Lithium has been used as an anti-depressant and a treatment for mood disorders since the mid-20th century, however the erratic performance of lithium mining stocks over the past decade has left some investors with mixed emotions. Which mood will we see from these stocks in 2023?

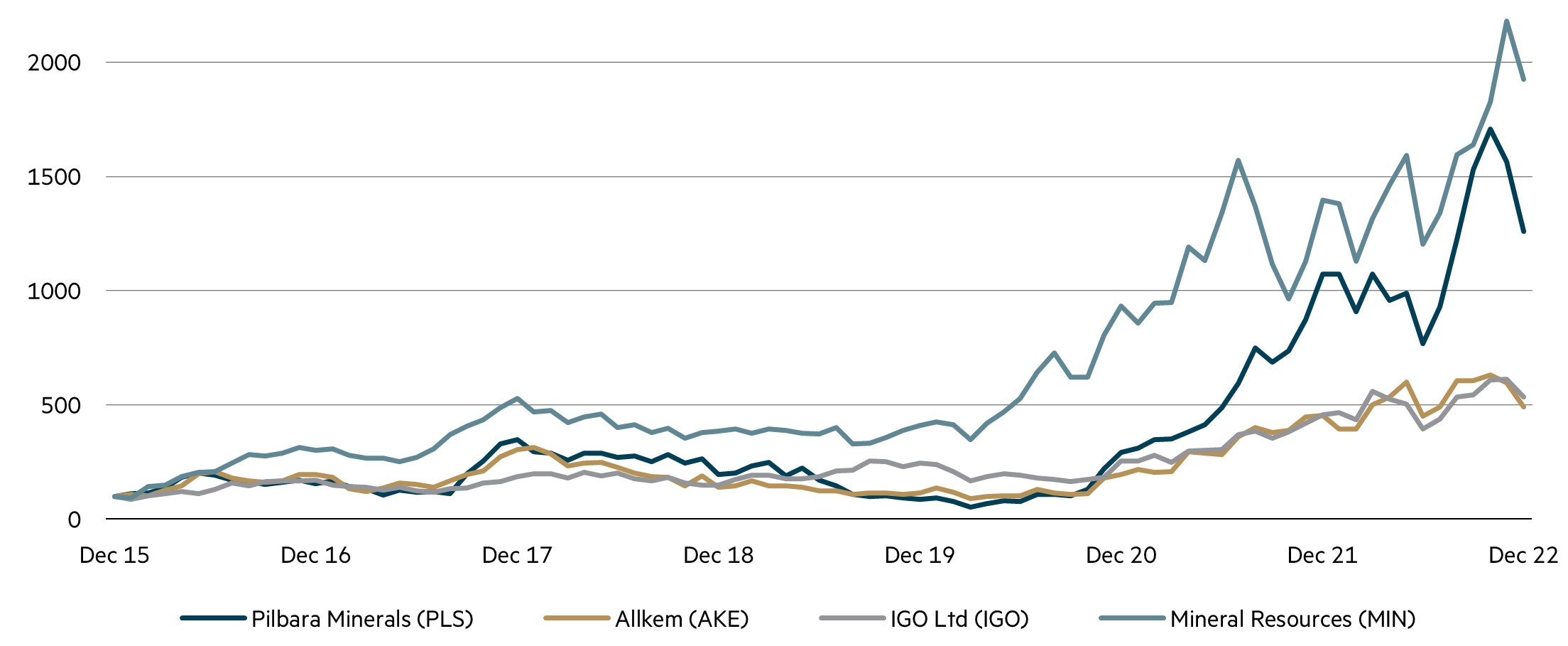

Lithium producer index

Source: FactSet, 31 December 2022, Indexed to 100 at 31 December 2015.

