1300 097 995. Past performance is not a reliable indicator of future performance. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are not a recommendation to buy, sell or hold, they are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this document. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications not described in this document. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of this information, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on this information. This information is current at 16 April 2024 and is subject to change at any time without notice. © 2024 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

Of Burritos and (inedible) Chips

The tale of two research trips: AI fizz in the US meets gloom across the ditch