2024 year in review for Australian small caps

The domestic equity market delivered a reasonable absolute return over the 2024 calendar year, although has significantly lagged the US equity market. The performance has been driven by fiscal dominance, a soft-landing narrative, start of the interest rate cutting cycle by major global central banks, and expectations of easing domestic financial conditions. However, this has been partially overshadowed by the RBA’s monetary policy status quo given stickier domestic inflation, disappointing Chinese economic growth, an absence of aggregate earnings growth and weaker Australian dollar.

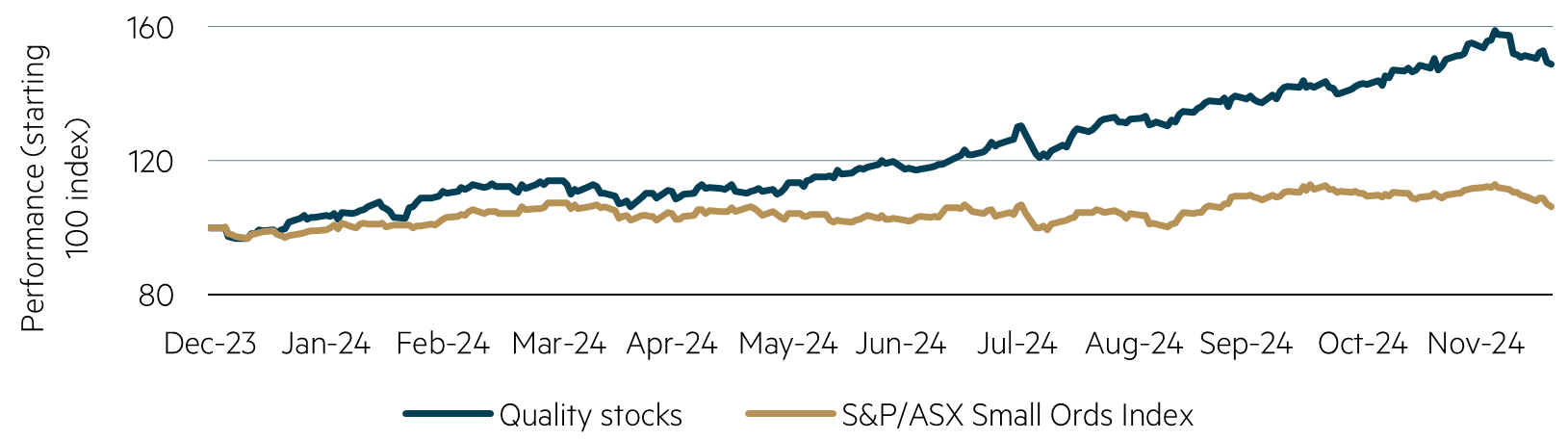

The Australian small cap market performance has been mediocre over the 2024 calendar year, with the S&P/ASX Small Ordinaries Index returning 6.3% (as at 20 December 2024), driven by a multiple re-rate rather than any earnings growth. The trend of underperformance of Australian small caps relative to large caps in the previous two calendar years has continued in 2024 with the S&P/ASX 100 Index returning 10.3% (as at 20 December 2024), with the larger end being well supported by the banking sector and strong momentum in high growth industrial stocks.

The performance of the Australian small cap market has been driven by a select group of high-quality companies that have been able to grow earnings faster than underlying economic growth. This has been driven by market share gains via product innovation, market penetration and/or offshore expansion.

2024 calendar year performance of quality stocks vs S&P/ASX Small Ords Index

Source: MBA, FactSet, 20 December 2024. Quality stocks include HUB, NWL, ARB, PWH, TNE, BRG, PMV, CDA, PME, AUB, IRE and DTL.

Source: MBA, FactSet, 20 December 2024. Quality stocks include HUB, NWL, ARB, PWH, TNE, BRG, PMV, CDA, PME, AUB, IRE and DTL.

