In December 2021, we published our inaugural Maple-Brown Abbott Global Listed Infrastructure Task Force on Climate-related Financial Disclosures (TCFD) report as part of our firm-wide commitment to climate change risk reporting. Building on that report, this article summarises the findings of our latest climate change scenario analysis and provides an update on our targets and metrics.

Summary

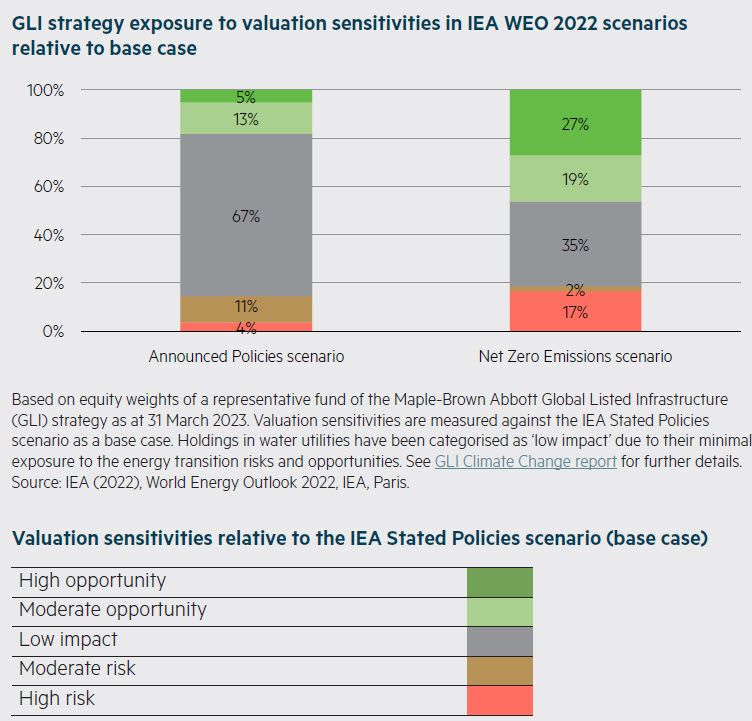

Despite an ongoing energy crisis and geopolitical instability, the latest IEA World Energy Outlook 2022 shows how the pace and scale of the energy transition has sped up with the introduction of landmark policy such as the US Inflation Reduction Act, RePowerEU and the EU’s Fit for 55 package of reforms. A more accelerated net zero emissions pathway could, according to our latest analysis, spell a material valuation upside for around 50% of companies held in the Maple-Brown Abbott Global Listed Infrastructure (GLI) strategy (by position weight) relative to our base case. Equally, around 20% of companies (by position weight) could experience valuation risks owing to their exposure to oil, natural gas, air and road markets.1

What is climate change scenario analysis?

Key to the analysis of transition risks and opportunities is the question of whether the global energy transition will be gradual or rapid. Scenario analysis can assist investment managers analyse the breadth of potential transition trajectories and should be considered a stress testing exercise to explore the extreme ends of the energy transition and what this could look like for a portfolio of investments.

We refresh our energy transition assumptions using the IEA World Energy Outlook scenarios every year to ensure our valuation assumptions account for the current state of the transition. This helps us identify risks and opportunities in our company models and use these insights to inform our ESG company engagements and other stewardship activities.

IEA World Energy Outlook 2022 scenarios2

| Stated Policies scenario (base case) | Announced Pledges scenario | Net Zero Emissions by 2050 scenario | |

|---|---|---|---|

| Description | Reflects current policy settings currently enacted by governments. The scenario implies a temperature rise of around 2.5°C above pre-industrial levels by 2100 with a 50% probability. | Assumes that all climate commitments are upheld and met in time and in full by governments around the world – irrespective of whether or not there are policies in place to secure implementation. The scenario implies a temperature rise of around 1.7°C above pre-industrial levels by 2100 with a 50% probability. | Sets out a narrow pathway for the global energy sector to achieve net zero emissions by 2050. The scenario models a pathway to a temperature rise of around 1.5°C above pre-industrial levels by 2050. |

Breaking down our findings

In our latest analysis, we used the IEA Stated Policies scenario as a proxy for our base case and flexed various company-specific assumptions to account for a faster transition (the Announced Pledges scenario) and the fastest transition (the Net Zero Emissions by 2050 scenario).

Relative to the IEA Stated Policies scenario, our analysis shows that a faster pace of the energy transition could create significant opportunities for the GLI strategy. The results vary substantially across industries:

- Potential opportunities are most pronounced in the case of electric and multi-utilities, contracted renewable energy companies and railroads. These companies comprise a total weighting of around 50%.3

- The impact of a faster energy transition on airport infrastructure is more ‘middle of the road’ in the sense that the industry does not look to be structurally challenged or exposed to stranded asset risk, but instead could face uncertainties that impact its long-term valuation outlook.

- The most challenged industries – when it comes to a faster-paced energy transition – are the midstream and energy storage companies owing to their exposures to oil and natural gas markets.

- The pace and scale of the energy transition has a relatively immaterial impact on the valuations of the water utilities, communications infrastructure and toll roads we analysed.

What does this mean for the GLI strategy?

