Viewpoint

- In New Zealand, interest rate rises have clearly ‘worked’, with the Kiwi economy recently in recession and no green shoots yet to emerge. However, as bottom-up investors we continue to find dual-listed stock ideas uncorrelated to economic conditions and believe significant value may be on offer as the New Zealand cycle turns.

- In the US, building out AI’s chip and data centre ecosystem is becoming a story well told. While the use case playbook remains thinner than we might hope, for key portfolio holding Pro Medicus, monetisation of AI applications already appear within reach.

- Our focus is on managing a portfolio of idiosyncratic company-level exposures as opposed to picking macro-economic or thematic trends. Our process allows us to avoid areas beset with economic gloom and identify areas where market fizz may – or may not – translate to medium-term earnings delivery.

A trip across the ditch – is it a good time to be buying New Zealand companies?

By Matt Griffin, Co-Portfolio Manager, Australian Small Companies

We recently spent three days in Auckland meeting with a number of small cap companies, the majority of which are dual listed on both the ASX and NZX. The New Zealand economy is clearly in a tough position, slipping in and out of recession in 2024, unemployment rising and house prices down approximately 20% from the peak. The companies we met with spoke of a continuation of these difficult conditions, with no green shoots evident from key areas such as consumer spending or construction.

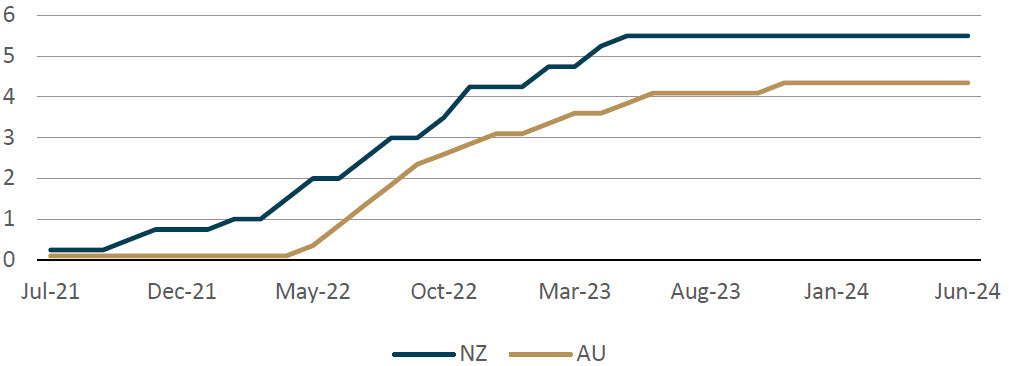

A rapid increase in interest rates from 0.25% in mid-2021 to 5.5% just two years later has clearly worked to slow the economy, with a broad consensus from our meetings that rate cuts are needed from later this year in order to stimulate demand. Heat in the labour market has eased significantly, with many companies we met seeing reduced staff turnover, minimal wage growth and limited issues in filling open roles. As a stark example, a property company we spoke to had over 400 applicants for a receptionist role that was unable to be filled two years ago!

The construction market has fallen away rapidly, with volumes for major building material companies now down approximately 30% from the peak compared to 15% six months ago. One executive told us they have seen a “decline in trading conditions not seen since the GFC”. Materials prices have started to fall slightly, but with labour rates holding up and house prices down 20%, economics for new builds are currently challenging. Profitability across the space has become extremely challenging and many companies are facing debt issues – this may result in strong, well-run companies emerging in a position of strength at the other end of the cycle, with acquisition opportunities along the way.

The bright spot in housing is the low end of the market where first home buyers remain active. We also toured retirement villages operated by Summerset Holdings, who are in the process of expanding to Australia with projects in Victoria and Queensland. The offering is, in our view, of a higher quality than we have seen in Australia, and it will be interesting to track consumer adoption. There is a growing market for high end retirement units in New Zealand, with one developer selling luxury retirement apartments in Auckland for up to NZ$12m per unit.

Luxury retirement unit in a Summerset village – this one is on the market for ~NZ$3.4m.

Retailers are seeing patchy demand and a smaller pool of consumer discretionary spend. Price inflation and cost of living pressures are resulting in people venturing out less often to the pub, restaurants and hair and beauty appointments. Somewhat surprisingly, fast food is bucking the trend, with KFC sales up 11% in the past quarter, as consumers trade down from pubs and restaurants.

The trip also posed an interesting thought relating to the trajectory of the Australian economy. Australia started raising interest rates seven months later than New Zealand, and given the weakness in recent updates from domestic consumer-related stocks, there is the potential that more significant economic pressure in Australia is coming given the delayed effect of rate rises.

Official Interest Rates (%)

Source: RBA, RBNZ (June 2024).

Countering this are a few factors which may insulate the domestic economy: a large and strong mining sector, higher immigration, a resiliently low unemployment rate and interest rates that have peaked for now at 1.15% below New Zealand.

The outlook for New Zealand remains difficult: we expect a continuation of these challenging conditions for the next couple of years which will make investing in cyclical companies hard, but rate cuts may stimulate growth in which case there will be significant value on offer if the cycle turns.

Our process is not to try and pick turning points and we prefer to wait for evidence that earnings have bottomed, and we are therefore doing the work on quality cyclicals ahead of a potential future upswing in market conditions.

