Equity market rotation or just a blip?

For equity markets, the March 2025 quarter has been the antithesis of the 2024 calendar year.

Globally, many of the popular 2024 investment themes, including a more resilient US economic growth outlook, moderating inflation and US exceptionalism, together with crowded trades, including the Magnificent 7 stocks, have made way to increased US policy uncertainty (due mainly to tariffs) and increasing US recession fears (off a low base) which has been a drag on US market performance. This has been partially offset by positive economic surprise outside of the US and the reallocation of investor capital to both European and Asian equity markets.

A similar rotation has been experienced domestically with many of the popular holdings held by Australian small cap managers, including technology, quality, growth and defensively exposed companies having underperformed over the quarter – this has been despite many continuing to deliver on, and even exceeding, market earnings expectations. There has been a clear investor theme to recycle capital from many of these crowded trades which are trading on elevated multiples relative to historical averages into cheaper quality stocks and/or value/cyclical companies with improving earnings momentum.

‘Winner takes all’ unwind?

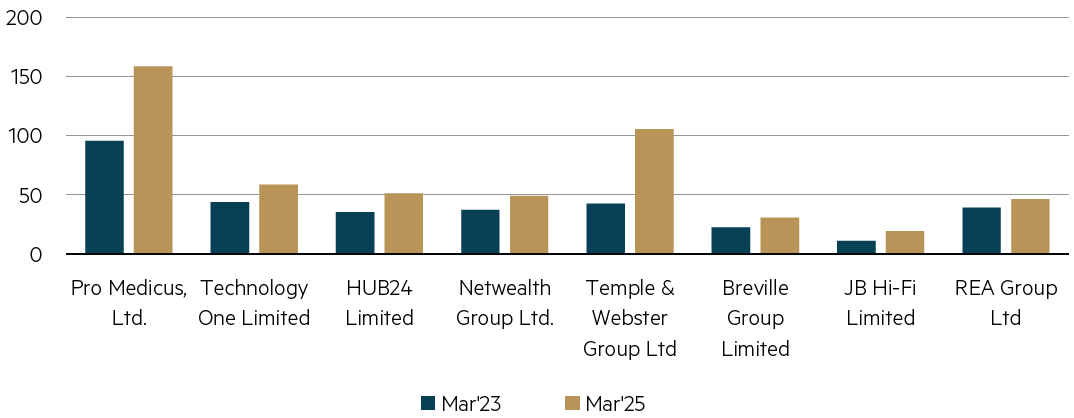

Another key investment theme over the quarter has been the potential unwind of the ‘winner takes all’. Over the past two years, the market has been pricing in winners in select industries ‘taking all’ which has resulted in a material valuation re-rate for those companies that have been able to grow market share in a challenging macroeconomic environment. Some notable examples include HUB24 and Netwealth Group in the wealth management platform market, Temple & Webster in the online furniture market, JB Hi-Fi in the electronics retail market and REA Group in the online residential classified market.

