Investing in Australian small companies where we have conviction on medium-term earnings delivery that are supported by sustainable business models

Home » Australian Small Companies

Australian small companies

- ‘Agnostic’ investment style based on the belief that earnings drive share price performance

- Sustainability factors are integral to our investment process

- Focused investment process designed to create an ‘all weather portfolio’ comprised of stocks that rank highly on our earnings, sustainability and risk measures

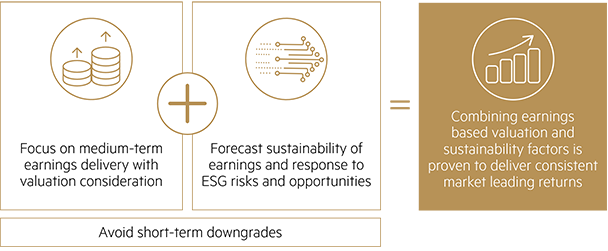

We believe it is through combining our earnings-based valuation approach with a focus on sustainability that the strategy will deliver enhanced investment performance in Australian small companies.

Our investment philosophy

Rather than defining ourselves by a particular investment style, our investment philosophy is based on our belief that earnings drive share prices.

Our three core beliefs underpinning the philosophy are:

1. Share price performance is driven by medium-term earnings delivery with consideration given to valuation and where the company is in the earnings cycle

2. Sustainability factors are an important driver of long-term performance and superior risk-reward characteristics

3. Companies which disappoint on short-term earnings expectations typically underperform.

By taking time to understand where a company is in the earnings cycle, we can determine the price paid for the future earnings stream. Given the breadth of the Australian small cap market, we believe we can find undervalued companies where we have conviction in medium-term earnings delivery at any point of the market cycle.

Sustainability is key

Sustainability is integral to our investment process. We believe sustainable companies provide superior risk-reward characteristics over the longer term and are exemplified by strong, persistent earnings streams over long-term periods and across various market cycles. We believe sustainability factors influence a company’s long-term value and are more persistent than shorter term cyclical earnings factors.

We view sustainability using a multi-faceted approach and undertake a deep dive into industry positioning and how a company manages the opportunities and risks associated with sustainability. When assessing a company’s sustainability drivers, we consider the entrepreneurial spirit that has driven the success of many small cap companies alongside the appropriate sustainability policies needed to ensure long-term outcomes.

Our approach is hands-on. Continuous engagement with company management, company chair and directors is a key feature of our approach, as well as rating companies on environmental, social and governance risks. The portfolio managers have demonstrated a strong correlation between ESG ratings and subsequent share price performances for Australian small cap companies.*

Aiming for outperformance over the long term

We actively manage the portfolio, combining earnings-based valuation and sustainability factors, in addition to minimising exposure to short-term downgrades, and believe this combination can deliver outperformance over the long term.

* The past performance and experience of the portfolio managers was achieved managing a different portfolio with substantially the same investment strategy. Past performance is not a reliable indicator of future performance.

* The past performance and experience of the portfolio managers was achieved managing a different portfolio with substantially the same investment strategy. Past performance is not a reliable indicator of future performance.

Our investment approach

We use an idea generation tool to filter the investable universe and identify potential investment opportunities. We then subject those companies to our proprietary fundamental research to ensure our analysis reflects the company rather than market consensus.

Using an earnings-based valuation, we gain an understanding of earnings drivers through meetings with company management and site visits, as well as engaging with competitors, customers, suppliers and other industry contacts. We also assess the sustainability factors of each company. Considering these two factors helps us determine stock recommendations and appropriate position ranges, which we adjust for any expected downside earnings risks and illiquidity factors.

We typically hold 30–50 stocks with the focus on diversification and stock specific risk management.

Portfolio Managers

A team of experienced and dedicated investment professionals.

Phillip Hudak joined Maple-Brown Abbott in April 2022 as Co-Portfolio Manager for Australian Small Companies, bringing over 20 years’ investment experience, with 15 years dedicated to Australian small cap equity portfolio management and fundamental stock research. In his current role, Phillip is responsible for leading the Australian small companies equity business, focusing on medium-term earnings delivery combined with a differentiated market-leading sustainability framework which is designed to outperform in most market environments.

Before joining Maple-Brown Abbott, Phillip worked as Co-Portfolio Manager on the AMP Capital Australian Emerging Companies strategy for nine years. Prior to that, he was a small companies analyst at ING Investment Management, analyst at MIR Investment Management and an investment consultant with Russell Investment Group.

Phillip

Matt Griffin joined Maple-Brown Abbott in April 2022 as Co-Portfolio Manager for Australian Small Companies, bringing 14 years’ investment experience in Australian small cap equity portfolio management and fundamental stock research. In his current role, he is responsible for leading the Australian small companies equity business, focusing on medium-term earnings delivery combined with a differentiated market-leading sustainability framework which is designed to outperform in most market environments.

Before joining Maple-Brown Abbott, Matt worked as Co-Portfolio Manager on the AMP Capital Australian Emerging Companies strategy for four years. Prior to that, he was Investment Director at IFM Investors, where he was integral to the launch of the IFM Australia small caps and micro caps strategy, and a small companies analyst at Macquarie Asset Management.

Matt

Maple-Brown Abbott Australian Small Companies Fund

The Fund is actively managed and is primarily invested in companies listed (or expected to be listed) on an Australian securities exchange which, at the time they are first invested, are not included in the S&P/ASX 100 Index and have a minimum market capitalisation of $100 million.

We believe that company earnings drive share prices over the medium-term. We use a disciplined fundamental research process to identify undervalued companies where we have conviction in medium-term earnings delivery. We focus on earnings-based valuations, assessment of how sustainable a company’s business model is and consideration of earnings risk. We believe that this focus can deliver strong and consistent returns over the long-term. Given the breadth of the Australian small companies market, we believe companies with this profile can be found at any point in the market cycle.

The portfolio managers have a proven and repeatable investment process, focused on in-depth fundamental research at the company level.* This approach is designed to create a portfolio of compelling high conviction ideas for our investors.

We typically hold 30–50 stocks which score well on combined earnings-based valuation and sustainability measures, with the focus on diversification and stock specific risk management.

*The past performance and experience of the portfolio managers was achieved managing a different fund with substantially the same investment strategy as the Fund. Past performance is not a reliable indicator of future performance.

| Fund facts | |

|

Inception date 24/06/2022 |

Distribution frequency Annually |

|

Benchmark S&P/ASX Small Ordinaries Total Return Index |

Minimum initial application $ 20,000 |

|

APIR code MPL1241AU |

Management fees and costs %*^ 1.10 Performance fee^ 15% of the Fund’s outperformance of the Benchmark |

|

Pricing frequency & cut-off Daily/12pm Sydney time on a Business Day |

Buy/Sell spread %^ 0.25/0.25 |

*Management fees and costs for the Fund are made up of the management fee, indirect costs (if any) and estimated recoverable expenses.

^Additional fees and costs may also apply in relation to an investment in the Fund. For a full description of the fees and costs refer to the Product Disclosure Statement and Additional Information Booklet for the Fund.

Portfolio Managers

A team of experienced and dedicated investment professionals.

Phillip Hudak joined Maple-Brown Abbott in April 2022 as Co-Portfolio Manager for Australian Small Companies, bringing over 20 years’ investment experience, with 15 years dedicated to Australian small cap equity portfolio management and fundamental stock research. In his current role, Phillip is responsible for leading the Australian small companies equity business, focusing on medium-term earnings delivery combined with a differentiated market-leading sustainability framework which is designed to outperform in most market environments.

Before joining Maple-Brown Abbott, Phillip worked as Co-Portfolio Manager on the AMP Capital Australian Emerging Companies strategy for nine years. Prior to that, he was a small companies analyst at ING Investment Management, analyst at MIR Investment Management and an investment consultant with Russell Investment Group.

Phillip

Matt Griffin joined Maple-Brown Abbott in April 2022 as Co-Portfolio Manager for Australian Small Companies, bringing 14 years’ investment experience in Australian small cap equity portfolio management and fundamental stock research. In his current role, he is responsible for leading the Australian small companies equity business, focusing on medium-term earnings delivery combined with a differentiated market-leading sustainability framework which is designed to outperform in most market environments.

Before joining Maple-Brown Abbott, Matt worked as Co-Portfolio Manager on the AMP Capital Australian Emerging Companies strategy for four years. Prior to that, he was Investment Director at IFM Investors, where he was integral to the launch of the IFM Australia small caps and micro caps strategy, and a small companies analyst at Macquarie Asset Management.