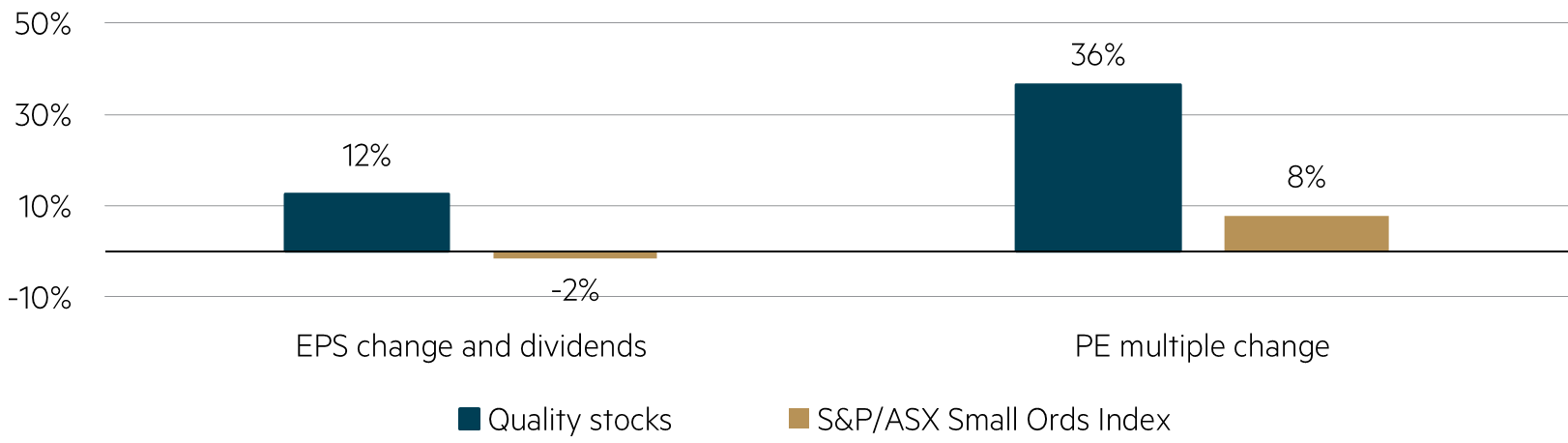

2024 calendar year EPS vs PE multiple changes for quality stocks and S&P/Small Ords Index

Source: MBA, FactSet, 20 December 2024. Quality stocks include HUB, NWL, ARB, PWH, TNE, BRG, PMV, CDA, PME, AUB, IRE and DTL.

Source: MBA, FactSet, 20 December 2024. Quality stocks include HUB, NWL, ARB, PWH, TNE, BRG, PMV, CDA, PME, AUB, IRE and DTL.

