Global efforts to decarbonise energy while improving security at an affordable price remains one of the world’s great challenges. Government net zero commitments and policy are shaping the transition to renewables, however, as the world was reminded in 2022 with the Russian invasion of Ukraine and rampant inflation, it will not be an easy task. Governments now face an energy trilemma where decarbonisation has to happen in an environment where society can keep the lights on and make household budgets balance.

Infrastructure will play a pivotal role in solving this puzzle over the next two decades and we think many listed infrastructure companies will be part of the solution. A significant amount of capital needs to be invested in energy networks and renewable energy generators, and we have identified numerous companies we believe will be able to undertake the large investment programs required at an attractive rate of return. Our focus as specialist infrastructure investors is to identify and assess problems such as the energy trilemma, then invest in the best infrastructure companies that we believe are providing solutions. One such company is the UK-listed SSE PLC (formerly Scottish and Southern Energy PLC).

Transition to renewables well underway in the UK

The UK energy market is complex and evolving. To achieve the country’s net zero obligations by 2050, this energy transition will require large scale investment into the electric grids that need to be expanded, reconfigured and modernised. Offshore wind will also grow rapidly to displace fossil fuel generation, with the UK targeting 50GW of installed offshore capacity by 2030 (from 11GW currently) and a fully decarbonised UK power system by 2035. This transition to renewables is well underway, with the UK targeting zero coal generation by October 2024 compared to around 40% of coal-fired electricity generation in 2011.

SSE owns a complimentary set of utility assets, with regulated electricity networks and a renewables portfolio, primarily located in Scotland. Both segments are fast-growing and offer strong inflation protection, with regulated network returns set in real terms and renewable projects benefiting from Contracts for Difference (CfD) payments linked to CPI escalators. SSE is an economic beneficiary of high inflation, and the company subsequently pays a dividend linked to UK inflation. SSE currently has an equity market capitalisation of approximately £18 billion. This compares to the company’s £12.5 billion capex plan over the five years to March 2026.