Matt

Fund performance^

as at 30/04/2025

| blank | 1 mth % | 3 mths % | Calendar year to date | 1 yr % p.a. | 2 year p.a. | Since inception % p.a.* | asdate |

|---|---|---|---|---|---|---|---|

| Fund | 3.5 | -0.2 | 5.20 | 17.7 | 14.70 | 18.5 | 30/04/2025 |

| Benchmark | 1.8 | -4.6 | -0.20 | 3.7 | 5.50 | 7.6 | 30/04/2025 |

| Difference | 1.7 | 4.3 | 5.40 | 14.0 | 9.20 | 11.0 | 30/04/2025 |

^Past performance is not a reliable indicator of future performance. No warranty can be given for future performance. Returns are volatile and may fluctuate quickly and significantly. Total return is based on the movement in net asset value per unit plus distributions and is before tax and after all fees and charges. Imputation and foreign income tax offsets are not included in the performance figures.

Source: Maple-Brown Abbott and S&P

*Inception date is 24 June 2022

Unit price

| Date | Application price | Net asset value | Redemption price | DISTRIBUTION |

|---|---|---|---|---|

| 27/06/2022 | 1.0248 | 1.0222 | 1.0196 | |

| 28/06/2022 | 1.0330 | 1.0304 | 1.0278 | |

| 29/06/2022 | 1.0145 | 1.0120 | 1.0095 | |

| 30/06/2022 | 1.0059 | 1.0034 | 1.0009 | |

| 01/07/2022 | 1.0081 | 1.0056 | 1.0031 | |

| 04/07/2022 | 1.0273 | 1.0247 | 1.0221 | |

| 05/07/2022 | 1.0286 | 1.0260 | 1.0234 | |

| 06/07/2022 | 1.0286 | 1.0260 | 1.0234 | |

| 07/07/2022 | 1.0330 | 1.0304 | 1.0278 | |

| 08/07/2022 | 1.0556 | 1.0530 | 1.0504 | |

| 11/07/2022 | 1.0251 | 1.0225 | 1.0199 | |

| 12/07/2022 | 1.0192 | 1.0167 | 1.0142 | |

| 13/07/2022 | 1.0250 | 1.0224 | 1.0198 | |

| 14/07/2022 | 1.0350 | 1.0324 | 1.0298 | |

| 15/07/2022 | 1.0314 | 1.0288 | 1.0262 | |

| 18/07/2022 | 1.0427 | 1.0401 | 1.0375 | |

| 19/07/2022 | 1.0436 | 1.0410 | 1.0384 | |

| 20/07/2022 | 1.0598 | 1.0572 | 1.0546 | |

| 21/07/2022 | 1.0719 | 1.0692 | 1.0665 | |

| 22/07/2022 | 1.0649 | 1.0622 | 1.0595 | |

| 25/07/2022 | 1.0645 | 1.0618 | 1.0591 | |

| 26/07/2022 | 1.0559 | 1.0533 | 1.0507 | |

| 27/07/2022 | 1.0592 | 1.0566 | 1.0540 | |

| 28/07/2022 | 1.0855 | 1.0828 | 1.0801 | |

| 29/07/2022 | 1.1007 | 1.0980 | 1.0953 | |

| 01/08/2022 | 1.0954 | 1.0927 | 1.0900 | |

| 02/08/2022 | 1.1010 | 1.0983 | 1.0956 | |

| 03/08/2022 | 1.1079 | 1.1051 | 1.1023 | |

| 04/08/2022 | 1.1140 | 1.1112 | 1.1084 | |

| 05/08/2022 | 1.1209 | 1.1181 | 1.1153 | |

| 08/08/2022 | 1.1188 | 1.1160 | 1.1132 | |

| 09/08/2022 | 1.1197 | 1.1169 | 1.1141 | |

| 10/08/2022 | 1.1132 | 1.1104 | 1.1076 | |

| 11/08/2022 | 1.1271 | 1.1243 | 1.1215 | |

| 12/08/2022 | 1.1286 | 1.1258 | 1.1230 | |

| 15/08/2022 | 1.1355 | 1.1327 | 1.1299 | |

| 16/08/2022 | 1.1332 | 1.1304 | 1.1276 | |

| 17/08/2022 | 1.1334 | 1.1306 | 1.1278 | |

| 18/08/2022 | 1.1357 | 1.1329 | 1.1301 | |

| 19/08/2022 | 1.1389 | 1.1361 | 1.1333 | |

| 22/08/2022 | 1.1250 | 1.1222 | 1.1194 | |

| 23/08/2022 | 1.1173 | 1.1145 | 1.1117 | |

| 24/08/2022 | 1.1256 | 1.1228 | 1.1200 | |

| 25/08/2022 | 1.1385 | 1.1357 | 1.1329 | |

| 26/08/2022 | 1.1422 | 1.1394 | 1.1366 | |

| 29/08/2022 | 1.1199 | 1.1171 | 1.1143 | |

| 30/08/2022 | 1.1332 | 1.1304 | 1.1276 | |

| 31/08/2022 | 1.1543 | 1.1514 | 1.1485 | |

| 01/09/2022 | 1.1244 | 1.1216 | 1.1188 | |

| 02/09/2022 | 1.1160 | 1.1132 | 1.1104 | |

| 05/09/2022 | 1.1190 | 1.1162 | 1.1134 | |

| 06/09/2022 | 1.1240 | 1.1212 | 1.1184 | |

| 07/09/2022 | 1.1177 | 1.1149 | 1.1121 | |

| 08/09/2022 | 1.1374 | 1.1346 | 1.1318 | |

| 09/09/2022 | 1.1444 | 1.1415 | 1.1386 | |

| 12/09/2022 | 1.1538 | 1.1509 | 1.1480 | |

| 13/09/2022 | 1.1624 | 1.1595 | 1.1566 | |

| 14/09/2022 | 1.1370 | 1.1342 | 1.1314 | |

| 15/09/2022 | 1.1387 | 1.1359 | 1.1331 | |

| 16/09/2022 | 1.1234 | 1.1206 | 1.1178 | |

| 19/09/2022 | 1.1145 | 1.1117 | 1.1089 | |

| 20/09/2022 | 1.1269 | 1.1241 | 1.1213 | |

| 21/09/2022 | 1.1165 | 1.1137 | 1.1109 | |

| 23/09/2022 | 1.0882 | 1.0855 | 1.0828 | |

| 26/09/2022 | 1.0601 | 1.0575 | 1.0549 | |

| 27/09/2022 | 1.0641 | 1.0614 | 1.0587 | |

| 28/09/2022 | 1.0577 | 1.0551 | 1.0525 | |

| 29/09/2022 | 1.0741 | 1.0714 | 1.0687 | |

| 30/09/2022 | 1.0728 | 1.0701 | 1.0674 | |

| 04/10/2022 | 1.1021 | 1.0994 | 1.0967 | |

| 05/10/2022 | 1.1287 | 1.1259 | 1.1231 | |

| 06/10/2022 | 1.1259 | 1.1231 | 1.1203 | |

| 07/10/2022 | 1.1203 | 1.1175 | 1.1147 | |

| 10/10/2022 | 1.0974 | 1.0947 | 1.0920 | |

| 11/10/2022 | 1.0908 | 1.0881 | 1.0854 | |

| 12/10/2022 | 1.0876 | 1.0849 | 1.0822 | |

| 13/10/2022 | 1.0813 | 1.0786 | 1.0759 | |

| 14/10/2022 | 1.0969 | 1.0942 | 1.0915 | |

| 17/10/2022 | 1.0841 | 1.0814 | 1.0787 | |

| 18/10/2022 | 1.1121 | 1.1093 | 1.1065 | |

| 19/10/2022 | 1.1198 | 1.1170 | 1.1142 | |

| 20/10/2022 | 1.1109 | 1.1081 | 1.1053 | |

| 21/10/2022 | 1.1118 | 1.1090 | 1.1062 | |

| 24/10/2022 | 1.1280 | 1.1252 | 1.1224 | |

| 25/10/2022 | 1.1273 | 1.1245 | 1.1217 | |

| 26/10/2022 | 1.1321 | 1.1293 | 1.1265 | |

| 27/10/2022 | 1.1458 | 1.1429 | 1.1400 | |

| 28/10/2022 | 1.1323 | 1.1295 | 1.1267 | |

| 31/10/2022 | 1.1488 | 1.1459 | 1.1430 | |

| 01/11/2022 | 1.1639 | 1.1610 | 1.1581 | |

| 02/11/2022 | 1.1666 | 1.1637 | 1.1608 | |

| 03/11/2022 | 1.1460 | 1.1431 | 1.1402 | |

| 04/11/2022 | 1.1520 | 1.1491 | 1.1462 | |