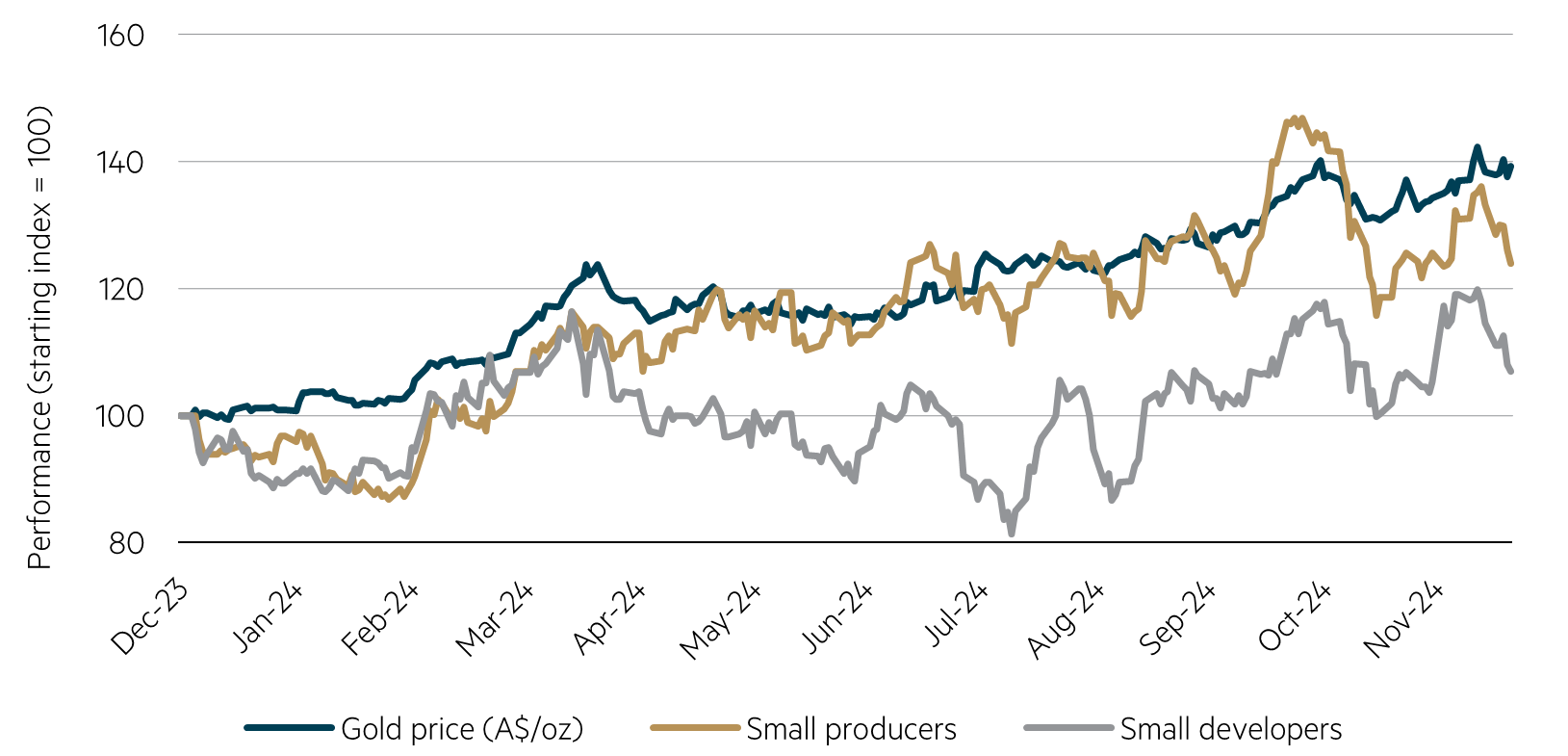

In addition, the market has been supported by the small gold miners which now represent approximately 12% of the index weight (based on market capitalisation). Gold has been one of the best performing asset classes over the 2024 calendar year with the small gold mining sector being positively leveraged. The key stock beneficiaries include those producers (e.g. Genesis Minerals and Perseus Mining) delivering/exceeding on production growth and meeting/beating cost guidance as labour pressure and cost inputs eased. Given strong free cashflow generation, we have seen increasing cash reserves drive industry corporate activity, notably for developers which have lagged the underlying gold price (e.g. De Grey Mining).

2024 calendar year gold price versus small producers and small developers performance

Source: MBA, FactSet, 20 December 2024. Small producers include CMM, EMR, GMD, GOR, PRU, VAU, RMS, RRL, RSG, WAF and WGX, Small developers include BGL, DEG and PDI.

Source: MBA, FactSet, 20 December 2024. Small producers include CMM, EMR, GMD, GOR, PRU, VAU, RMS, RRL, RSG, WAF and WGX, Small developers include BGL, DEG and PDI.

Other notable positive performance thematics included: (1) the rise of Artificial Intelligence and exponential computational data consumption (e.g. data centres via Infratil); (2) M&A activity (e.g. Chemist Warehouse’s back-door listing via Sigma Healthcare); (3) index inclusions (e.g. Life360’s inclusion in the Russell 2000 Index); (4) government support via cost-of-living measures for the aged care and childcare sectors (e.g. Regis Healthcare and G8 Education); and (5) continued founder-led business outperformance (e.g. Netwealth) despite governance and board oversight concerns for select companies.