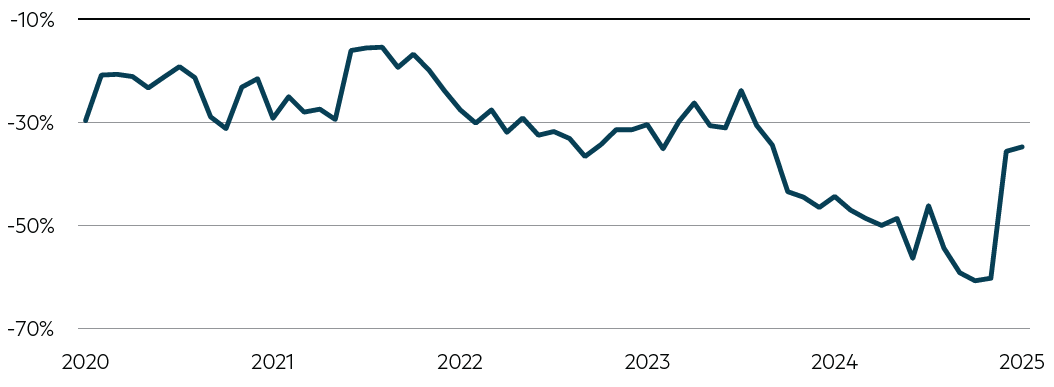

The key question for investors is whether the ‘winner takes all’ thematic is likely to ‘fully’ play out? The takeover proposal of Doman Holdings Australia by CoStar Group during the quarter suggests ‘no’. Domain is the no.2 player in the domestic online real estate portal which has typically traded at a 25-30% discount to the market leader, REA Group, which has been growing volumes faster and generating better yields. However, over the past two years the relative P/E discount has widened to 50%-60% with the market pricing in REA continuing to take market share. CoStar Group, a US property marketplace, with a >US$30bn market cap with deeper marketing pockets relative to REA, looks to be attracted to the Australian online marketplace and thinks there is considerable value, lobbing a $4.20ps bid at 35% premium to the previous close price. In summary, we believe the ‘winner takes all’ thematic being priced in for select stocks is unjustified.

P/E multiple change over the past 2 years for high quality companies taking market share

Source: MBA, FactSet, March 2025.

P/E discount of Domain Holdings vs. REA Group

Source: MBA, FactSet, March 2025.

Consumer relief for stretched households?

Over the quarter, the trading updates from consumer discretionary exposed companies have been underwhelming given extended promotional activity during key sales periods. This has been driven by a more value conscious consumer in a cost-of-living environment which has impacted gross margins for the retailers, including Myer Holdings, Adairs and Accent Group.

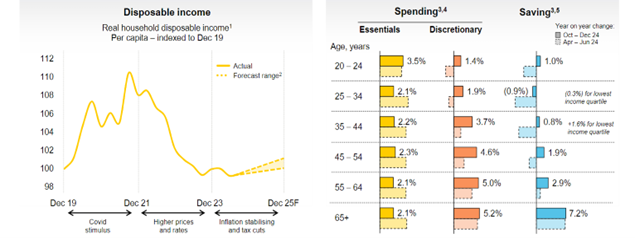

The key question for investors whether there is a more optimistic outlook for the domestic consumer? CBA thinks so given strong employment, wage increases, moderating inflation and tax cuts which are expected to see improving disposable income and discretionary spending across different age cohorts.

Disposable income, spending and savings dynamics across age cohorts

Source: Commonwealth Bank (CBA) ASX presentation, Australian Bureau of Statistics (ABS), Reserve Bank of Australia (RBA), 12 February 2025.

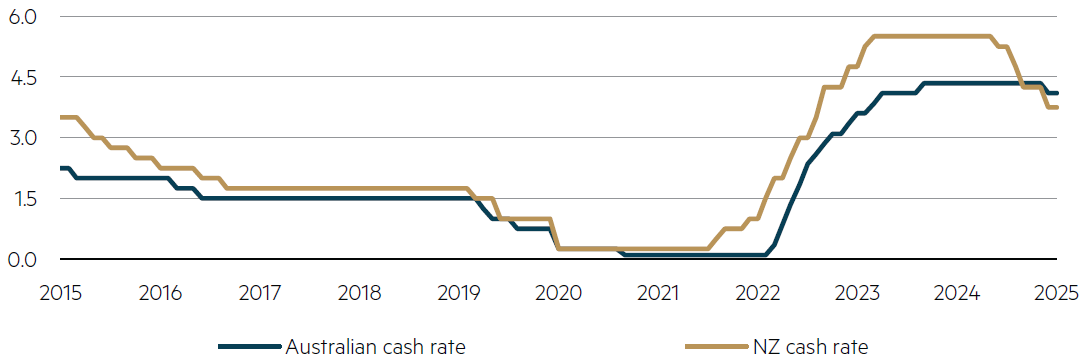

The other key question for investors is whether the start of the domestic interest rate cutting cycle by the RBA will be positive for the consumer? Using New Zealand as an example suggests ‘no’. New Zealand has been approximately 6 months ahead of Australia with interest rate cuts from a peak of 5.5% in mid-2024 to 3.75% currently with Australia getting its first cut in February 2025 from 4.35% to 4.10%.