| 07/11/2022 | 1.1514 | 1.1485 | 1.1456 | |

| 08/11/2022 | 1.1498 | 1.1469 | 1.1440 | |

| 09/11/2022 | 1.1587 | 1.1558 | 1.1529 | |

| 10/11/2022 | 1.1448 | 1.1419 | 1.1390 | |

| 11/11/2022 | 1.1808 | 1.1779 | 1.1750 | |

| 14/11/2022 | 1.1683 | 1.1654 | 1.1625 | |

| 15/11/2022 | 1.1668 | 1.1639 | 1.1610 | |

| 16/11/2022 | 1.1605 | 1.1576 | 1.1547 | |

| 17/11/2022 | 1.1639 | 1.1610 | 1.1581 | |

| 18/11/2022 | 1.1578 | 1.1549 | 1.1520 | |

| 21/11/2022 | 1.1561 | 1.1532 | 1.1503 | |

| 22/11/2022 | 1.1583 | 1.1554 | 1.1525 | |

| 23/11/2022 | 1.1677 | 1.1648 | 1.1619 | |

| 24/11/2022 | 1.1670 | 1.1641 | 1.1612 | |

| 25/11/2022 | 1.1662 | 1.1633 | 1.1604 | |

| 28/11/2022 | 1.1626 | 1.1597 | 1.1568 | |

| 29/11/2022 | 1.1623 | 1.1594 | 1.1565 | |

| 30/11/2022 | 1.1720 | 1.1691 | 1.1662 | |

| 01/12/2022 | 1.1754 | 1.1725 | 1.1696 | |

| 02/12/2022 | 1.1704 | 1.1675 | 1.1646 | |

| 05/12/2022 | 1.1680 | 1.1651 | 1.1622 | |

| 06/12/2022 | 1.1555 | 1.1526 | 1.1497 | |

| 07/12/2022 | 1.1369 | 1.1341 | 1.1313 | |

| 08/12/2022 | 1.1326 | 1.1298 | 1.1270 | |

| 09/12/2022 | 1.1359 | 1.1331 | 1.1303 | |

| 12/12/2022 | 1.1284 | 1.1256 | 1.1228 | |

| 13/12/2022 | 1.1335 | 1.1307 | 1.1279 | |

| 14/12/2022 | 1.1470 | 1.1441 | 1.1412 | |

| 15/12/2022 | 1.1396 | 1.1368 | 1.1340 | |

| 16/12/2022 | 1.1333 | 1.1305 | 1.1277 | |

| 19/12/2022 | 1.1362 | 1.1334 | 1.1306 | |

| 20/12/2022 | 1.1147 | 1.1119 | 1.1091 | |

| 21/12/2022 | 1.1308 | 1.1280 | 1.1252 | |

| 22/12/2022 | 1.1485 | 1.1456 | 1.1427 | |

| 23/12/2022 | 1.1375 | 1.1347 | 1.1319 | |

| 28/12/2022 | 1.1313 | 1.1285 | 1.1257 | |

| 29/12/2022 | 1.1261 | 1.1233 | 1.1205 | |

| 30/12/2022 | 1.1322 | 1.1294 | 1.1266 | |

| 03/01/2023 | 1.1214 | 1.1186 | 1.1158 | |

| 04/01/2023 | 1.1386 | 1.1358 | 1.1330 | |

| 05/01/2023 | 1.1451 | 1.1422 | 1.1393 | |

| 06/01/2023 | 1.1507 | 1.1478 | 1.1449 | |

| 09/01/2023 | 1.1628 | 1.1599 | 1.1570 | |

| 10/01/2023 | 1.1595 | 1.1566 | 1.1537 | |

| 11/01/2023 | 1.1689 | 1.1660 | 1.1631 | |

| 12/01/2023 | 1.1809 | 1.1780 | 1.1751 | |

| 13/01/2023 | 1.1891 | 1.1861 | 1.1831 | |

| 16/01/2023 | 1.1925 | 1.1895 | 1.1865 | |

| 17/01/2023 | 1.1934 | 1.1904 | 1.1874 | |

| 18/01/2023 | 1.1992 | 1.1962 | 1.1932 | |

| 19/01/2023 | 1.1953 | 1.1923 | 1.1893 | |

| 20/01/2023 | 1.1994 | 1.1964 | 1.1934 | |

| 23/01/2023 | 1.2046 | 1.2016 | 1.1986 | |

| 24/01/2023 | 1.2067 | 1.2037 | 1.2007 | |

| 25/01/2023 | 1.2040 | 1.2010 | 1.1980 | |

| 27/01/2023 | 1.2080 | 1.2050 | 1.2020 | |

| 30/01/2023 | 1.2077 | 1.2047 | 1.2017 | |

| 31/01/2023 | 1.1983 | 1.1953 | 1.1923 | |

| 01/02/2023 | 1.1951 | 1.1921 | 1.1891 | |

| 02/02/2023 | 1.2038 | 1.2008 | 1.1978 | |

| 03/02/2023 | 1.2016 | 1.1986 | 1.1956 | |

| 06/02/2023 | 1.1914 | 1.1884 | 1.1854 | |

| 07/02/2023 | 1.1892 | 1.1862 | 1.1832 | |

| 08/02/2023 | 1.1883 | 1.1853 | 1.1823 | |

| 09/02/2023 | 1.1787 | 1.1758 | 1.1729 | |

| 10/02/2023 | 1.1666 | 1.1637 | 1.1608 | |

| 13/02/2023 | 1.1628 | 1.1599 | 1.1570 | |

| 14/02/2023 | 1.1718 | 1.1689 | 1.1660 | |

| 15/02/2023 | 1.1725 | 1.1696 | 1.1667 | |

| 16/02/2023 | 1.1844 | 1.1814 | 1.1784 | |

| 17/02/2023 | 1.1717 | 1.1688 | 1.1659 | |

| 20/02/2023 | 1.1636 | 1.1607 | 1.1578 | |

| 21/02/2023 | 1.1678 | 1.1649 | 1.1620 | |

| 22/02/2023 | 1.1608 | 1.1579 | 1.1550 | |

| 23/02/2023 | 1.1706 | 1.1677 | 1.1648 | |

| 24/02/2023 | 1.1783 | 1.1754 | 1.1725 | |

| 27/02/2023 | 1.1595 | 1.1566 | 1.1537 | |

| 28/02/2023 | 1.1755 | 1.1726 | 1.1697 | |

| 01/03/2023 | 1.1724 | 1.1695 | 1.1666 | |

| 02/03/2023 | 1.1733 | 1.1704 | 1.1675 | |

| 03/03/2023 | 1.1742 | 1.1713 | 1.1684 | |

| 06/03/2023 | 1.1791 | 1.1762 | 1.1733 | |

| 07/03/2023 | 1.1848 | 1.1818 | 1.1788 | |

| 08/03/2023 | 1.1775 | 1.1746 | 1.1717 | |

| 09/03/2023 | 1.1853 | 1.1823 | 1.1793 | |

| 10/03/2023 | 1.1635 | 1.1606 | 1.1577 | |

| 13/03/2023 | 1.1566 | 1.1537 | 1.1508 | |

| 14/03/2023 | 1.1391 | 1.1363 | 1.1335 | |

| 15/03/2023 | 1.1524 | 1.1495 | 1.1466 | |

| 16/03/2023 | 1.1287 | 1.1259 | 1.1231 | |

| 17/03/2023 | 1.1363 | 1.1335 | 1.1307 | |

| 20/03/2023 | 1.1230 | 1.1202 | 1.1174 | |

| 21/03/2023 | 1.1343 | 1.1315 | 1.1287 | |

| 22/03/2023 | 1.1481 | 1.1452 | 1.1423 | |

| 23/03/2023 | 1.1424 | 1.1396 | 1.1368 | |

| 24/03/2023 | 1.1517 | 1.1488 | 1.1459 | |

| 27/03/2023 | 1.1525 | 1.1496 | 1.1467 | |

| 28/03/2023 | 1.1761 | 1.1732 | 1.1703 | |

| 29/03/2023 | 1.1786 | 1.1757 | 1.1728 | |

| 30/03/2023 | 1.1913 | 1.1883 | 1.1853 | |

| 31/03/2023 | 1.2037 | 1.2007 | 1.1977 | |

| 03/04/2023 | 1.2156 | 1.2126 | 1.2096 | |

| 04/04/2023 | 1.2205 | 1.2175 | 1.2145 | |

| 05/04/2023 | 1.2286 | 1.2255 | 1.2224 | |

| 06/04/2023 | 1.2136 | 1.2106 | 1.2076 | |

| 11/04/2023 | 1.2235 | 1.2204 | 1.2173 | |

| 12/04/2023 | 1.2291 | 1.2260 | 1.2229 | |

| 13/04/2023 | 1.2305 | 1.2274 | 1.2243 | |

| 14/04/2023 | 1.2380 | 1.2349 | 1.2318 | |

| 17/04/2023 | 1.2377 | 1.2346 | 1.2315 | |

| 18/04/2023 | 1.2354 | 1.2323 | 1.2292 | |

| 19/04/2023 | 1.2351 | 1.2320 | 1.2289 | |

| 20/04/2023 | 1.2329 | 1.2298 | 1.2267 | |

| 21/04/2023 | 1.2317 | 1.2286 | 1.2255 | |

