Until recently, cross-sectoral fragmentation and a lack of regulatory clarity over the management of PFAS has stalled progress on managing and investing in this ubiquitous issue. This is amplified by the cost and limited options of PFAS monitoring and treatment solutions. Combined with a stringent focus on managing customer bill increases to a minimum, these factors have weakened the extent to which water utilities could implement and justify PFAS solutions in their regulatory filings.

As detailed in our recently released white paper, regulatory developments in the US and UK have instigated a step change in water sector investment needs for PFAS monitoring and reduction technologies over the next 4-5 years. US and UK water utilities must manage PFAS levels below certain thresholds, thereby requiring new capital investments and ongoing maintenance and operating costs. We believe these additional capital expenditures will modestly increase utilities’ rate base on which they are able to earn a return. Overall, we see this regulatory pivot to minimising PFAS as a net positive for the water sector, customers and investors alike.

What is PFAS?

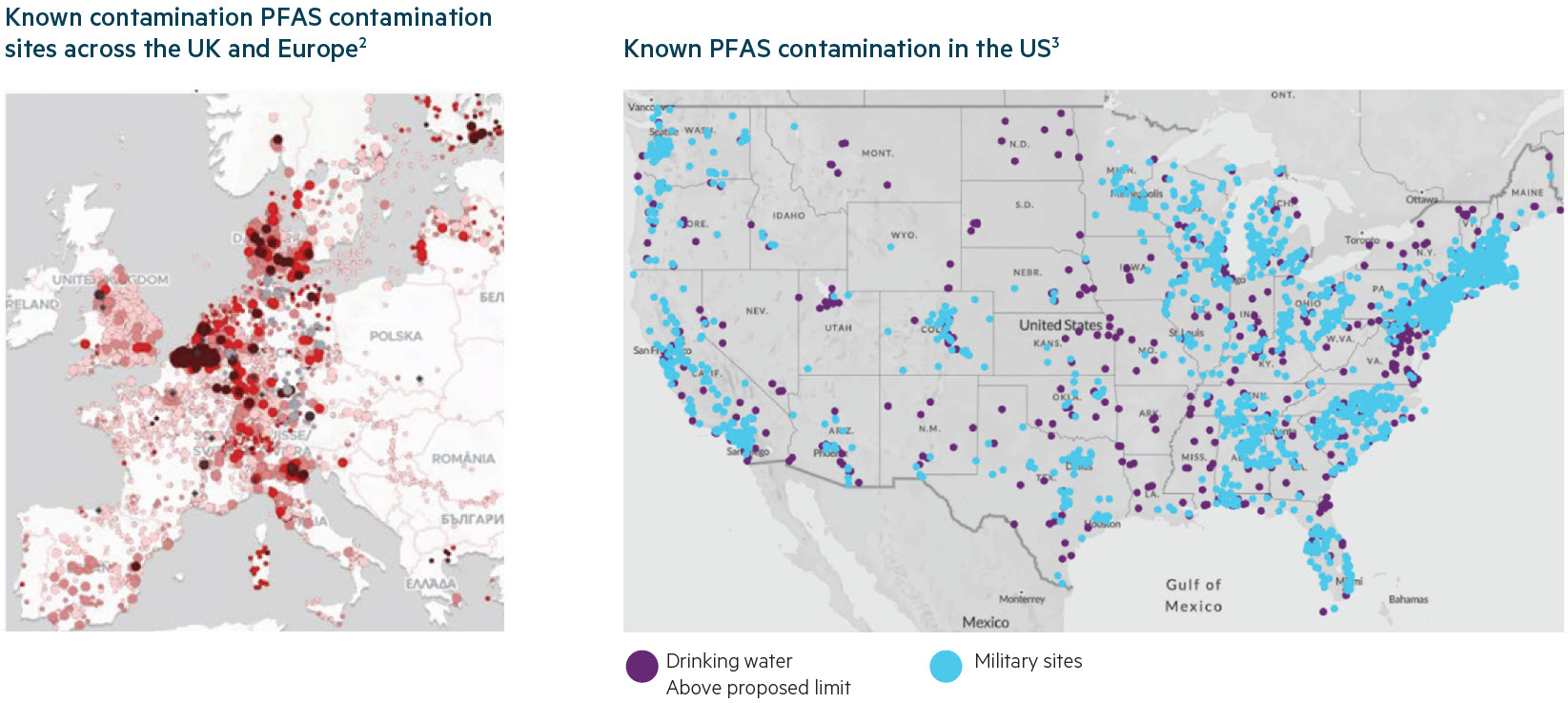

PFAS chemicals are a group of virtually indestructible chemicals that are used in a range of manufacturing processes, beauty and homecare products and have entered most water systems around the world. PFAS chemicals are known to be dangerous to human and environmental health. Estimates suggest at least 45% of tap water in the US contains one or more types of PFAS, while 14.3% of European teenagers have PFAS in their blood at levels exceeding the health limits.1 Drinking water is one of the main sources of PFAS contamination for humans.

Though there has been some clarity, we find the pace and scale of recent regulatory action on PFAS varies across regions; with the US EPA’s stringent stance translating to more meaningful capital expenditure opportunities for listed US water utilities, and the UK DWI’s precautionary approach translating to more modest rate base growth for UK companies. Beyond the US and the UK, we are seeing similar regulatory developments playing out in other markets such as the EU, Canada, Australia and New Zealand.

The investment case

We see new PFAS regulatory developments as a net positive for the water sector in both the UK and the US. Like other investment programs for water infrastructure and the infrastructure sector more generally, solving the PFAS problem will require large investments and long timelines, which at this stage are not well defined. We believe traditional infrastructure replacement and water quality improvement are the dominant growth drivers for the water sector, thereby requiring frequent regulatory rate case filings and a possible step up in capital requirements for the foreseeable future.