Following the initial electric vehicle (EV) euphoria during 2016-17, demand was delayed as new mines started supplying into a thin market, resulting in lithium prices declining. This resulted in some mines, including Altura’s Pilgangoora and Mineral Resources’ Wodgina mines, ceasing production which balanced the market. COVID-19 stimulus and EV subsidies resulted in a significant demand surge, with the price of lithium spodumene increasing from <US$500/tonne to over US$7000/tonne over a two-year period, which drove strong share price returns for the four producers highlighted in the chart (more than tripling in the case of IGO, up 5 times for AKE and MIN, and 23 times for PLS). We have now reached an interesting juncture, with lithium prices peaking and starting to decline across the board.

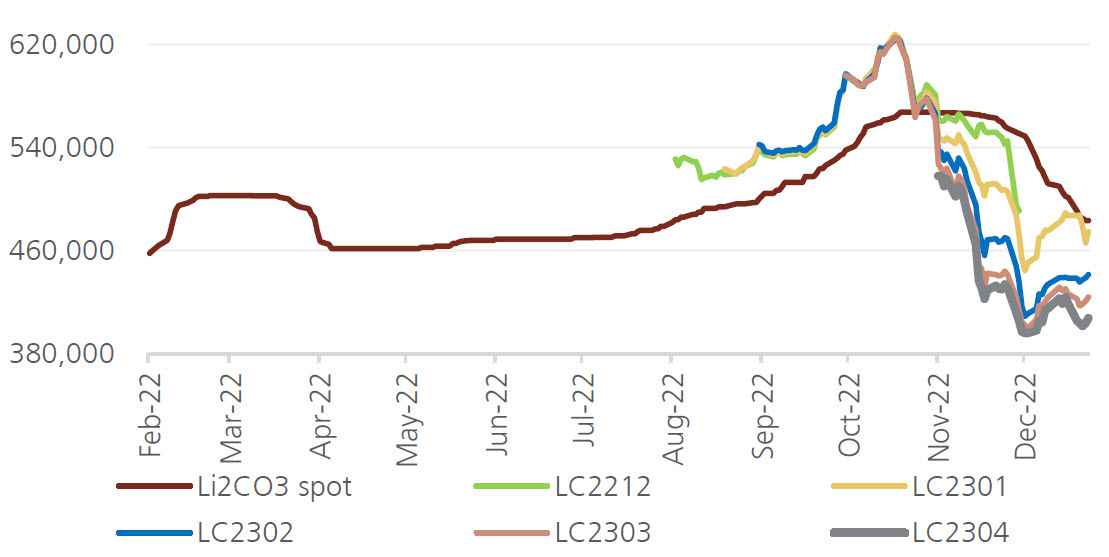

Lithium carbonate prices (RMB/t)

Source: UBS, data as at 16 December 2022.

There are fears regarding both demand (slowing global economy and Chinese de-stocking) and supply (material new mines in China and new supply in Australia, Canada and Chile). Prices have risen significantly with the potential to materially decline, with up to 80% from current levels to reach consensus long-term prices for most lithium products. Given the incredible share price performance of most lithium producers and developers, we believe further commodity price declines may lead to significant share price de-rates.

While from a short-term perspective the sector appears vulnerable, a pull-back in the sector during 2023 may represent an attractive entry point from a longer-term perspective. In our view, new supply is expected to be more costly and take longer to come into production than market expectations. This is a similar experience to the previous lithium boom with most new projects going over capex budgets, starting production later than expected and recovering less lithium than suggested by feasibility study forecasts. Lithium mining and processing is complicated relative to most other industrial minerals and can take many years to execute properly. In addition, many new deposits are relying on relatively new technology that is largely untested outside of the lab or pilot scale plants, including Direct Lithium Extraction (DLE). These projects have the potential to disappoint in terms of their ability to fill the supply gap.

Demand is unlikely to be the linear path upwards that forecasters expect either, although the end point of EV adoption appears clearer in a decarbonised world. We believe this presents attractive buying opportunities over the longer term.