The New Zealand experience showed optimism with the first interest rate cut although has quickly faded with a continuation of subdued retailer trading updates recently from the likes of Michael Hill International, KMD Brands and Biscoe Group. We see a risk of a shallow interest rate cutting cycle being flagged by the RBA having minimal positive impact to the challenged retail sector and prefer structural growth companies, notably Nick Scali.

Australian and New Zealand cash rates (%)

Source: Maple-Brown Abbott, FactSet, 31 March 2025.

The new ‘golden’ age for Australian small cap miners

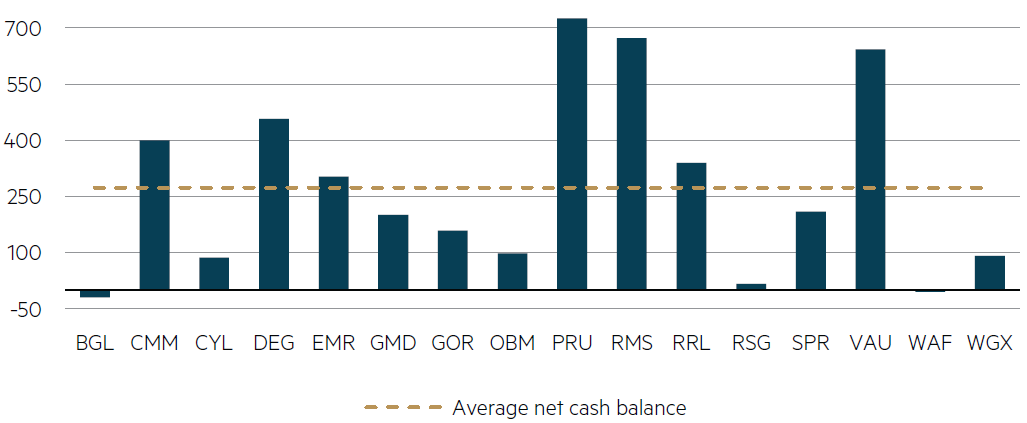

The meteoric rise of the gold price has seen Australian small cap miners outperform given the significant commodity price leverage combined with moderating cost pressures and strong free cash flow generation. Australian small cap gold miners are now becoming a meaningful weight in the S&P/ASX Small Ordinaries Index and given increasing cash balances, we expect further corporate activity to continue in the sector. Key stock beneficiaries of corporate activity include De Grey Mining and Spartan Resources which are pending takeover bids from Northern Star Mining and Ramelius Resources, respectively.

Net cash balance for Australian small cap gold miners (A$m)

Source: MBA, FactSet, March 2025.

Other key themes from the quarter include:

- Banks: share prices for the big banks started to crack given increasing concerns regarding Net interest Margin (NIM) compression

- Index changes: passive investing and index changes driving stock volatility, notably for Life360 and Sigma Healthcare

- Corporate activity: continue to see a ramp-up with private equity and offshore companies arbitraging the opportunities at the ‘value’ end of the market, notably Insignia Financial and Mayne Pharma Group

- Corporate governance: concerns for founder led businesses continue to attract investor interest, notably Wistech Global and Mineral Resources

- Federal election: the election uncertainty going into May with the potential risk of a minority government will be a watchpoint for investors despite minimal policy differentiation between the major parties, outside of energy and climate change

- Reporting season volatility: share price volatility over the February 2025 reporting season for the Australian small caps market has been one of the most elevated in recent reporting season history with disproportionate company performance relative to consensus earnings revisions

In summary, the thematic shifts and heightened market volatility is creating increased value adding opportunities for active Australian small cap managers that have a competitive information advantage.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, AFSL No. 237296 (“MBA”). This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate, and obtain the relevant Product Disclosure Statement and Target Market Determination for any financial product you are considering. This information does not constitute an offer or solicitation by anyone in any jurisdiction. Past performance is not a reliable indicator of future performance. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Any companies, securities and or/case studies referenced or discussed are used only for illustrative purposes. The information provided is not a recommendation for any particular security or strategy, and is not an indication of the trading intent of MBA. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. This information is current at 21 March 2025 and is subject to change at any time without notice. © 2025 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update