In saying this, increased regulation also comes with potential downside risk. To the extent incremental regulations are enforced and water utilities are non-compliant, then penalties and/or disallowed operating and management costs could negatively impact earnings. Equally, operational failures to ensure safe drinking water and/or compliance with wastewater treatment PFAS standards could also lead to financial risks for companies.

Examples of listed water utility PFAS investments

| Country | Water utility | No. of customers | Anticipated capex investments | Anticipated operating & maintenance costs |

|---|---|---|---|---|

| US |

American Water Company4 |

14 million | US$1 billion (2024–2028) | US$50 million |

| US |

SJW Group5 |

1.5 million | US$230 million (California and Connecticut, 2025–30) | Not disclosed |

| US |

Essential Utilities6 |

5 million | US$450 million (2024–2028) | US$22.5 million |

| UK |

Severn Trent7 |

8 million | £56.2 million (2025–2030) | Not disclosed |

| UK |

United Utilities8 |

7 million | £48-49 million (2025–2030) | £1-1.5 million (2030–) |

| UK |

Pennon9 |

3.5 million | £61-76 million (2025–2030) | £1-1.5 million (2030–) |

1 United States Geological Survey (“USGS”), ‘Tap Water Study Detects PFAS ‘Forever Chemicals’ Across the US’ (5 July 2023). European Environment Agency (“EEA”), ‘Risks of PFAS for Human Health in Europe’ (16 April 2024).

2 The Forever Pollution Project (2023).

3 Environmental Working Group, ‘PFAS Contamination in the US’ (August 2024).

4 American Water Works Company, Investor Presentations from June 2024 & September 2024. Number of customers relates to the regulated customer count.

5 SJW Group, ’Investor Presentation‘ (October 2024) and SJW Group, ’Q1 2024 Earnings Call‘ (26 April 2024).

6 Essential Utilities, ’Q2 2024 Financial Results and Investor Presentation‘ (Q3 2024). Essential Utilities estimates around $22.5 million of O&M costs annually, with guidance that annual O&M costs will increase by 5% of capital invested in PFAS.

7 Severn Trent, ’PR24 Draft Determination: Raw Water Deterioration’ (August 2024). Subject to final decision from Ofwat.

8 United Utilities, ‘PR24 Draft Determination: PFAS Enhancement Case’ (August 2024). Subject to final decision from Ofwat.

9 Pennon Group, ‘Enhancement Business Case: Water Quality Upgrades at our Water Treatment Works’ (August 2024).

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, AFSL No. 237296 (“MBA”). This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. Past performance is not a reliable indicator of future performance. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Any companies, securities and or/case studies referenced or discussed are used only for illustrative purposes. The information provided is not a recommendation for any particular security or strategy, and is not an indication of the trading intent of MBA. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. This information is current at 1 November 2024 and is subject to change at any time without notice. © 2024 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update