| 24/04/2023 | 1.2344 | 1.2313 | 1.2282 | |

| 26/04/2023 | 1.2294 | 1.2263 | 1.2232 | |

| 27/04/2023 | 1.2293 | 1.2262 | 1.2231 | |

| 28/04/2023 | 1.2353 | 1.2322 | 1.2291 | |

| 01/05/2023 | 1.2351 | 1.2320 | 1.2289 | |

| 02/05/2023 | 1.2290 | 1.2259 | 1.2228 | |

| 03/05/2023 | 1.2211 | 1.2181 | 1.2151 | |

| 04/05/2023 | 1.2229 | 1.2199 | 1.2169 | |

| 05/05/2023 | 1.2310 | 1.2279 | 1.2248 | |

| 08/05/2023 | 1.2411 | 1.2380 | 1.2349 | |

| 09/05/2023 | 1.2291 | 1.2260 | 1.2229 | |

| 10/05/2023 | 1.2339 | 1.2308 | 1.2277 | |

| 11/05/2023 | 1.2311 | 1.2280 | 1.2249 | |

| 12/05/2023 | 1.2333 | 1.2302 | 1.2271 | |

| 15/05/2023 | 1.2352 | 1.2321 | 1.2290 | |

| 16/05/2023 | 1.2237 | 1.2206 | 1.2175 | |

| 17/05/2023 | 1.2180 | 1.2150 | 1.2120 | |

| 18/05/2023 | 1.2205 | 1.2175 | 1.2145 | |

| 19/05/2023 | 1.2295 | 1.2264 | 1.2233 | |

| 22/05/2023 | 1.2209 | 1.2179 | 1.2149 | |

| 23/05/2023 | 1.2188 | 1.2158 | 1.2128 | |

| 24/05/2023 | 1.2104 | 1.2074 | 1.2044 | |

| 25/05/2023 | 1.1990 | 1.1960 | 1.1930 | |

| 26/05/2023 | 1.2015 | 1.1985 | 1.1955 | |

| 29/05/2023 | 1.2119 | 1.2089 | 1.2059 | |

| 30/05/2023 | 1.2108 | 1.2078 | 1.2048 | |

| 31/05/2023 | 1.2036 | 1.2006 | 1.1976 | |

| 01/06/2023 | 1.2070 | 1.2040 | 1.2010 | |

| 02/06/2023 | 1.2122 | 1.2092 | 1.2062 | |

| 05/06/2023 | 1.2171 | 1.2141 | 1.2111 | |

| 06/06/2023 | 1.2100 | 1.2070 | 1.2040 | |

| 07/06/2023 | 1.2112 | 1.2082 | 1.2052 | |

| 08/06/2023 | 1.1973 | 1.1943 | 1.1913 | |

| 09/06/2023 | 1.2006 | 1.1976 | 1.1946 | |

| 13/06/2023 | 1.2081 | 1.2051 | 1.2021 | |

| 14/06/2023 | 1.2115 | 1.2085 | 1.2055 | |

| 15/06/2023 | 1.2099 | 1.2069 | 1.2039 | |

| 16/06/2023 | 1.2245 | 1.2214 | 1.2183 | |

| 19/06/2023 | 1.2276 | 1.2245 | 1.2214 | |

| 20/06/2023 | 1.2321 | 1.2290 | 1.2259 | |

| 21/06/2023 | 1.2296 | 1.2265 | 1.2234 | |

| 22/06/2023 | 1.2046 | 1.2016 | 1.1986 | |

| 23/06/2023 | 1.1907 | 1.1877 | 1.1847 | |

| 26/06/2023 | 1.1902 | 1.1872 | 1.1842 | |

| 27/06/2023 | 1.1867 | 1.1837 | 1.1807 | |

| 28/06/2023 | 1.2007 | 1.1977 | 1.1947 | |

| 29/06/2023 | 1.2074 | 1.2044 | 1.2014 | |

| 30/06/2023 | 1.2077 | 1.2047 | 1.2017 | |

| 03/07/2023 | 1.2114 | 1.2084 | 1.2054 | |

| 04/07/2023 | 1.2186 | 1.2156 | 1.2126 | |

| 05/07/2023 | 1.2132 | 1.2102 | 1.2072 | |

| 06/07/2023 | 1.2054 | 1.2024 | 1.1994 | |

| 07/07/2023 | 1.1849 | 1.1819 | 1.1789 | |

| 10/07/2023 | 1.1815 | 1.1786 | 1.1757 | |

| 11/07/2023 | 1.1990 | 1.1960 | 1.1930 | |

| 12/07/2023 | 1.1991 | 1.1961 | 1.1931 | |

| 13/07/2023 | 1.2189 | 1.2159 | 1.2129 | |

| 14/07/2023 | 1.2271 | 1.2240 | 1.2209 | |

| 17/07/2023 | 1.2245 | 1.2214 | 1.2183 | |

| 18/07/2023 | 1.2218 | 1.2188 | 1.2158 | |

| 19/07/2023 | 1.2299 | 1.2268 | 1.2237 | |

| 20/07/2023 | 1.2355 | 1.2324 | 1.2293 | |

| 21/07/2023 | 1.2285 | 1.2254 | 1.2223 | |

| 24/07/2023 | 1.2250 | 1.2219 | 1.2188 | |

| 25/07/2023 | 1.2327 | 1.2296 | 1.2265 | |

| 26/07/2023 | 1.2386 | 1.2355 | 1.2324 | |

| 27/07/2023 | 1.2503 | 1.2472 | 1.2441 | |

| 28/07/2023 | 1.2416 | 1.2385 | 1.2354 | |

| 31/07/2023 | 1.2346 | 1.2315 | 1.2284 | |

| 01/08/2023 | 1.2394 | 1.2363 | 1.2332 | |

| 02/08/2023 | 1.2255 | 1.2224 | 1.2193 | |

| 03/08/2023 | 1.2190 | 1.2160 | 1.2130 | |

| 04/08/2023 | 1.2197 | 1.2167 | 1.2137 | |

| 07/08/2023 | 1.2217 | 1.2187 | 1.2157 | |

| 08/08/2023 | 1.2179 | 1.2149 | 1.2119 | |

| 09/08/2023 | 1.2191 | 1.2161 | 1.2131 | |

| 10/08/2023 | 1.2277 | 1.2246 | 1.2215 | |

| 11/08/2023 | 1.2272 | 1.2241 | 1.2210 | |

| 14/08/2023 | 1.2273 | 1.2242 | 1.2211 | |

| 15/08/2023 | 1.2262 | 1.2231 | 1.2200 | |

| 16/08/2023 | 1.2169 | 1.2139 | 1.2109 | |

| 17/08/2023 | 1.2114 | 1.2084 | 1.2054 | |

| 18/08/2023 | 1.2072 | 1.2042 | 1.2012 | |

| 21/08/2023 | 1.2070 | 1.2040 | 1.2010 | |

| 22/08/2023 | 1.2112 | 1.2082 | 1.2052 | |

| 23/08/2023 | 1.2133 | 1.2103 | 1.2073 | |

| 24/08/2023 | 1.2234 | 1.2203 | 1.2172 | |

| 25/08/2023 | 1.2180 | 1.2150 | 1.2120 | |

| 28/08/2023 | 1.2255 | 1.2224 | 1.2193 | |

| 29/08/2023 | 1.2301 | 1.2270 | 1.2239 | |

| 30/08/2023 | 1.2452 | 1.2421 | 1.2390 | |

| 31/08/2023 | 1.2510 | 1.2479 | 1.2448 | |

| 01/09/2023 | 1.2508 | 1.2477 | 1.2446 | |

| 04/09/2023 | 1.2608 | 1.2577 | 1.2546 | |

| 05/09/2023 | 1.2529 | 1.2498 | 1.2467 | |

| 06/09/2023 | 1.2469 | 1.2438 | 1.2407 | |

| 07/09/2023 | 1.2363 | 1.2332 | 1.2301 | |

| 08/09/2023 | 1.2357 | 1.2326 | 1.2295 | |

| 11/09/2023 | 1.2370 | 1.2339 | 1.2308 | |

| 12/09/2023 | 1.2404 | 1.2373 | 1.2342 | |

| 13/09/2023 | 1.2286 | 1.2255 | 1.2224 | |

| 14/09/2023 | 1.2363 | 1.2332 | 1.2301 | |

| 15/09/2023 | 1.2509 | 1.2478 | 1.2447 | |

| 18/09/2023 | 1.2338 | 1.2307 | 1.2276 | |

| 19/09/2023 | 1.2332 | 1.2301 | 1.2270 | |

| 20/09/2023 | 1.2296 | 1.2265 | 1.2234 | |

| 21/09/2023 | 1.2194 | 1.2164 | 1.2134 | |

| 22/09/2023 | 1.2219 | 1.2189 | 1.2159 | |

| 25/09/2023 | 1.2274 | 1.2243 | 1.2212 | |

| 26/09/2023 | 1.2247 | 1.2216 | 1.2185 | |

| 27/09/2023 | 1.2245 | 1.2214 | 1.2183 | |

| 28/09/2023 | 1.2196 | 1.2166 | 1.2136 | |

| 29/09/2023 | 1.2257 | 1.2226 | 1.2195 | |

| 03/10/2023 | 1.1991 | 1.1961 | 1.1931 | |

| 04/10/2023 | 1.1917 | 1.1887 | 1.1857 | |

