Given ongoing heightened geopolitical tensions, de-globalisation, and onshoring of defence production and supply chains, we see increasing global defence spending as being a structural growth thematic. Codan Limited (CDA) is positively exposed to this theme via their expansion of communication services for military and emergency response.

Codan was founded in 1959 in Adelaide, with the company’s DNA based on its Minelab business which focused on the design, development, manufacture, and marketing of metal detection equipment. The company has a dominant market share in gold prospecting / mining (notably in Africa), increasing market share in recreation / professional (notably in North America and Europe markets), and countermine (recent beneficiary of the Russia/Ukraine conflict) segments. Over the past few years, the company’s strategy has been to expand further into communications, which is exposed to several key positive drivers, including increasing military spend, growth in use of unmanned systems and increased government spend on public safety. In addition, the company has a tracking solutions division, although this is immaterial to the overall business going forward.

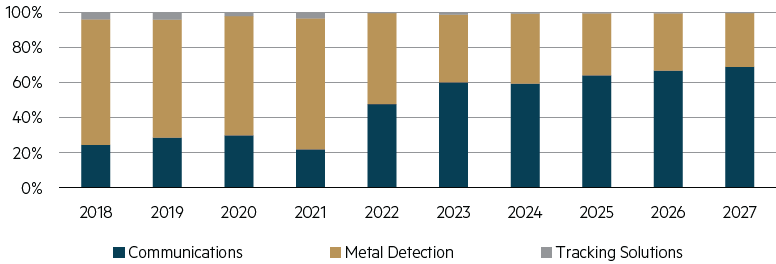

Divisional revenue exposure (%)

Source: Company data, MBA estimates, December 2024.

The company has a strong track record of innovation with sustained levels of engineering investment ($57.4m spend in FY24 which represents ~10% of group sales). We believe the company’s earnings profile is at an inflection point, being in the early stages of the earnings upgrade cycle. Codan’s recent investment in the Communications division, in addition to expected new product releases in the Metal Detections division, are expected to result in positive operating leverage over the medium-term.

In the Communications division, management has focused on expanding the product suite to grow the total addressable market, via widening the range of customers and industry verticals. In addition, the company is building more predictable and recurring revenue streams (order book of $197m represents over 60% of the FY24 Communications divisional revenue), which has the potential to lead to increased valuation multiples over time as a growing proportion of revenue is expected to come from software sales, in what has historically been a hardware business.

This strategy is being enhanced by aligned acquisitions, which offer enhanced scale, core business expansion, increased penetration in adjacent markets, and complement existing technology and market exposures. A recent example is the acquisition of Kagwerks, which is a global leader in tactical operator-worn networking solution – this provides soldiers with a lightweight, compact network hub, integrating disparate equipment into a single portable compact communications solution, which is highly complementary to Codan’s existing product suite. The business allows Codan access to a significant new customer, being the US Department of Defence. We see the potential for material revenue and earnings upside based on the following drivers:

- Roll-out: the US Army Nett Warrior Program1 roll-out has only 30,000 docking products currently in field for the US Army as compared to a total addressable market of approximately 450,000 US soldiers currently

- Product mix: Material upside to product mix with new product deployments e.g. the Dock Ultra, which supports Artificial Intelligence solutions, is expected to have a price point multiple times of the existing Dock Lite product

Cross-sell: Given interoperability (radio agnostic), the Kagwerks solution provides the potential to cross-sell Codan’s DTC radio product solutions as part of the overall docking solution - Other defence opportunities: Potential expansion of the Nett Warrior Program into other US defence segments and/or Five Eyes (strategic alliance comprising Australia, Canada, New Zealand and US).

Kagwerks dismounted solider systems

Source: Codan presentation, ASX release, 28 November 2024.

We believe there is the potential for further acquisitions given Codan’s strong balance sheet and the company’s existing bank facility being recently increased to $170 million (from $140 million), with additional capacity available of $150 million to support future inorganic growth opportunities.

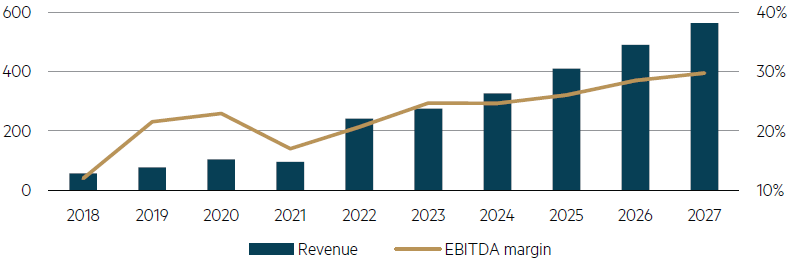

For the Communications division, we see potential upside risk to company management’s medium-term revenue growth target of 10%-15% pa, given the step-up in order book, underlying base business performance and recent acquisitions tracking better than original expectations. We also see the potential for divisional EBITDA margins to increase from 24.6% in FY24 toward company management’s target of 30% over the medium-term given expected operating leverage coming through.