The year ahead for Australian small caps

Looking to the year ahead, we believe the key drivers for Australian small cap outperformance are in place, including a supportive global stimulatory backdrop and expectations of falling domestic interest rates.

Globally, we have seen an acceleration of liquidity injected into financial markets given moderating inflation growth back to within central bank target ranges. In addition, the Trump presidency’s pro-growth stance with tax cuts and reduced regulation is expected to be stimulatory for economic activity. There are also hopes that geopolitical tensions with Russia/Ukraine and the Middle East may be showing signs of easing.

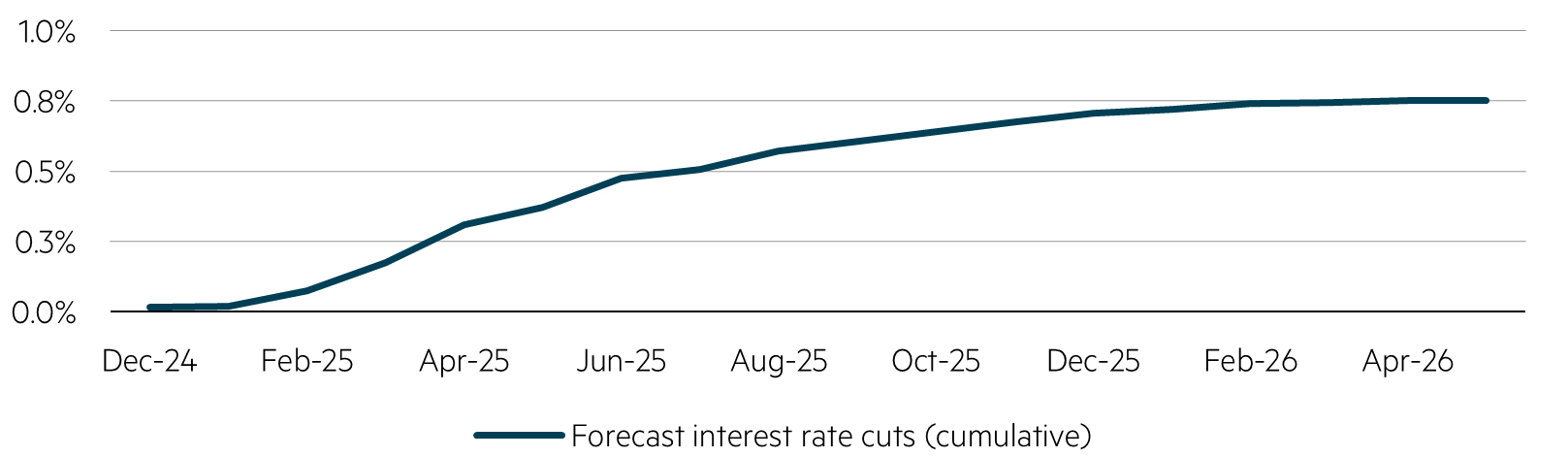

Domestically, the RBA has been uncoordinated with other central banks, remaining more hawkish given stickier inflation, although the December meeting has recast a more dovish tone with interest rate cuts expected to start early in 2025 with the market factoring in close to 0.75% reduction by year-end. This compares to the US which has already cut interest rates by 1.0% in 2024 with the US Federal Reserve flagging at the most recent FOMC meeting that the trajectory of interest rate cuts into 2025 is expected to slow with only an additional 0.5% reduction expected by year-end. This set-up is expected to be supportive and renew investor interest for Australian small caps. US equity markets have seen the smaller end start to outperform the larger end in the second half of 2024 as the US Federal Reserve flagged and subsequently reduced interest rates which is a precedent for what may happen domestically in 2025.