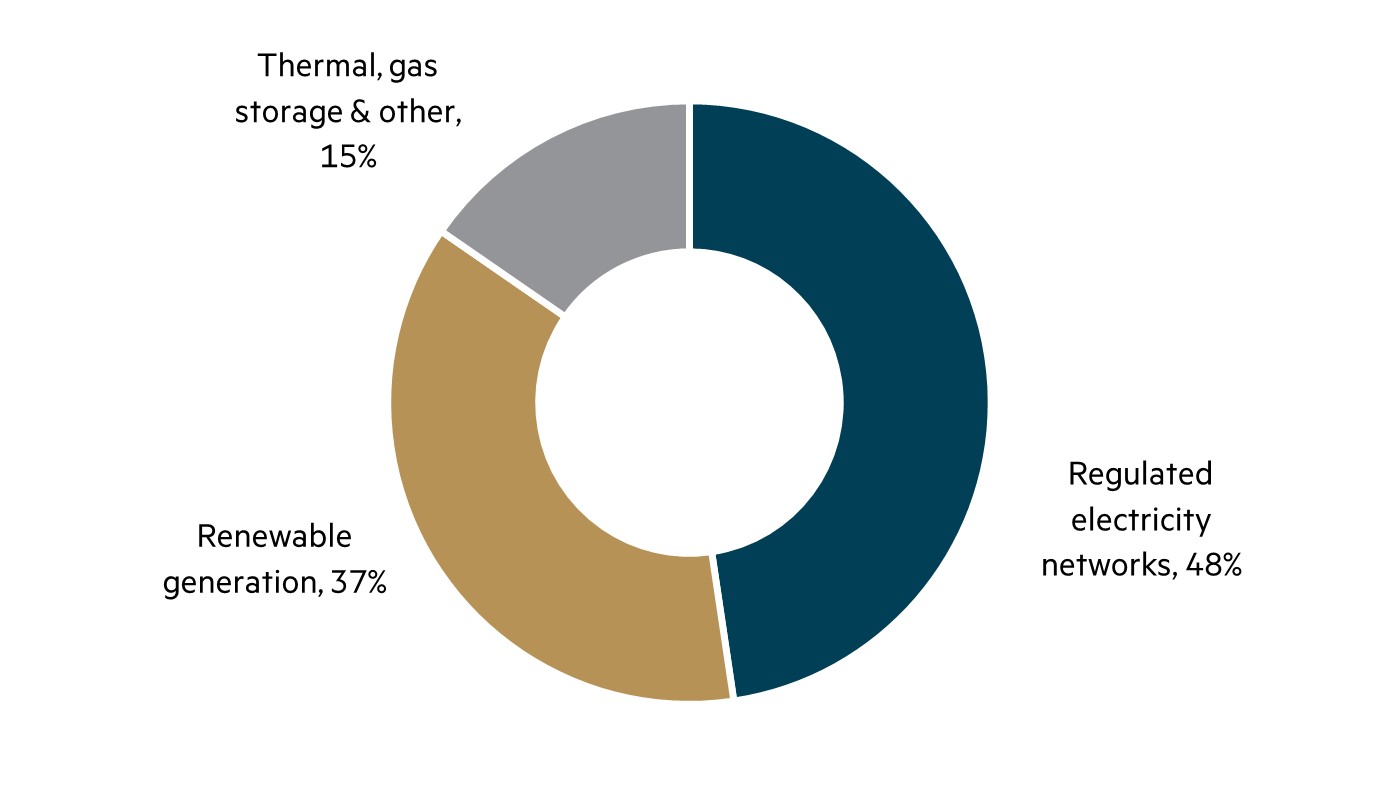

Adjusted EBIT (FY22)

Source: SSE Annual Report FY22.

Note: EBIT is earnings before interest and tax. SSE defines ‘Adjusted EBIT’ as underlying earnings including proportionate EBIT from JVs and associates and excluding one-offs and discontinued businesses.