| 05/10/2023 | 1.2004 | 1.1974 | 1.1944 | |

| 06/10/2023 | 1.1990 | 1.1960 | 1.1930 | |

| 09/10/2023 | 1.2000 | 1.1970 | 1.1940 | |

| 10/10/2023 | 1.2085 | 1.2055 | 1.2025 | |

| 11/10/2023 | 1.2238 | 1.2207 | 1.2176 | |

| 12/10/2023 | 1.2252 | 1.2221 | 1.2190 | |

| 13/10/2023 | 1.2134 | 1.2104 | 1.2074 | |

| 16/10/2023 | 1.2053 | 1.2023 | 1.1993 | |

| 17/10/2023 | 1.2069 | 1.2039 | 1.2009 | |

| 18/10/2023 | 1.2086 | 1.2056 | 1.2026 | |

| 19/10/2023 | 1.2022 | 1.1992 | 1.1962 | |

| 20/10/2023 | 1.1922 | 1.1892 | 1.1862 | |

| 23/10/2023 | 1.1837 | 1.1807 | 1.1777 | |

| 24/10/2023 | 1.1910 | 1.1880 | 1.1850 | |

| 25/10/2023 | 1.1834 | 1.1804 | 1.1774 | |

| 26/10/2023 | 1.1686 | 1.1657 | 1.1628 | |

| 27/10/2023 | 1.1685 | 1.1656 | 1.1627 | |

| 30/10/2023 | 1.1595 | 1.1566 | 1.1537 | |

| 31/10/2023 | 1.1596 | 1.1567 | 1.1538 | |

| 01/11/2023 | 1.1681 | 1.1652 | 1.1623 | |

| 02/11/2023 | 1.1856 | 1.1826 | 1.1796 | |

| 03/11/2023 | 1.1979 | 1.1949 | 1.1919 | |

| 06/11/2023 | 1.1993 | 1.1963 | 1.1933 | |

| 07/11/2023 | 1.2033 | 1.2003 | 1.1973 | |

| 08/11/2023 | 1.2065 | 1.2035 | 1.2005 | |

| 09/11/2023 | 1.2065 | 1.2035 | 1.2005 | |

| 10/11/2023 | 1.2030 | 1.2000 | 1.1970 | |

| 13/11/2023 | 1.1974 | 1.1944 | 1.1914 | |

| 14/11/2023 | 1.2159 | 1.2129 | 1.2099 | |

| 15/11/2023 | 1.2309 | 1.2278 | 1.2247 | |

| 16/11/2023 | 1.2193 | 1.2163 | 1.2133 | |

| 17/11/2023 | 1.2199 | 1.2169 | 1.2139 | |

| 20/11/2023 | 1.2204 | 1.2174 | 1.2144 | |

| 21/11/2023 | 1.2273 | 1.2242 | 1.2211 | |

| 22/11/2023 | 1.2222 | 1.2192 | 1.2162 | |

| 23/11/2023 | 1.2187 | 1.2157 | 1.2127 | |

| 24/11/2023 | 1.2170 | 1.2140 | 1.2110 | |

| 27/11/2023 | 1.2140 | 1.2110 | 1.2080 | |

| 28/11/2023 | 1.2238 | 1.2207 | 1.2176 | |

| 29/11/2023 | 1.2348 | 1.2317 | 1.2286 | |

| 30/11/2023 | 1.2410 | 1.2379 | 1.2348 | |

| 01/12/2023 | 1.2435 | 1.2404 | 1.2373 | |

| 04/12/2023 | 1.2517 | 1.2486 | 1.2455 | |

| 05/12/2023 | 1.2351 | 1.2320 | 1.2289 | |

| 06/12/2023 | 1.2521 | 1.2490 | 1.2459 | |

| 07/12/2023 | 1.2399 | 1.2368 | 1.2337 | |

| 08/12/2023 | 1.2416 | 1.2385 | 1.2354 | |

| 11/12/2023 | 1.2390 | 1.2359 | 1.2328 | |

| 12/12/2023 | 1.2394 | 1.2363 | 1.2332 | |

| 13/12/2023 | 1.2421 | 1.2390 | 1.2359 | |

| 14/12/2023 | 1.2691 | 1.2659 | 1.2627 | |

| 15/12/2023 | 1.2760 | 1.2728 | 1.2696 | |

| 18/12/2023 | 1.2835 | 1.2803 | 1.2771 | |

| 19/12/2023 | 1.2964 | 1.2932 | 1.2900 | |

| 20/12/2023 | 1.3081 | 1.3048 | 1.3015 | |

| 21/12/2023 | 1.2931 | 1.2899 | 1.2867 | |

| 22/12/2023 | 1.2991 | 1.2959 | 1.2927 | |

| 27/12/2023 | 1.3132 | 1.3099 | 1.3066 | |

| 28/12/2023 | 1.3214 | 1.3181 | 1.3148 | |

| 29/12/2023 | 1.3134 | 1.3101 | 1.3068 | |

| 02/01/2024 | 1.3147 | 1.3114 | 1.3081 | |

| 03/01/2024 | 1.2946 | 1.2914 | 1.2882 | |

| 04/01/2024 | 1.2886 | 1.2854 | 1.2822 | |

| 05/01/2024 | 1.2797 | 1.2765 | 1.2733 | |

| 08/01/2024 | 1.2755 | 1.2723 | 1.2691 | |

| 09/01/2024 | 1.2855 | 1.2823 | 1.2791 | |

| 10/01/2024 | 1.2915 | 1.2883 | 1.2851 | |

| 11/01/2024 | 1.2976 | 1.2944 | 1.2912 | |

| 12/01/2024 | 1.2996 | 1.2964 | 1.2932 | |

| 15/01/2024 | 1.3078 | 1.3045 | 1.3012 | |

| 16/01/2024 | 1.2976 | 1.2944 | 1.2912 | |

| 17/01/2024 | 1.2891 | 1.2859 | 1.2827 | |

| 18/01/2024 | 1.2842 | 1.2810 | 1.2778 | |

| 19/01/2024 | 1.2910 | 1.2878 | 1.2846 | |

| 22/01/2024 | 1.2945 | 1.2913 | 1.2881 | |

| 23/01/2024 | 1.2973 | 1.2941 | 1.2909 | |

| 24/01/2024 | 1.3057 | 1.3024 | 1.2991 | |

| 25/01/2024 | 1.3122 | 1.3089 | 1.3056 | |

| 29/01/2024 | 1.3127 | 1.3094 | 1.3061 | |

| 30/01/2024 | 1.3192 | 1.3159 | 1.3126 | |

| 31/01/2024 | 1.3310 | 1.3277 | 1.3244 | |

| 01/02/2024 | 1.3163 | 1.3130 | 1.3097 | |

| 02/02/2024 | 1.3436 | 1.3402 | 1.3368 | |

| 05/02/2024 | 1.3319 | 1.3286 | 1.3253 | |

| 06/02/2024 | 1.3325 | 1.3292 | 1.3259 | |

| 07/02/2024 | 1.3461 | 1.3427 | 1.3393 | |

| 08/02/2024 | 1.3461 | 1.3427 | 1.3393 | |

| 09/02/2024 | 1.3397 | 1.3364 | 1.3331 | |

| 12/02/2024 | 1.3406 | 1.3373 | 1.3340 | |

| 13/02/2024 | 1.3415 | 1.3382 | 1.3349 | |

| 14/02/2024 | 1.3290 | 1.3257 | 1.3224 | |

| 15/02/2024 | 1.3327 | 1.3294 | 1.3261 | |

| 16/02/2024 | 1.3288 | 1.3255 | 1.3222 | |

| 19/02/2024 | 1.3299 | 1.3266 | 1.3233 | |

| 20/02/2024 | 1.3321 | 1.3288 | 1.3255 | |

| 21/02/2024 | 1.3189 | 1.3156 | 1.3123 | |

| 22/02/2024 | 1.3159 | 1.3126 | 1.3093 | |

| 23/02/2024 | 1.3150 | 1.3117 | 1.3084 | |

| 26/02/2024 | 1.3222 | 1.3189 | 1.3156 | |

| 27/02/2024 | 1.3188 | 1.3155 | 1.3122 | |

| 28/02/2024 | 1.3256 | 1.3223 | 1.3190 | |

| 29/02/2024 | 1.3396 | 1.3363 | 1.3330 | |

| 01/03/2024 | 1.3522 | 1.3488 | 1.3454 | |

| 04/03/2024 | 1.3582 | 1.3548 | 1.3514 | |

| 05/03/2024 | 1.3613 | 1.3579 | 1.3545 | |

| 06/03/2024 | 1.3612 | 1.3578 | 1.3544 | |

| 07/03/2024 | 1.3768 | 1.3734 | 1.3700 | |

| 08/03/2024 | 1.3861 | 1.3826 | 1.3791 | |

| 11/03/2024 | 1.3698 | 1.3664 | 1.3630 | |

| 12/03/2024 | 1.3803 | 1.3769 | 1.3735 | |

| 13/03/2024 | 1.3865 | 1.3830 | 1.3795 | |

| 14/03/2024 | 1.3809 | 1.3775 | 1.3741 | |

| 15/03/2024 | 1.3766 | 1.3732 | 1.3698 | |

| 18/03/2024 | 1.3770 | 1.3736 | 1.3702 | |

| 19/03/2024 | 1.3792 | 1.3758 | 1.3724 | |

