Regulated electric utilities are an “underappreciated” winner from the energy transition and have attractive valuations, according to Andrew Maple-Brown, Co-Founder and Managing Director, Maple-Brown Abbott Global Listed Infrastructure.

Speaking to Zenith Investment Partners in a special interview about the infrastructure sector, ESG and the energy transition, Andrew said “In terms of the outlook for growth, we believe the energy transition clearly provides a very large opportunity for new investment and that will create absolute winners. One underappreciated winner we believe are the regulated electric utilities because of the size of the opportunity.”

Andrew said the combination of very strong rate-based growth with attractive returns delivered strong earnings growth.

“The electric utilities we’re looking at are often growing earnings about 5.0%–7.0%. You add that to the dividend yield of 3.0%–3.5%. We believe that the combination of that strong capital investment growth, the favourable policy outlook, the stable, predictable returns from regulated returns . . . we believe that the valuations are attractive.”

Georgia Hall, ESG Analyst, Maple-Brown Abbott Global Listed Infrastructure, also took part in the interview, talking about the critical nature of ESG to listed infrastructure as an asset class.

“Listed infrastructure assets are long-dated assets,” Georgia said. “They provide essential services to society. We’re talking about the provision of water, electricity, energy to customers, the facilitation of transportation from A to B, whether that be toll roads, for example, and also facilitation of communications, so communications infrastructure.

“As such long-dated assets, it’s essential that they are sustainable, not only from a longevity perspective but equally in terms of their mitigating any negative impacts and contributing to a sustainable future.”

Georgia spoke about what it means for companies to move towards ‘net zero’ by 2050 – working towards reducing their emissions considerably and offsetting any further emissions and how creating accountability to meet their targets through governance, risk management and metrics was critical.

Thank you to Zenith Investment Partners for providing the opportunity to share these insights.

This content is intended to provide general information only. It does not constitute advice and should not be relied upon as such. You should seek investment advice in respect of your individual circumstances.

Interested in investing with us?

Investment Insights

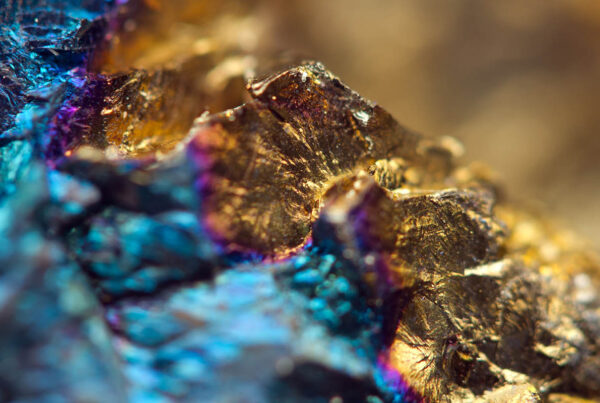

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update