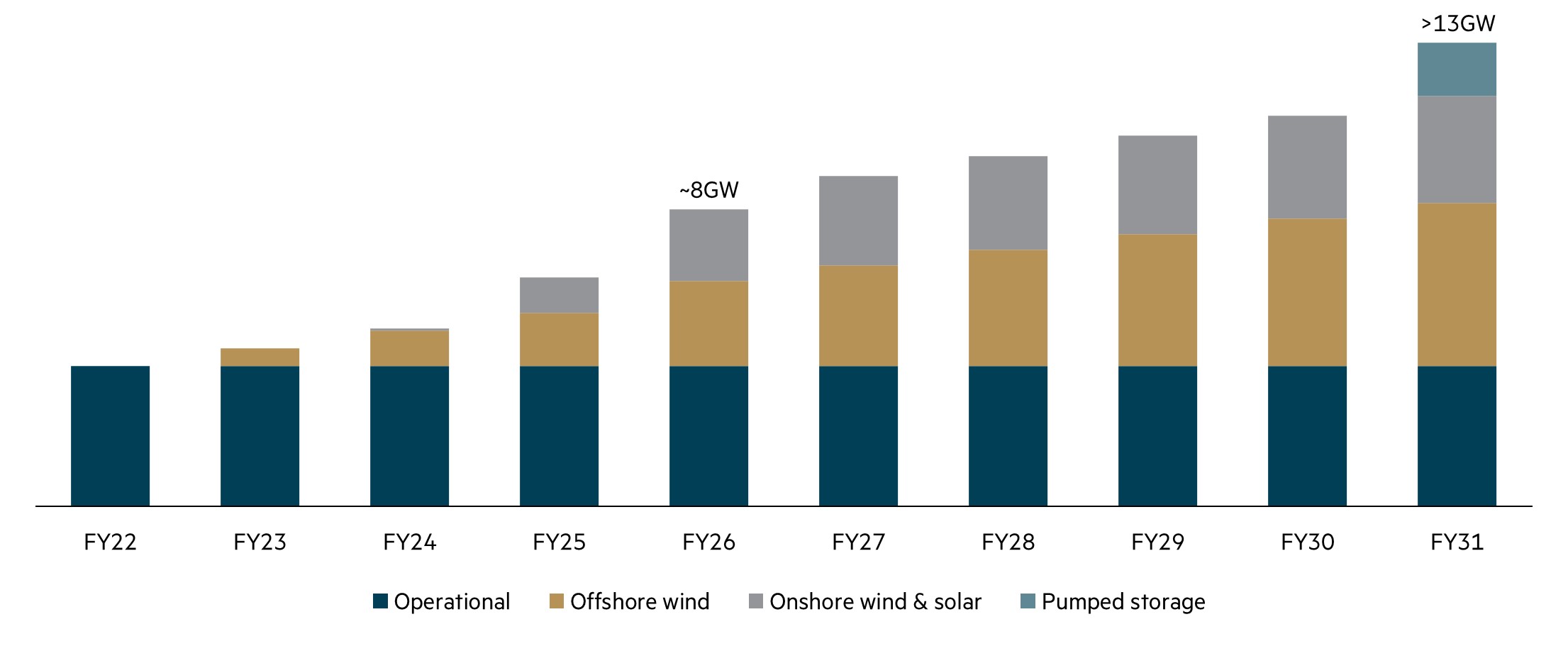

SSE’s fast-growing portfolio

SSE’s regulated networks are both electric transmission and distribution, with among the fastest regulated asset base growth in the developed world. The company is targeting 10% compounded annual growth in the combined regulated asset value (RAV) of the electric networks to March 2031, which is expected to earn a 7-9% post-tax return on equity.

SSE also has a fast-growing renewable generation portfolio that is a mixture of onshore wind, hydro capacity and offshore wind. SSE has around 4GW of installed renewable generation capacity with a target of 13GW installed by 2031, underpinned by a mostly visible pipeline with 4.9GW currently in construction or late-stage development and 8.9GW being secured in early-stage development.1 The fastest growing segment of this portfolio is offshore wind, where SSE is a world-leading developer, operator and owner of offshore wind assets. As part of a joint venture, SSE is currently constructing the world’s largest offshore wind project, the 3.6GW Dogger Bank Wind Farm, located 130km off the north-east coast of England in the North Sea. This is expected to power six million homes when it is complete in 2026. SSE is also developing Scotland’s largest, and the world’s deepest, fixed-bottom offshore site, the 1.1GW Seagreen Offshore Wind Farm as part of another joint venture. The renewable generation assets mostly operate under 15-year contractual and inflation-linked arrangements, meaning their cashflows are fairly reliable. SSE also aspires to expand internationally in the renewables business, but despite their market-leading offshore wind position in the UK, we view this with great caution due to the significant competitive and regulatory risks involved with a move into new markets. We have discussed this risk in depth with SSE’s management. The company also has thermal generation, gas storage and energy supply businesses, which sit outside our tight definition of infrastructure, however their materiality is sufficiently small such that the entire SSE business qualifies as an infrastructure business in our investment process.

Net renewable generation capacity additions targeted to FY31

Source: SSE 1H23 Results Presentation (16 November 2022).

Being a UK asset, SSE was buffeted by political and macro factors over 2022. The situation looks more stable now, though these risks are ever present when investing in infrastructure anywhere in the world. In November 2022, the UK government announced its long-anticipated energy profits levy at 45% of the net generation revenue above £75/MWh (real 2023 prices) until March 2028. The tax is designed to claw back some of the excess profits UK electricity generators, including renewables, are earning as a result of the high gas prices that have driven up electricity prices. While any type of government intervention is a risk, in this case SSE remains a net beneficiary of higher power prices.

Recent transaction multiples imply valuation upside

The most important piece of our investment process is the individual share price upside for each stock holding. As a cross-check to our discounted cashflow valuations, we watch and analyse the prices paid in direct infrastructure transactions, which have consistently been at a premium to comparable listed peers for various infrastructure sectors around the world. There is a long history of direct infrastructure players investing in inflation-linked UK regulated energy and water assets with the prices paid being well above the trading multiples of listed regulated UK companies. In November 2022, SSE sold a 25% stake in its UK electricity transmission network business to Ontario Teachers’ Pension Plan Board for £1,465 million of equity proceeds. The price represents approximately a 70% premium to the RAV at March 2023, and this compares favourably to the comparable implied multiples of 1.1 to 1.3x for other listed UK regulated utilities, even though the SSE transmission network demonstrates particularly high growth.

1 Company guidance as at 16 November 2022

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current as at 31 December 2022 and is subject to change at any time without notice. © 2023 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update