| 20/03/2024 | 1.3840 | 1.3805 | 1.3770 | |

| 21/03/2024 | 1.4085 | 1.4050 | 1.4015 | |

| 22/03/2024 | 1.3950 | 1.3915 | 1.3880 | |

| 25/03/2024 | 1.3981 | 1.3946 | 1.3911 | |

| 26/03/2024 | 1.3994 | 1.3959 | 1.3924 | |

| 27/03/2024 | 1.4060 | 1.4025 | 1.3990 | |

| 28/03/2024 | 1.4208 | 1.4173 | 1.4138 | |

| 02/04/2024 | 1.4249 | 1.4213 | 1.4177 | |

| 03/04/2024 | 1.3994 | 1.3959 | 1.3924 | |

| 04/04/2024 | 1.4137 | 1.4102 | 1.4067 | |

| 05/04/2024 | 1.4038 | 1.4003 | 1.3968 | |

| 08/04/2024 | 1.4202 | 1.4167 | 1.4132 | |

| 09/04/2024 | 1.4193 | 1.4158 | 1.4123 | |

| 10/04/2024 | 1.4186 | 1.4151 | 1.4116 | |

| 11/04/2024 | 1.4091 | 1.4056 | 1.4021 | |

| 12/04/2024 | 1.4147 | 1.4112 | 1.4077 | |

| 15/04/2024 | 1.3989 | 1.3954 | 1.3919 | |

| 16/04/2024 | 1.3676 | 1.3642 | 1.3608 | |

| 17/04/2024 | 1.3758 | 1.3724 | 1.3690 | |

| 18/04/2024 | 1.3799 | 1.3765 | 1.3731 | |

| 19/04/2024 | 1.3611 | 1.3577 | 1.3543 | |

| 22/04/2024 | 1.3782 | 1.3748 | 1.3714 | |

| 23/04/2024 | 1.3795 | 1.3761 | 1.3727 | |

| 24/04/2024 | 1.3809 | 1.3775 | 1.3741 | |

| 26/04/2024 | 1.3633 | 1.3599 | 1.3565 | |

| 29/04/2024 | 1.3865 | 1.3830 | 1.3795 | |

| 30/04/2024 | 1.3815 | 1.3781 | 1.3747 | |

| 01/05/2024 | 1.3616 | 1.3582 | 1.3548 | |

| 02/05/2024 | 1.3630 | 1.3596 | 1.3562 | |

| 03/05/2024 | 1.3772 | 1.3738 | 1.3704 | |

| 06/05/2024 | 1.3790 | 1.3756 | 1.3722 | |

| 07/05/2024 | 1.4070 | 1.4035 | 1.4000 | |

| 08/05/2024 | 1.4089 | 1.4054 | 1.4019 | |

| 09/05/2024 | 1.3962 | 1.3927 | 1.3892 | |

| 10/05/2024 | 1.4010 | 1.3975 | 1.3940 | |

| 13/05/2024 | 1.3928 | 1.3893 | 1.3858 | |

| 14/05/2024 | 1.3924 | 1.3889 | 1.3854 | |

| 15/05/2024 | 1.3972 | 1.3937 | 1.3902 | |

| 16/05/2024 | 1.4145 | 1.4110 | 1.4075 | |

| 17/05/2024 | 1.3985 | 1.3950 | 1.3915 | |

| 20/05/2024 | 1.4113 | 1.4078 | 1.4043 | |

| 21/05/2024 | 1.4163 | 1.4128 | 1.4093 | |

| 22/05/2024 | 1.4058 | 1.4023 | 1.3988 | |

| 23/05/2024 | 1.3973 | 1.3938 | 1.3903 | |

| 24/05/2024 | 1.3867 | 1.3832 | 1.3797 | |

| 27/05/2024 | 1.4055 | 1.4020 | 1.3985 | |

| 28/05/2024 | 1.3926 | 1.3891 | 1.3856 | |

| 29/05/2024 | 1.3862 | 1.3827 | 1.3792 | |

| 30/05/2024 | 1.3803 | 1.3769 | 1.3735 | |

| 31/05/2024 | 1.4027 | 1.3992 | 1.3957 | |

| 03/06/2024 | 1.3979 | 1.3944 | 1.3909 | |

| 04/06/2024 | 1.3869 | 1.3834 | 1.3799 | |

| 05/06/2024 | 1.3800 | 1.3766 | 1.3732 | |

| 06/06/2024 | 1.3935 | 1.3900 | 1.3865 | |

| 07/06/2024 | 1.3964 | 1.3929 | 1.3894 | |

| 11/06/2024 | 1.3724 | 1.3690 | 1.3656 | |

| 12/06/2024 | 1.3670 | 1.3636 | 1.3602 | |

| 13/06/2024 | 1.3796 | 1.3762 | 1.3728 | |

| 14/06/2024 | 1.3784 | 1.3750 | 1.3716 | |

| 17/06/2024 | 1.3721 | 1.3687 | 1.3653 | |

| 18/06/2024 | 1.3799 | 1.3765 | 1.3731 | |

| 19/06/2024 | 1.3898 | 1.3863 | 1.3828 | |

| 20/06/2024 | 1.3974 | 1.3939 | 1.3904 | |

| 21/06/2024 | 1.4090 | 1.4055 | 1.4020 | |

| 24/06/2024 | 1.3993 | 1.3958 | 1.3923 | |

| 25/06/2024 | 1.4097 | 1.4062 | 1.4027 | |

| 26/06/2024 | 1.4009 | 1.3974 | 1.3939 | |

| 27/06/2024 | 1.4044 | 1.4009 | 1.3974 | |

| 28/06/2024 | 1.4176 | 1.4141 | 1.4106 | 0.0002 |

| 01/07/2024 | 1.3993 | 1.3958 | 1.3923 | |

| 02/07/2024 | 1.3962 | 1.3927 | 1.3892 | |

| 03/07/2024 | 1.4070 | 1.4035 | 1.4000 | |

| 04/07/2024 | 1.4129 | 1.4094 | 1.4059 | |

| 05/07/2024 | 1.4127 | 1.4092 | 1.4057 | |

| 08/07/2024 | 1.4066 | 1.4031 | 1.3996 | |

| 09/07/2024 | 1.4136 | 1.4101 | 1.4066 | |

| 10/07/2024 | 1.4174 | 1.4139 | 1.4104 | |

| 11/07/2024 | 1.4362 | 1.4326 | 1.4290 | |

| 12/07/2024 | 1.4587 | 1.4551 | 1.4515 | |

| 15/07/2024 | 1.4612 | 1.4576 | 1.4540 | |

| 16/07/2024 | 1.4535 | 1.4499 | 1.4463 | |

| 17/07/2024 | 1.4654 | 1.4617 | 1.4580 | |

| 18/07/2024 | 1.4484 | 1.4448 | 1.4412 | |

| 19/07/2024 | 1.4398 | 1.4362 | 1.4326 | |

| 22/07/2024 | 1.4299 | 1.4263 | 1.4227 | |

| 23/07/2024 | 1.4495 | 1.4459 | 1.4423 | |

| 24/07/2024 | 1.4591 | 1.4555 | 1.4519 | |

| 25/07/2024 | 1.4358 | 1.4322 | 1.4286 | |

| 26/07/2024 | 1.4385 | 1.4349 | 1.4313 | |

| 29/07/2024 | 1.4530 | 1.4494 | 1.4458 | |

| 30/07/2024 | 1.4466 | 1.4430 | 1.4394 | |

| 31/07/2024 | 1.4801 | 1.4764 | 1.4727 | |

| 01/08/2024 | 1.4865 | 1.4828 | 1.4791 | |

| 02/08/2024 | 1.4518 | 1.4482 | 1.4446 | |

| 05/08/2024 | 1.3772 | 1.3738 | 1.3704 | |

| 06/08/2024 | 1.3817 | 1.3783 | 1.3749 | |

| 07/08/2024 | 1.3886 | 1.3851 | 1.3816 | |

| 08/08/2024 | 1.3776 | 1.3742 | 1.3708 | |

| 09/08/2024 | 1.4010 | 1.3975 | 1.3940 | |

| 12/08/2024 | 1.4109 | 1.4074 | 1.4039 | |

| 13/08/2024 | 1.4198 | 1.4163 | 1.4128 | |

| 14/08/2024 | 1.4269 | 1.4233 | 1.4197 | |

| 15/08/2024 | 1.4339 | 1.4303 | 1.4267 | |

| 16/08/2024 | 1.4506 | 1.4470 | 1.4434 | |

| 19/08/2024 | 1.4506 | 1.4470 | 1.4434 | |

| 20/08/2024 | 1.4521 | 1.4485 | 1.4449 | |

| 21/08/2024 | 1.4652 | 1.4615 | 1.4578 | |

| 22/08/2024 | 1.4631 | 1.4595 | 1.4559 | |

| 23/08/2024 | 1.4645 | 1.4608 | 1.4571 | |

| 26/08/2024 | 1.4809 | 1.4772 | 1.4735 | |

| 27/08/2024 | 1.4711 | 1.4674 | 1.4637 | |

| 28/08/2024 | 1.4666 | 1.4629 | 1.4592 | |

| 29/08/2024 | 1.4564 | 1.4528 | 1.4492 | |

| 30/08/2024 | 1.4803 | 1.4766 | 1.4729 | |