Communications division – revenue growth (%) and EBITDA margin (%)

Source: Company data, MBA estimates, December 2024.

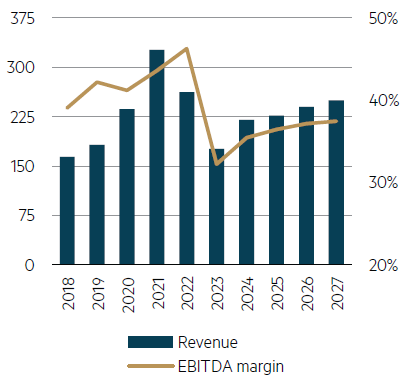

Following the rebasing of profitability for the Metal Detection division in FY23 due to geopolitical tensions impacting sales in Sudan, we see upside potential to both market revenue and margin assumptions given the following:

- Recreation market: Continued recreational growth driven via e-commerce and bricks-and-mortar retailers, notably in North America (Amazon and Walmart)

- Rest of World (RoW): ‘Rest of the World’ growth being strong based on market share gains via increased distribution and geographical exposure

- New products: 6 new products being earmarked for FY26 release across the mining, recreational and countermine segments which is expected to either upgrade existing product offerings or enter adjacent market segments and expand the total addressable market.

We do not factor any Sudan recovery and see upside potential from the current strong gold price supporting divisional growth.

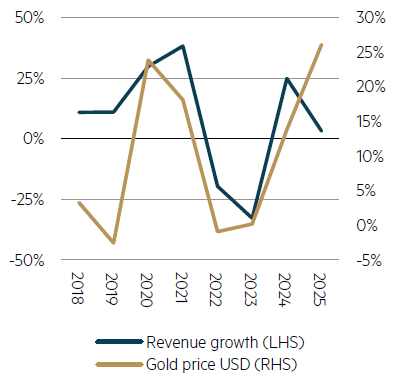

Metal Detection division – revenue growth (%) and gold price (%)

Metal Detection division – revenue growth (%) and EBITDA growth (%)

Source: Company data, MBA estimates, FactSet, financial year actual gold price change and consensus price forecast change based on broker estimates, December 2024.

In summary, we believe Codan’s earnings profile is at an inflection point, with upside risk to market expectations given exposure to positive thematics, including defence spending, as well as internal drivers which should result in market share gains.

1 The US Army Nett Warrior Secure Wired and Wireless Intra-Soldier Network Hub (Nett Warrior Program) is an advanced system developed by the US Army to improve situational awareness for battlefield soldiers. Nett Warrior Program is a funded and stable Army acquisition Program of Record. In 2022, Kagwerks was selected as a provider to this Program and is responsible for the development and supply of DOCK solutions. Kagwerks’ DOCK products are the centrepiece of Nett Warrior’s Soldier System which is scheduled to be fielded through to 2029. Kagwerks receives the majority of its contract orders for DOCK products through the Defence Logistics Agency Tailored Logistics Support Program from Prime Contractors based on specific battalion or deployment requirements and therefore orders are subject to government procurement cycles. Source; Codan presentation, ASX release, 28 November 2024.

Disclaimer

This article is prepared and issued by Maple-Brown Abbott Limited ABN 73 001 208 564, AFSL 237296 (‘MBA’) as the Responsible Entity of the MBA Australian Small Companies Fund (ARSN 658 552 688) (‘Fund’). This article contains general information only, and does not take into account your investment objectives, financial situation or specific needs. Before making any investment decision, you should seek independent financial advice. This document does not constitute an offer or solicitation by anyone in any jurisdiction. Past performance is not a reliable indicator of future performance. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are not a recommendation to buy, sell or hold, they are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this document. These individual stocks referred to may or may not be currently held by the Fund. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications not described in this document. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of this information, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on this information. Before making a decision whether to acquire, or to continue to hold an investment in the Fund, investors should obtain and consider the current PDS and Target Market Determination (TMD) or any other relevant disclosure document. For the Fund, the PDS, AIB and TMD are available at maple-brownabbott.com/document-library or by calling 1300 097 995. This information is current as of 12 December 2024 and is subject to change at any time without notice. © 2024 Maple-Brown Abbott Limited

Interested in investing with us?

Investment Insights

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update