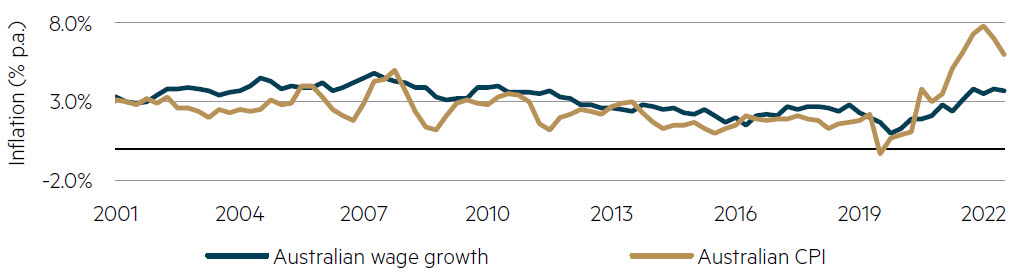

In recent times, the cost of living in Australia has grown faster than salaries, meaning ‘real’ wages have gone backwards. We believe this is about to reverse as the lagging effect of Australia’s employment regime abates. This should fuel material wage inflation over the next 6-12 months despite signs that the labour market may be softening. As a result, we expect to see Australian small cap companies increasingly divide between those that can cope with rising wages using pricing power, cost cutting and/or productivity initiatives – and those that can’t.

Is wage inflation being underestimated by the market?

A consistent theme coming through for most sectors across the Australian small cap universe is wage inflation. We believe wage inflation is trending higher, however this is yet to materially show up in official government statistics, which currently show wage growth tracking below the Consumer Price Index (CPI).

Australian wage and consumer price inflation (% p.a.)

Interested in investing with us?

Investment Insights

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update