As we enter 2023, we see a degree of complacency in markets, yet we believe this will be a challenging year with several areas potentially surprising investors, namely uncertainty around corporate earnings, the duration of elevated commodity prices and a possible reversal of US stock market outperformance.

A year to pay attention to forecasts

Often year-ahead forecasts are of limited importance as economies and markets are in well-established trends and there seems little reason to expect change in the new year. This was the case in late 2021 when the consensus was that 2022 would be a business-as-usual year. In the December 2021 Minutes of the Monetary Policy Meeting of the Reserve Bank of Australia (RBA), it was noted that while inflation had picked up and was a little above 2% for the first time in six years, only modest increases were expected with “underlying inflation to reach 2.5% over 2023”.1 In the same minutes, the RBA noted “the Board remained committed to maintaining highly supportive monetary conditions” until such time as the economy returned to full employment and inflation moved within the 2-3% target range, stating “this is likely to take some time and the Board is prepared to be patient”. The cash rate was 10 basis points.

The RBA was not alone in expecting a business-as-usual 2022. While there were signs that inflation was building following significant stimulus through the COVID period and even earlier, the Russian invasion of Ukraine in February 2022 ‘lit a fire’ under energy and other commodity prices on top of the enormous human tragedy that has unfolded. Together with an uplift in demand as COVID concerns eased, supply chain issues and manufacturing delays, inflation took an unexpected leg up. 2022 was nothing like the year that most had expected. As we look to 2023, opinion seems to be coalescing around a few key views. Global growth is expected to be tepid with the risk of recession in key countries. In terms of inflation, the general view is we are currently seeing the peak in developed markets and, that being the case, central bank monetary policy tightening is likely to be largely finished (this view has seen significant stock market rallies during 2022 but within the context of a market that has been under pressure for much of the year).

Uncertainty around corporate earnings

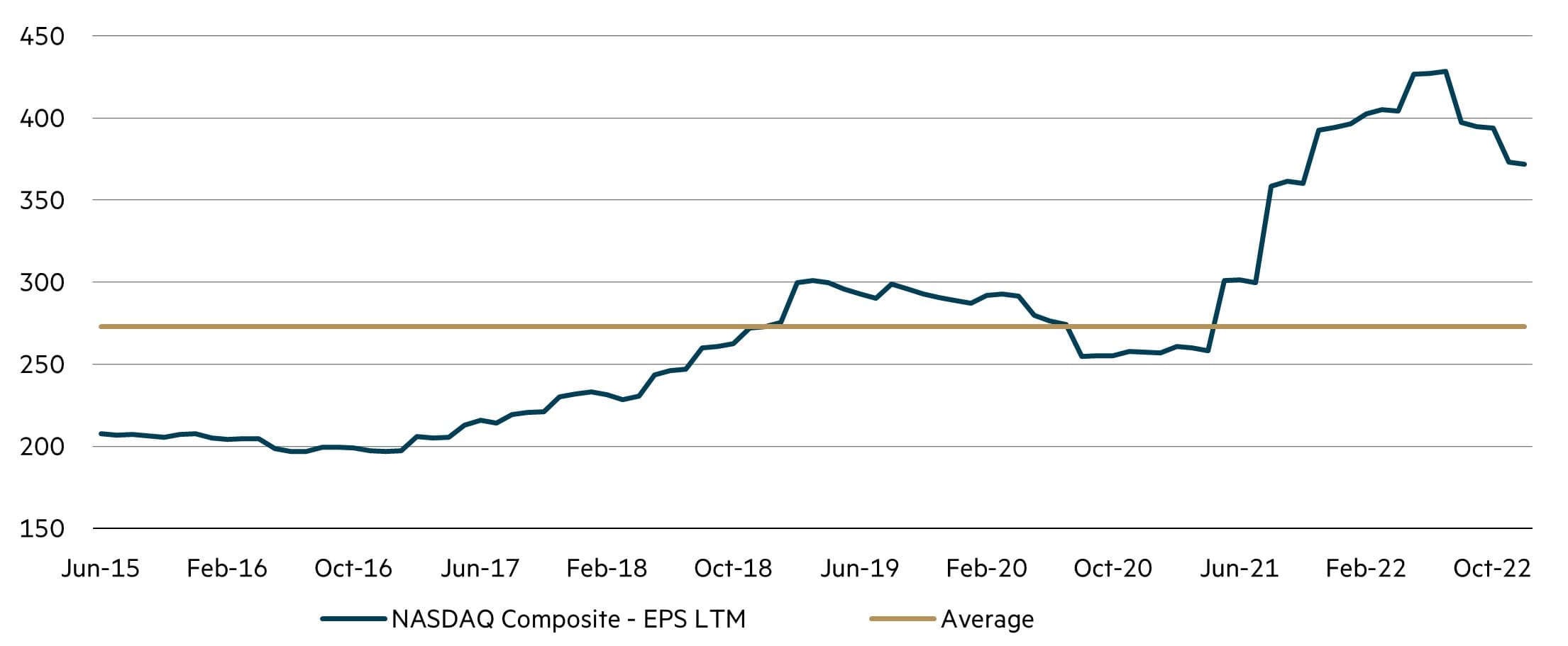

Of more interest to us is to reflect on where outcomes in 2023 may be different to expectations and what the ramifications of that might be. Perhaps the biggest uncertainty facing investors is what happens to corporate earnings this year. It is well and good that higher interest rates help to rein in inflation, but at least some of this will be achieved through reducing economic growth. There has been very little in the way of consensus earnings downgrades for Industrials in Australia, but we are starting to see some movement in the US, which is perhaps leading the way. Of most interest is what is happening in the Tech sector, which enjoyed an extraordinary uplift in earnings during COVID. Earnings have started to decline (very significantly in instances such as Amazon) and the NASDAQ has given up all its outperformance of the S&P 500 since the start of COVID, while remaining well above where it was a decade before that. The broader S&P 500 has not seen as much in the way of earnings downgrades either, but we have seen a turn and recent Federal Reserve moves and related commentary are likely to reinforce the trend. We therefore expect to see earnings downgrades in 2023 and believe this is likely to put pressure on stock markets, noting that the S&P/ASX 300 Total Return Index has now recovered to be within ~5% of all-time highs.