| 02/09/2024 | 1.4759 | 1.4722 | 1.4685 | |

| 03/09/2024 | 1.4764 | 1.4727 | 1.4690 | |

| 04/09/2024 | 1.4339 | 1.4303 | 1.4267 | |

| 05/09/2024 | 1.4398 | 1.4362 | 1.4326 | |

| 06/09/2024 | 1.4360 | 1.4324 | 1.4288 | |

| 09/09/2024 | 1.4250 | 1.4214 | 1.4178 | |

| 10/09/2024 | 1.4346 | 1.4310 | 1.4274 | |

| 11/09/2024 | 1.4306 | 1.4270 | 1.4234 | |

| 12/09/2024 | 1.4594 | 1.4558 | 1.4522 | |

| 13/09/2024 | 1.4727 | 1.4690 | 1.4653 | |

| 16/09/2024 | 1.4707 | 1.4670 | 1.4633 | |

| 17/09/2024 | 1.4689 | 1.4652 | 1.4615 | |

| 18/09/2024 | 1.4731 | 1.4694 | 1.4657 | |

| 19/09/2024 | 1.4899 | 1.4862 | 1.4825 | |

| 20/09/2024 | 1.4960 | 1.4923 | 1.4886 | |

| 23/09/2024 | 1.5029 | 1.4992 | 1.4955 | |

| 24/09/2024 | 1.5115 | 1.5077 | 1.5039 | |

| 25/09/2024 | 1.5099 | 1.5061 | 1.5023 | |

| 26/09/2024 | 1.5328 | 1.5290 | 1.5252 | |

| 27/09/2024 | 1.5296 | 1.5258 | 1.5220 | |

| 30/09/2024 | 1.5341 | 1.5303 | 1.5265 | |

| 01/10/2024 | 1.5305 | 1.5267 | 1.5229 | |

| 02/10/2024 | 1.5228 | 1.5190 | 1.5152 | |

| 03/10/2024 | 1.5188 | 1.5150 | 1.5112 | |

| 04/10/2024 | 1.5102 | 1.5064 | 1.5026 | |

| 08/10/2024 | 1.5174 | 1.5136 | 1.5098 | |

| 09/10/2024 | 1.5283 | 1.5245 | 1.5207 | |

| 10/10/2024 | 1.5368 | 1.5330 | 1.5292 | |

| 11/10/2024 | 1.5423 | 1.5385 | 1.5347 | |

| 14/10/2024 | 1.5486 | 1.5447 | 1.5408 | |

| 15/10/2024 | 1.5598 | 1.5559 | 1.5520 | |

| 16/10/2024 | 1.5488 | 1.5449 | 1.5410 | |

| 17/10/2024 | 1.5716 | 1.5677 | 1.5638 | |

| 18/10/2024 | 1.5577 | 1.5538 | 1.5499 | |

| 21/10/2024 | 1.5777 | 1.5738 | 1.5699 | |

| 22/10/2024 | 1.5656 | 1.5617 | 1.5578 | |

| 23/10/2024 | 1.5718 | 1.5679 | 1.5640 | |

| 24/10/2024 | 1.5591 | 1.5552 | 1.5513 | |

| 25/10/2024 | 1.5638 | 1.5599 | 1.5560 | |

| 28/10/2024 | 1.5563 | 1.5524 | 1.5485 | |

| 29/10/2024 | 1.5602 | 1.5563 | 1.5524 | |

| 30/10/2024 | 1.5559 | 1.5520 | 1.5481 | |

| 31/10/2024 | 1.5611 | 1.5572 | 1.5533 | |

| 01/11/2024 | 1.5465 | 1.5426 | 1.5387 | |

| 04/11/2024 | 1.5463 | 1.5424 | 1.5385 | |

| 05/11/2024 | 1.5359 | 1.5321 | 1.5283 | |

| 06/11/2024 | 1.5523 | 1.5484 | 1.5445 | |

| 07/11/2024 | 1.5439 | 1.5400 | 1.5362 | |

| 08/11/2024 | 1.5653 | 1.5614 | 1.5575 | |

| 11/11/2024 | 1.5640 | 1.5601 | 1.5562 | |

| 12/11/2024 | 1.5648 | 1.5609 | 1.5570 | |

| 13/11/2024 | 1.5450 | 1.5411 | 1.5372 | |

| 14/11/2024 | 1.5405 | 1.5367 | 1.5329 | |

| 15/11/2024 | 1.5428 | 1.5390 | 1.5352 | |

| 18/11/2024 | 1.5401 | 1.5363 | 1.5325 | |

| 19/11/2024 | 1.5626 | 1.5587 | 1.5548 | |

| 20/11/2024 | 1.5602 | 1.5563 | 1.5524 | |

| 21/11/2024 | 1.5535 | 1.5496 | 1.5457 | |

| 22/11/2024 | 1.5689 | 1.5650 | 1.5611 | |

| 25/11/2024 | 1.5761 | 1.5722 | 1.5683 | |

| 26/11/2024 | 1.5770 | 1.5731 | 1.5692 | |

| 27/11/2024 | 1.5858 | 1.5818 | 1.5778 | |

| 28/11/2024 | 1.5969 | 1.5929 | 1.5889 | |

| 29/11/2024 | 1.6025 | 1.5985 | 1.5945 | |

| 02/12/2024 | 1.6040 | 1.6000 | 1.5960 | |

| 03/12/2024 | 1.6118 | 1.6078 | 1.6038 | |

| 04/12/2024 | 1.6043 | 1.6003 | 1.5963 | |

| 05/12/2024 | 1.6232 | 1.6192 | 1.6152 | |

| 06/12/2024 | 1.6097 | 1.6057 | 1.6017 | |

| 09/12/2024 | 1.6017 | 1.5977 | 1.5937 | |

| 10/12/2024 | 1.5796 | 1.5757 | 1.5718 | |

| 11/12/2024 | 1.5772 | 1.5733 | 1.5694 | |

| 12/12/2024 | 1.5713 | 1.5674 | 1.5635 | |

| 13/12/2024 | 1.5689 | 1.5650 | 1.5611 | |

| 16/12/2024 | 1.5494 | 1.5455 | 1.5416 | |

| 17/12/2024 | 1.5587 | 1.5548 | 1.5509 | |

| 18/12/2024 | 1.5618 | 1.5579 | 1.5540 | |

| 19/12/2024 | 1.5355 | 1.5317 | 1.5279 | |

| 20/12/2024 | 1.5212 | 1.5174 | 1.5136 | |

| 23/12/2024 | 1.5410 | 1.5372 | 1.5334 | |

| 24/12/2024 | 1.5411 | 1.5373 | 1.5335 | |

| 27/12/2024 | 1.5601 | 1.5562 | 1.5523 | |

| 30/12/2024 | 1.5561 | 1.5522 | 1.5483 | |

| 31/12/2024 | 1.5456 | 1.5417 | 1.5378 | |

| 02/01/2025 | 1.5542 | 1.5503 | 1.5464 | |

| 03/01/2025 | 1.5684 | 1.5645 | 1.5606 | |

| 06/01/2025 | 1.5717 | 1.5678 | 1.5639 | |

| 07/01/2025 | 1.5803 | 1.5764 | 1.5725 | |

| 08/01/2025 | 1.5754 | 1.5715 | 1.5676 | |

| 09/01/2025 | 1.5692 | 1.5653 | 1.5614 | |

| 10/01/2025 | 1.5673 | 1.5634 | 1.5595 | |

| 13/01/2025 | 1.5408 | 1.5370 | 1.5332 | |

| 14/01/2025 | 1.5531 | 1.5492 | 1.5453 | |

| 15/01/2025 | 1.5522 | 1.5483 | 1.5444 | |

| 16/01/2025 | 1.5724 | 1.5685 | 1.5646 | |

| 17/01/2025 | 1.5739 | 1.5700 | 1.5661 | |

| 20/01/2025 | 1.5778 | 1.5739 | 1.5700 | |

| 21/01/2025 | 1.5899 | 1.5859 | 1.5819 | |

| 22/01/2025 | 1.6039 | 1.5999 | 1.5959 | |

| 23/01/2025 | 1.5999 | 1.5959 | 1.5919 | |

| 24/01/2025 | 1.6022 | 1.5982 | 1.5942 | |

| 28/01/2025 | 1.5951 | 1.5911 | 1.5871 | |

| 29/01/2025 | 1.6186 | 1.6146 | 1.6106 | |

| 30/01/2025 | 1.6084 | 1.6044 | 1.6004 | |

| 31/01/2025 | 1.6301 | 1.6260 | 1.6219 | |

| 03/02/2025 | 1.5986 | 1.5946 | 1.5906 | |

| 04/02/2025 | 1.6068 | 1.6028 | 1.5988 | |

| 05/02/2025 | 1.6236 | 1.6196 | 1.6156 | |

| 06/02/2025 | 1.6339 | 1.6298 | 1.6257 | |

| 07/02/2025 | 1.6306 | 1.6265 | 1.6224 | |

| 10/02/2025 | 1.6210 | 1.6170 | 1.6130 | |

| 11/02/2025 | 1.6292 | 1.6251 | 1.6210 | |

| 12/02/2025 | 1.6184 | 1.6144 | 1.6104 | |

| 13/02/2025 | 1.6203 | 1.6163 | 1.6123 | |

| 14/02/2025 | 1.6387 | 1.6346 | 1.6305 | |