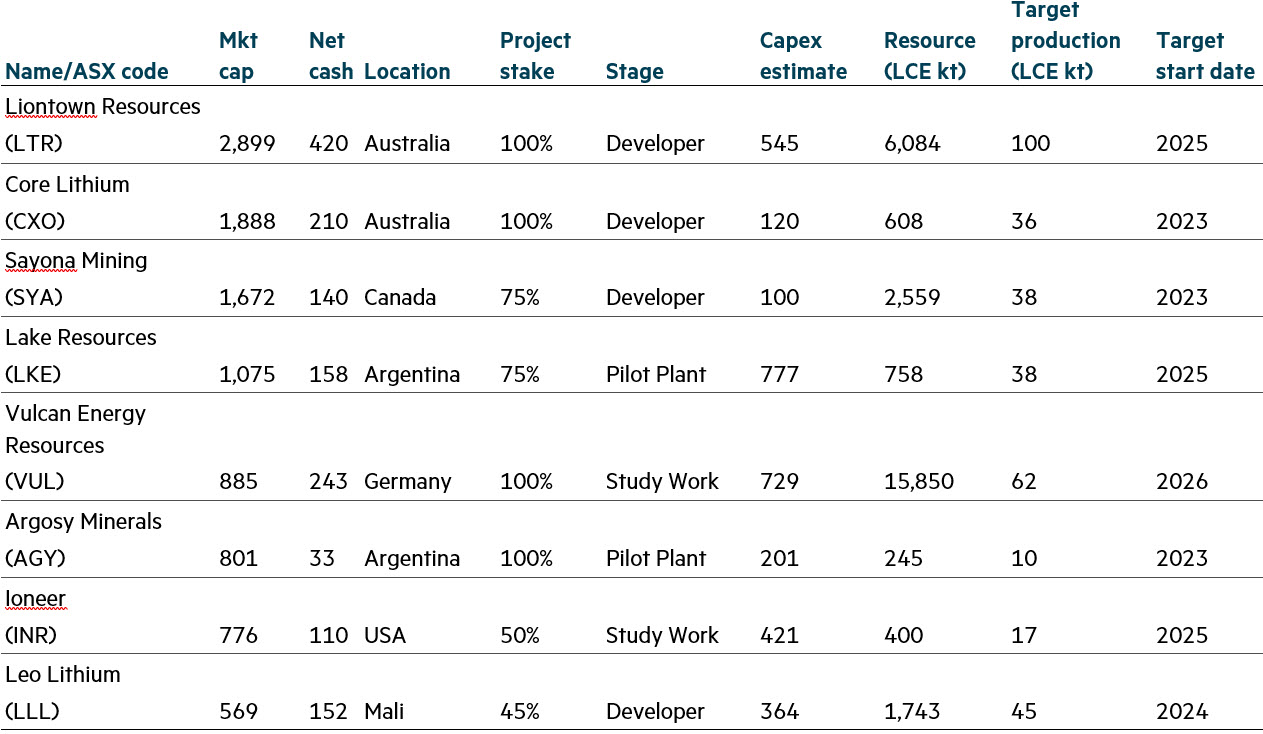

Lithium stocks represent approximately 4% of the S&P/ASX Small Ordinaries Index by weight, with our strategy currently having zero exposure to the sector. The four producers mentioned earlier have all graduated into the S&P/ASX 100 Index with the lithium stocks that remain in the S&P/ASX Small Ordinaries Index being either developers or explorers. This presents an interesting conundrum given most developers will require more capital to build their projects and produce less than market expectations, which would ordinarily lead to share price underperformance. However, the market needs new lithium supply and if supply fails to materialise, the market will see a higher lithium price in the future. Balancing these opposing factors will be key to investing in developers. Our investment strategy is to wait for a more attractive entry point in terms of lithium price and see more realistic assumptions for the developers regarding consensus production and cashflow estimates before considering any new investments.

ASX listed Australian small cap lithium stock metrics

Source: MBA, FactSet, 31 December 2022.

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current as at 31 December 2022 and is subject to change at any time without notice. © 2023 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update