Fortunately in small cap investing, we can find stock ideas uncorrelated to economic conditions in companies that have idiosyncratic drivers, and we came away from the trip with two new investment opportunities for the Maple-Brown Abbott Australian Small Companies Fund (the Fund).

US Insights: AI at an inflection point

By William Hanna, Investment Analyst, Australian Small Companies

We recently visited the United States with a focus on the Information Technology and Healthcare sectors. With insights gleaned from both US and Australian listed company meetings across ten cities, there are some key takeaways on what we are seeing globally in those sectors.

Meeting technology companies from Boston to San Francisco, the primary focus was on the development of AI applications and more importantly, the monetisation of AI features. A range of semiconductor, data centre and online businesses provided an optimistic outlook on the long-term prospects for AI, yet the short-term use cases appeared dispersed and varied across a number of different business models.

We are still in the early stages of AI adoption, with investors focused firmly on the infrastructure required to build out the ecosystems (chips and data centres), rather than having a clear view to long-term winners and losers from a user perspective.

It is clear to us that data centre and semiconductor companies are constructive on the forward-looking pipeline of demand provided the limited supply on offer. Equinix, a leading data centre company, said the current pipeline is “the best they’ve ever seen it” with hyperscalers (i.e. Amazon, Google, Meta, Microsoft, Tesla) signing 10-15 year leases with installed bookings seeing a 90% take up rate from existing customers.

Equinix offices, San Francisco, California.

On the other side of the dichotomy (outside of direct data centre and semiconductor plays), it is challenging to pinpoint how other businesses are developing, applying and effectively monetising AI. For example:

- Wayfair (online furniture retailer) discussed use cases for making software developers more efficient and better scrutinising customer feedback;

- Bumble (dating app) talked about using AI to generate conversations between users; and

- Reddit (social media) are using licensing agreements to sell data to Google and Open AI to train large language models (LLM).

Use case examples are currently thin and ultimately reflect the early-stage inflection point we now find ourselves at. Mastercard summed it best at a conference we attended by stating “AI, 5G, edge computing will all converge in the next five years. The digital commerce experience will be uplifted and we see it as a big opportunity”. A similar sentiment was provided by Equinix, believing Enterprise AI is still in the early stages of adoption, with monetisation of the technology a key issue to justify spend for their customers. Therefore, while we’re yet to see widespread application, the market is increasingly focused on what the world looks like in the medium to long term (rather than the next quarter), and investors are pricing in significant changes to the global digital economy.

As it relates to AI in Healthcare, we met with Microsoft and Pro Medicus (ASX: PME) – the latter a key holding in the Fund. Microsoft pointed out two key trends:

- Generative AI should allow physicians to record interactions and generate clinical notes, ultimately reducing the administrative burden to address burnout in healthcare; and

- Re-acceleration of growth in the Cloud – including migration to the cloud trend, increased use of data analytics and new services in development for hybrid space/adaptable cloud users.

Pro Medicus is a key holding in the Fund, as we seek to identify companies with solid medium-term earnings prospects tied to a clear structural thematic. It was clear from the visit that a radiologist shortage still needs to be addressed, with AI being part of the solution. Pro Medicus recently participated in an equity funding round for an AI specialist in cardiac scans, Elucid, with material reimbursements which we see as providing additional optionality to Pro Medicus’s AI strategy. Over time, a monetisable framework should, in our view, emerge via an integration fee with third party partnerships and charging on a fee per study model.

The key message from the trip is that we find the global economy on the cusp of a major productivity inflection point. We see this more immediately in the accelerating demand for data centres and semiconductor companies, which we do not view as disippating anytime soon, but are yet to fully see it permeate through the broader economy. While we are in the early stages of seeing the fifth industrial revolution play out, we believe the Fund is best positioned in companies such as Pro Medicus which meets at the intersection between technology, healthcare and AI.

Parting thought

An exciting element of being active investors is understanding the global markets that Australian small cap companies compete in. Our recent trips highlight the divergence between anything AI-related and the challenges facing cyclical stocks. We continue to employ measured doses of patience, skepticism and optimism, anchoring to our investment philosophy based on earnings delivery, sustainability factors and risk measures.

Disclaimer

This information is prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, AFSL. 237296 (‘MBA’) as the Responsible Entity of the Maple-Brown Abbott Australian Small Companies Fund ARSN 658 552 688 (‘Fund’). This article contains general information only, and does not take into account your investment objectives, financial situation or specific needs. Before making a decision whether to acquire, or to continue to hold an investment in the Fund, investors should obtain independent financial advice and consider the current PDS and Target Market Determination (TMD) or any other relevant disclosure document of those products. For the Fund, the PDS, AIB and TMD are available at maple-brownabbott.com/document-library or by calling 1300 097 995. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are not a recommendation to buy, sell or hold, they are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this document. The individual stocks referred to may or may not be currently held by the Fund. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications not described in this document. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of this information, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on this information. Units in the Fund mentioned in this article are issued by MBA. This information is current as of 21 June 2024 and is subject to change at any time without notice. © 2024 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

Of Burritos and (inedible) Chips

The tale of two research trips: AI fizz in the US meets gloom across the ditch