Potential for material interest rate cuts into 2025

Source: ASX RBA Rate Tracker, 19 December 2024.

Source: ASX RBA Rate Tracker, 19 December 2024.

2025 is expected to be another interesting year for Australian small cap investors with the following key themes investors should be looking out for:

- Stock performance broadening: Given a more favourable domestic macroeconomic backdrop, we expect a better earnings outlook at the smaller end of the market (relative to large caps) over the next couple of years, resulting in a broadening out of stock performance across the index. We continue to see structural growth and Information Technology exposed companies delivering on earnings although many now are being priced for perfection. We no longer expect a ‘earnings scarcity’ premium going forward (unlike what we experienced over the 2023 and 2024 financial years) as investors may look to recycle capital into under-appreciated Australian small cap companies with more attractive valuation metrics and strong earnings outlook that are less crowded, including Perenti (PRN) and Service Stream (SSM).

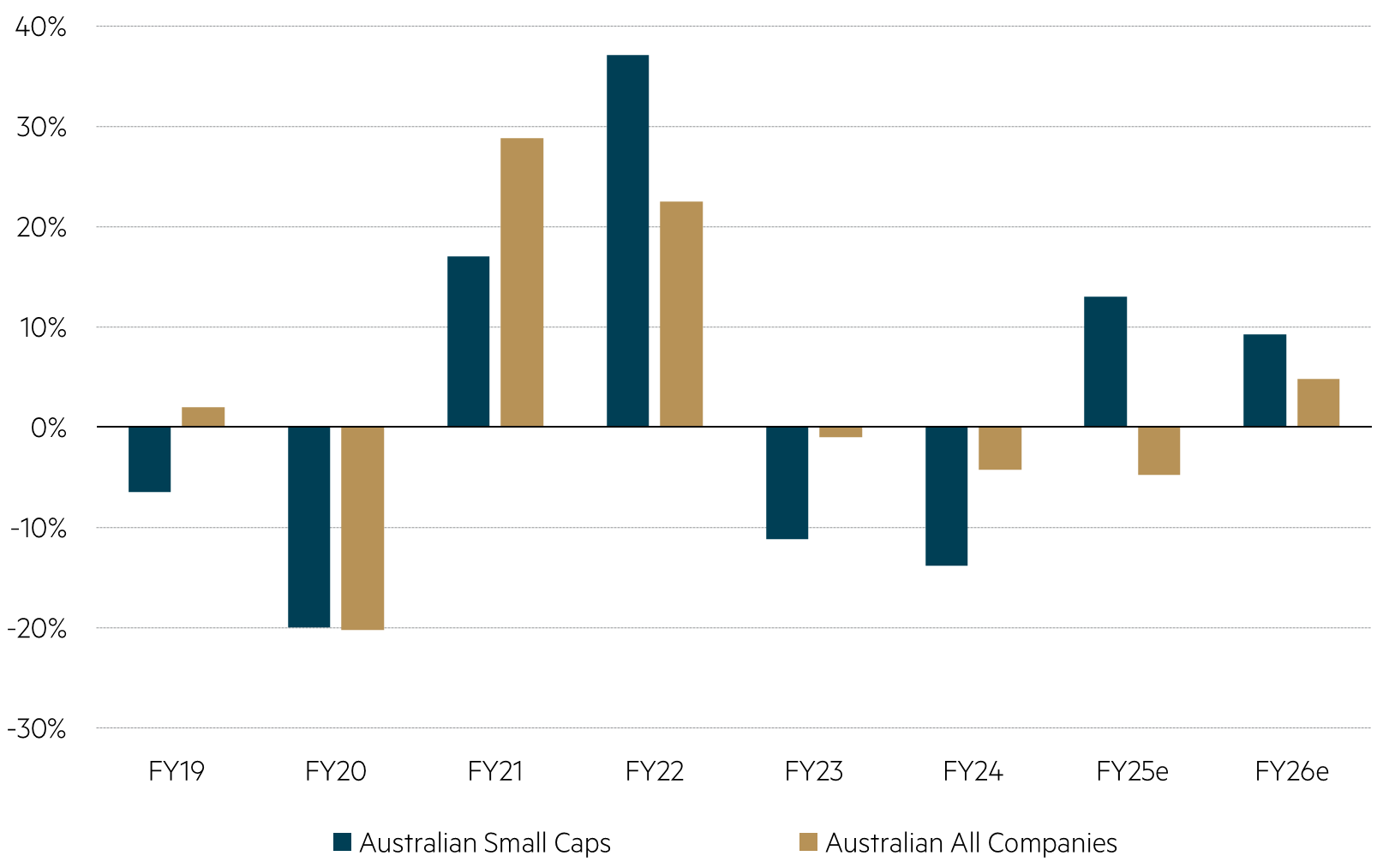

Superior future earnings growth (EPSg)

Source: Macquarie Equity Research, 1 December 2024.

Source: Macquarie Equity Research, 1 December 2024.

- Onshoring/defence exposures: A key trend post-COVID has been companies seeking greater supply chain security via on/near-shoring. In addition, we are seeing heightened geopolitical tension and de-globalisation with increasing global defence spending being a structural growth thematic which we expect to escalate under the next Trump presidency. Both Codan Limited (CDA) and Austal (ASB) are positively exposed to this theme via expansion of communication services for military and US shipbuilding, respectively.

- Election uncertainty: The 2025 calendar year is expected to be particularly interesting given the upcoming Federal election, which must be held by May 2025. We expect cost-of-living measures and fiscal spending to continue which should be supportive for our holdings in the aged care and childcare sectors. However, investor attention is now focusing on the potential for a minority government and/or change in government (Coalition currently drawing ahead now) outcome which will provide a level of uncertainty equity markets for the first half of the year.