| 17/02/2025 | 1.6415 | 1.6374 | 1.6333 | |

| 18/02/2025 | 1.6388 | 1.6347 | 1.6306 | |

| 19/02/2025 | 1.6370 | 1.6329 | 1.6288 | |

| 20/02/2025 | 1.6211 | 1.6171 | 1.6131 | |

| 21/02/2025 | 1.6289 | 1.6248 | 1.6207 | |

| 24/02/2025 | 1.6060 | 1.6020 | 1.5980 | |

| 25/02/2025 | 1.6113 | 1.6073 | 1.6033 | |

| 26/02/2025 | 1.6104 | 1.6064 | 1.6024 | |

| 27/02/2025 | 1.6184 | 1.6144 | 1.6104 | |

| 28/02/2025 | 1.6029 | 1.5989 | 1.5949 | |

| 03/03/2025 | 1.6157 | 1.6117 | 1.6077 | |

| 04/03/2025 | 1.5922 | 1.5882 | 1.5842 | |

| 05/03/2025 | 1.5838 | 1.5799 | 1.5760 | |

| 06/03/2025 | 1.5949 | 1.5909 | 1.5869 | |

| 07/03/2025 | 1.5728 | 1.5689 | 1.5650 | |

| 10/03/2025 | 1.5757 | 1.5718 | 1.5679 | |

| 11/03/2025 | 1.5331 | 1.5293 | 1.5255 | |

| 12/03/2025 | 1.5122 | 1.5084 | 1.5046 | |

| 13/03/2025 | 1.5239 | 1.5201 | 1.5163 | |

| 14/03/2025 | 1.5501 | 1.5462 | 1.5423 | |

| 17/03/2025 | 1.5651 | 1.5612 | 1.5573 | |

| 18/03/2025 | 1.5770 | 1.5731 | 1.5692 | |

| 19/03/2025 | 1.5681 | 1.5642 | 1.5603 | |

| 20/03/2025 | 1.5898 | 1.5858 | 1.5818 | |

| 21/03/2025 | 1.6022 | 1.5982 | 1.5942 | |

| 24/03/2025 | 1.5882 | 1.5842 | 1.5802 | |

| 25/03/2025 | 1.5930 | 1.5890 | 1.5850 | |

| 26/03/2025 | 1.6037 | 1.5997 | 1.5957 | |

| 27/03/2025 | 1.5878 | 1.5838 | 1.5798 | |

| 28/03/2025 | 1.5966 | 1.5926 | 1.5886 | |

| 31/03/2025 | 1.5711 | 1.5672 | 1.5633 | |

| 01/04/2025 | 1.5715 | 1.5676 | 1.5637 | |

| 02/04/2025 | 1.5641 | 1.5602 | 1.5563 | |

| 03/04/2025 | 1.5515 | 1.5476 | 1.5437 | |

| 04/04/2025 | 1.5021 | 1.4984 | 1.4947 | |

| 07/04/2025 | 1.4449 | 1.4413 | 1.4377 | |

| 08/04/2025 | 1.4929 | 1.4892 | 1.4855 | |

| 09/04/2025 | 1.4526 | 1.4490 | 1.4454 | |

| 10/04/2025 | 1.5450 | 1.5411 | 1.5372 | |

| 11/04/2025 | 1.5446 | 1.5407 | 1.5368 | |

| 14/04/2025 | 1.5634 | 1.5595 | 1.5556 | |

| 15/04/2025 | 1.5633 | 1.5594 | 1.5555 | |

| 16/04/2025 | 1.5729 | 1.5690 | 1.5651 | |

| 17/04/2025 | 1.5859 | 1.5819 | 1.5779 | |

| 22/04/2025 | 1.5755 | 1.5716 | 1.5677 | |

| 23/04/2025 | 1.5754 | 1.5715 | 1.5676 | |

| 24/04/2025 | 1.5902 | 1.5862 | 1.5822 | |

| 28/04/2025 | 1.5870 | 1.5830 | 1.5790 | |

| 29/04/2025 | 1.6192 | 1.6152 | 1.6112 | |

| 30/04/2025 | 1.6263 | 1.6222 | 1.6181 | |

| 01/05/2025 | 1.6340 | 1.6299 | 1.6258 | |

| 02/05/2025 | 1.6433 | 1.6392 | 1.6351 | |

| 05/05/2025 | 1.6349 | 1.6308 | 1.6267 | |

| 06/05/2025 | 1.6507 | 1.6466 | 1.6425 | |

| 07/05/2025 | 1.6740 | 1.6698 | 1.6656 | |

| 08/05/2025 | 1.6918 | 1.6876 | 1.6834 | |

| 09/05/2025 | 1.6954 | 1.6912 | 1.6870 | |

| 12/05/2025 | 1.6854 | 1.6812 | 1.6770 | |

| 13/05/2025 | 1.6915 | 1.6873 | 1.6831 | |

| 14/05/2025 | 1.6990 | 1.6948 | 1.6906 | |

| 15/05/2025 | 1.6808 | 1.6766 | 1.6724 | |

| 16/05/2025 | 1.6970 | 1.6928 | 1.6886 | |

| 19/05/2025 | 1.6936 | 1.6894 | 1.6852 | |

| 20/05/2025 | 1.7044 | 1.7001 | 1.6958 | |

| 21/05/2025 | 1.7170 | 1.7127 | 1.7084 |

Interested in investing with us?

Forms and fund information

Fund ratings

Rating/recommendation

Rating/recommendation

Lonsec

The Lonsec rating issued 10/2024 is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec). Ratings are general advice only, and have been prepared without taking account of your objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec assumes no obligation to update. Lonsec uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. ©2023 Lonsec. All rights reserved.

Morningstar Medalist Rating(TM)

Assigned as of 08/01/25

Analyst Driven % 100

Data Coverage % 100

Fund Maple-Brown Abbott Australian Small Companies received a Morningstar Medalist Rating(TM) of ‘Silver’ on 08/01/25.

© 2025 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. This report or data has been prepared for clients of Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or New Zealand wholesale clients of Morningstar Research Ltd, subsidiaries of Morningstar, Inc. Any general advice has been provided without reference to your financial objectives, situation or needs. For more information refer to our Financial Services Guide at morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Morningstar’s publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Morningstar’s full research reports are the source of any Morningstar Ratings and are available from Morningstar or your adviser. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a financial adviser.

Zenith

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned MPL1241AU February 2025) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.

We currently do not have any funds registered for sale in your jurisdiction

Please contact Simon Beram, Head of Institutional and Research Relationships for further information on:

T +61 2 8226 6231 | E sberam@maple-brownabbott.com

Investment Insights

by Phillip Hudak

Co-Portfolio Manager, Australian Small Companies

The gold rush in the small caps market

by Matt Griffin

Co-Portfolio Manager, Australian Small Companies

Australian Equities March 2025 update

by Garth Rossler

Chief Investment Officer

Pinnacle Insights Series

by Dougal Maple-Brown

Head of Australian Value Equities