NASDAQ COVID benefits begin to unwind

Broader market earnings likely to follow

Source: FactSet, data to December 2022.

Will commodity prices stay elevated even longer than expected?

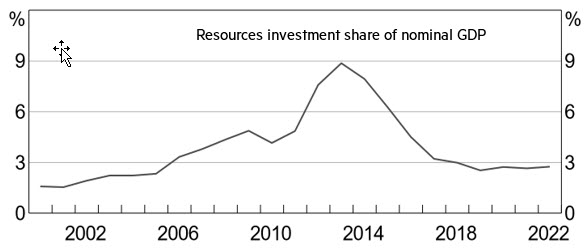

Another area of potential surprise is the extent to which commodity prices may remain at elevated levels for longer than expected. While there could be some softness in 2023 in some sectors as economies slow, the medium- and longer-term picture is likely to surprise on the upside. One of the key contributing factors is the lack of new investment across most commodities. There are many reasons for this including poor outcomes from growth projects in the previous cycle, associated pressure from shareholders and the impact of climate policies. As the RBA has highlighted2, this also has implications for inflation longer term. The supply side part of the economy is likely to have much less flexibility than it has had over the three previous decades – resource under-investment being one of the considerations. We believe we are likely to see higher commodity prices and more variability in inflation, which in turn has implications for interest rates and stock valuations, particularly at the premium-valuation end of the market. In addition, commodity stocks in general are not pricing in the benefits of an extended cycle.

Resources capex has been constrained

Commodity prices to be supported at higher levels than otherwise

Sources: ABS; RBA, data as at 30 June 2022.

Could US stock market outperformance reverse?

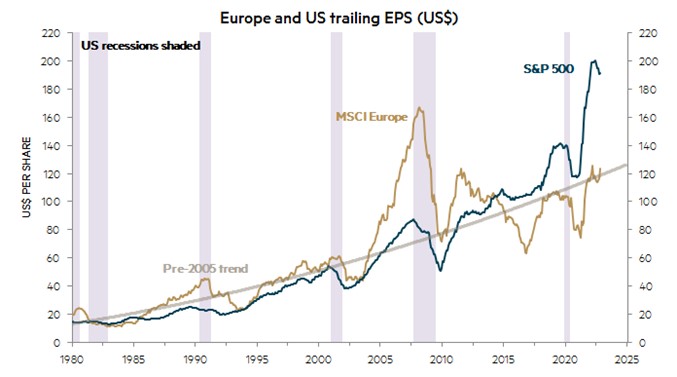

A third area of potential surprise is that the extraordinary outperformance of the US stock market relative to other global markets may well reverse. Earnings growth in the US has been exceptional and stock prices have followed suit. As noted earlier, a significant factor has been the performance of the Tech sector, which has already shown signs of a significant turn in fortune. Europe continues to be in a slump, but this means it is starting from a much lower base than the US. The chart below highlights the relative strength of European earnings in the early 2000s and the time it has taken for the excesses to be worked through. The picture in the US looks extremely similar to that of Europe earlier and suggests the US market may well be facing an extended period of earnings weakness, flowing through to stock market performance. While this does not have direct application to our market, it is another indication of how longer-term trends (and conventional wisdom) seem to be coming under pressure. We are of the view that this has ramifications for our market in terms of the consensus thinking that has underpinned the market over the past decade.

US earnings have spiked higher but now under pressure

Reversal of longer-term US market outperformance likely

Source: Minack Advisor, data to December 2022.

Challenges of 2023 likely to benefit bottom-up disciplined value investors

There is rarely a dull moment in investment markets and in our view 2023 will be no different. We see a degree of complacency in markets, with investors underappreciating the risks faced by the market. There is an associated mindset that is awaiting signs that monetary tightening has peaked, with the view that this will provide the opportunity to add to equity positions that reflect the successes of the past decade. We believe that 2023 is going to be a challenging year, where earnings come under pressure and some of the excesses of the past decade continue to be addressed, noting that even Japan has commenced the process of normalising monetary policies after nearly a decade of yield curve control. We expect this environment will be a favourable to investors with a bottom-up, value investment philosophy, highlighting again the importance of active management.

1 Minutes of the Monetary Policy Meeting of the Reserve Bank Board, 7 December 2021

2 Price Stability, the Supply Side and Prosperity – Philip Lowe. CEDA Annual Dinner Address, 22 November 2022

Disclaimer

This information was prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (“MBA”). This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. Neither MBA, nor any of its related parties, directors or employees, make any representation or give any guarantee as to the return of capital, performance, any specific rate of return, or the taxation consequences of, any investment. This information is current as at 31 December 2022 and is subject to change at any time without notice. © 2023 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update