- Rising industrial action driving stickier wage inflation?: A key surprise from 2024 has been the strength in the labour force despite forward indicators having softened. Whilst the major driver has been public sector linked jobs growth, there are risks to the wage inflation environment being stickier given the following: (1) cost-of-living pressures have eroded real wages with the Fair Work Decision looking again set to increase minimum wages by in excess of 3.5%; (2) new union delegate rights and enforced negotiations are driving a wave of employee strikes across select industries; and (3) recent trends in EBA outcomes look to have re-accelerated. We continue to focus on companies with pricing power that can pass through potential cost increases or have cost levers to pull to protect margins.

- Corporate activity: Given the lower Australian dollar, improving earnings outlook and attractive valuations on offer, we expect increased M&A interest from offshore players for growing domestic small and nimble businesses.

In summary, we have been underwhelmed with the performance of the Australian small caps market relative to their larger counterpart given the number of tailwinds as risk appetite returns to the space after a challenging few years. We believe 2025 has all the hallmarks of being ‘the year of the Australian small caps’.

Disclaimer

This article is prepared and issued by Maple-Brown Abbott Limited ABN 73 001 208 564, AFSL 237296 (‘MBA’) as the Responsible Entity of the MBA Australian Small Companies Fund (ARSN 658 552 688) (‘Fund’). This article contains general information only, and does not take into account your investment objectives, financial situation or specific needs. Before making any investment decision, you should seek independent financial advice. This document does not constitute an offer or solicitation by anyone in any jurisdiction. Past performance is not a reliable indicator of future performance. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are not a recommendation to buy, sell or hold, they are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this document. These individual stocks referred to may or may not be currently held by the Fund. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications not described in this document. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of this information, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on this information. Before making a decision whether to acquire, or to continue to hold an investment in the Fund, investors should obtain and consider the current PDS and Target Market Determination (TMD) or any other relevant disclosure document. For the Fund, the PDS, AIB and TMD are available at maple-brownabbott.com/document-library or by calling 1300 097 995. This information is current as of 20 December and is subject to change at any time without notice. © 2024 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update