Our analysis indicates the GLI strategy may be well positioned to tap into the opportunities associated with the valuation upside of a faster energy transition. For instance, according to our analysis, 18% of GLI strategy holdings (by position weight) see moderate to high valuation opportunities under the IEA Announced Policies scenario, which increases to 46% under the Net Zero Emissions scenario.

Equally, the faster the pace of the energy transition, the greater the potential valuation downside for midstream infrastructure energy and storage infrastructure companies. Under the IEA Announced Policies scenario, around 15% of GLI strategy holdings see moderate to high valuation risks. This number increases to 20% of companies under the IEA Net Zero Emissions scenario.

Targets and metrics

Emissions versus “rate of change”

We believe emissions are not a good metric for forward-looking assessments of companies as they relate to a point in time as opposed to the potential rate of change. We use emissions data for specific purposes in the investment process, but consider companies’ business activities, capital expenditure plans and energy transition strategies to be better forward-looking measures.

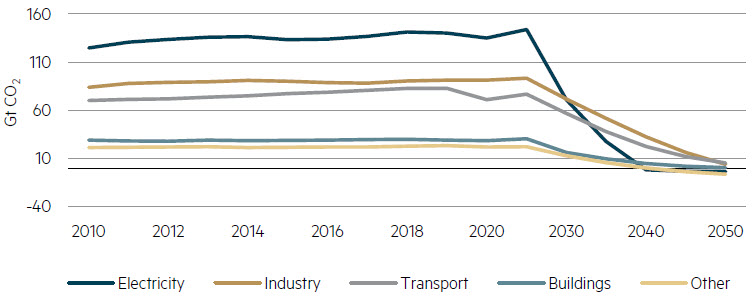

The energy transition will not be possible without the right infrastructure investment, especially in the electric and multi-utilities sector which accounted for over one third of global energy related emissions in 2021.4 According to modelling undertaken by the IEA, the electricity sector is set to lead emissions reductions over the next decade as it carries the most potential to retire emissions-intensive assets and invest in renewable energy, battery storage and the requisite electricity grid infrastructure.

CO2 emissions by sector in the Net Zero Emissions scenario

Source: IEA (2022), World Energy Outlook 2022, Paris, IEA.

To achieve net zero emissions, the electricity sector will need to undergo the steepest and deepest cuts in emissions over the coming decade.

Walking the talk on emissions

In 2021, the GLI strategy became a signatory to the Net Zero Asset Managers initiative (NZAMi). We have committed to aligning the GLI strategy with a pathway towards net zero emissions by 2050 and have set an interim emissions target to assist with this trajectory.

Making this commitment has been a key driving force behind our stepped-up climate risk and decarbonisation research, engagements and proxy voting decisions in recent years. We have seen some excellent outcomes from our engagement and proxy voting efforts, especially in relation to emissions targets and the incorporation of ESG objectives into executive remuneration frameworks. We also use global best practice standards and frameworks – such as the Paris Aligned Investment Initiative – to assess the quality of companies’ emissions targets.

After all, our ability to execute on our own emissions targets depends on the execution of the companies we invest in. This is the crux of our philosophy: we believe long-term decarbonisation will not be possible through a binary approach to divestment but instead through active stewardship.

1 Based on equity weights of a representative fund of the Maple-Brown Abbott Global Listed Infrastructure (GLI) strategy as at 31 March 2023.

2 Source: IEA (2022), World Energy Outlook 2022, IEA, Paris.

3 Based on equity weights of a representative fund of the Maple-Brown Abbott Global Listed Infrastructure (GLI) strategy as at 31 March 2023.

4 Source: IEA (2022), World Energy Outlook 2022, IEA, Paris.

Disclaimer

This material was prepared and issued by ©Maple-Brown Abbott Ltd ABN 73 001 208 564, Australian Financial Service Licence No. 237296 (MBA). MBA is registered as an investment advisor with the United State Securities and Exchange Commission under the Investment Advisers Act of 1940. This information must not be reproduced or transmitted in any form without the prior written consent of MBA. This information does not constitute investment advice or an investment recommendation of any kind and should not be relied upon as such. This information is general information only and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate. This information does not constitute an offer or solicitation by anyone in any jurisdiction. This information is not an advertisement and is not directed at any person in any jurisdiction where the publication or availability of the information is prohibited or restricted by law. Past performance is not a reliable indicator of future performance. Any comments about investments are not a recommendation to buy, sell or hold. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this information. The views and opinions contained herein are those of the authors as at the date of publication and are subject to change due to market and other conditions. Such views and opinions may not necessarily represent those expressed or reflected in other MBA communications, strategies or funds. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications compiled by the relevant source and this information does not purport to provide a complete description of all or any such assumptions and qualifications. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of the information contained herein, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on any part of this information. This information is current as at 31 March 2023 and is subject to change at any time without notice. This information is general information only to wholesale clients as defined by the Corporations Act 2001 (Cth) (Australia) and the Financial Markets Conduct Act 2013 (NZ) and it does not have regard to any person’s investment objectives, financial situation or needs. Before making any investment decision, you should seek independent investment, legal, tax, accounting or other professional advice as appropriate and read any relevant PDS documents here and the Maple-Brown Abbott Financial Services Guide found here. © 2023 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update