Another strong quarter and another intra-period record high for both the Australian market (S&P/ASX 300 Total Return Index) as well as the NASDAQ Composite and the S&P 500. As has been the case for the past few years, following the recovery of earnings post the 25% decline during COVID, much of the strength in markets has been driven by price earnings (PE) multiple expansion and major markets trade on earnings multiples that are at the very top end of ranges seen over the past 25 years. The Australian market PE multiple at 18.8 times1 is the highest since the turn of the millennium, other than briefly during the COVID impacted period. Even including that period, the PE multiple is at the 95th percentile of readings this millennium and the more recent expansion in multiples has seen our market outpacing similar trends in most global markets. It is worth noting that resource stocks are trading slightly cheaper relative to their history and thus the valuation picture for industrial stocks is even more extreme.

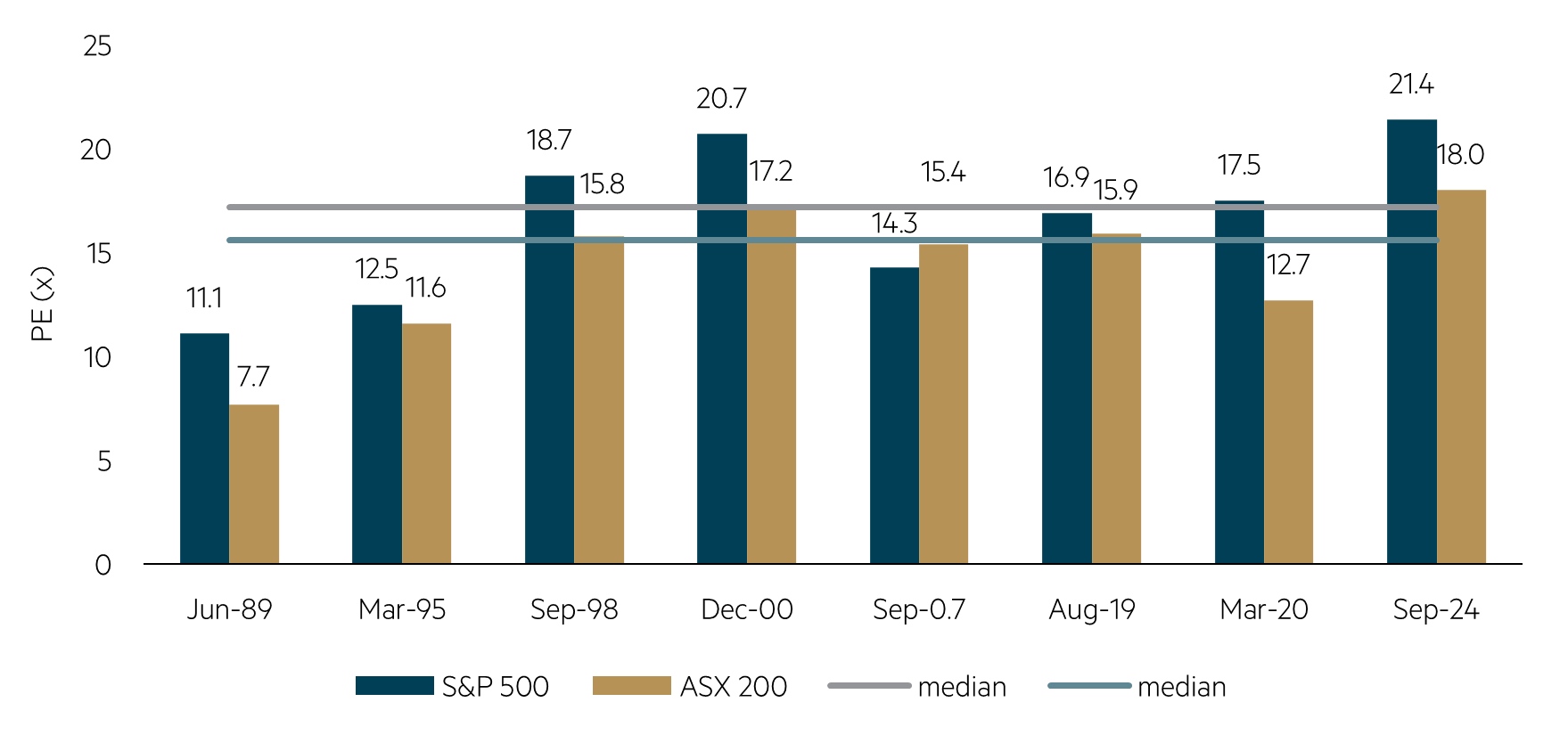

The two major features of the market this past quarter have been the debate around the timing and size of interest rate cuts by the Federal Reserve, and the Australian reporting season. The Fed finally cut rates by 0.50% during September, much later than initially expected given that inflation remains elevated. The beginning of a rate cut cycle is often seen as the impetus for a market recovery as monetary conditions begin to ease, and profits start to recover after being pressured by tighter monetary conditions. The current cycle has been quite different in that there has been no sustained weakness in the market through the whole tightening phase and earnings for the market have remained resilient. In addition, the chart below highlights that current market PE multiples for both the US and Australia are at their highest level at the start of a rate cutting cycle in nearly 50 years of data. Given this, it seems unwise to expect that there is room for multiples to expand much further, particularly with earnings at elevated levels – and indeed some correction in valuations seems a more likely outcome.

PE multiples at record highs for the start of a US rate cutting cycle

S&P 500 & ASX 200 12m fwd PE at start of Fed cutting cycles

Source: FactSet, Refinitiv, MST Marquee.

Reporting season – key takeaways

The second focus of the market this quarter has been the financial reporting season. Given that PE multiples are already very extended, the likely path to further market strength would seem to be higher earnings. As noted above, earnings to date have remained resilient, except for resources where lower commodity prices have impacted negatively. This resilience has given air to the debate on a potential soft landing whereby monetary authorities engineer a cooling of the economy without an undue negative impact on demand and hence reported earnings. The reporting season was therefore closely observed to see how this thesis is playing through. Individual market strategists collate data in diverse ways but the overall “feel” of reporting season was that it was one of the softer periods in recent times. One strategist highlighted that this season was in the weakest 15% of periods of the 30 years they have data for. This softness was reflected in a ~4% downgrade to FactSet CY25 Earnings Per Share (EPS) numbers, with the downgrades weighted to the resources segment of the market. Our view, and that of many others, was that there was not much in reporting season to support the view that the earnings outlook was anything other than mixed. Hence, future earnings growth is unlikely to be a materially positive support to share prices in the short to medium term. This would see the market reliant on multiple expansion if further gains are to be forthcoming, and as already noted history strongly suggests that valuations are unlikely to be sustained at these or even higher levels.

Banks – Still good value?

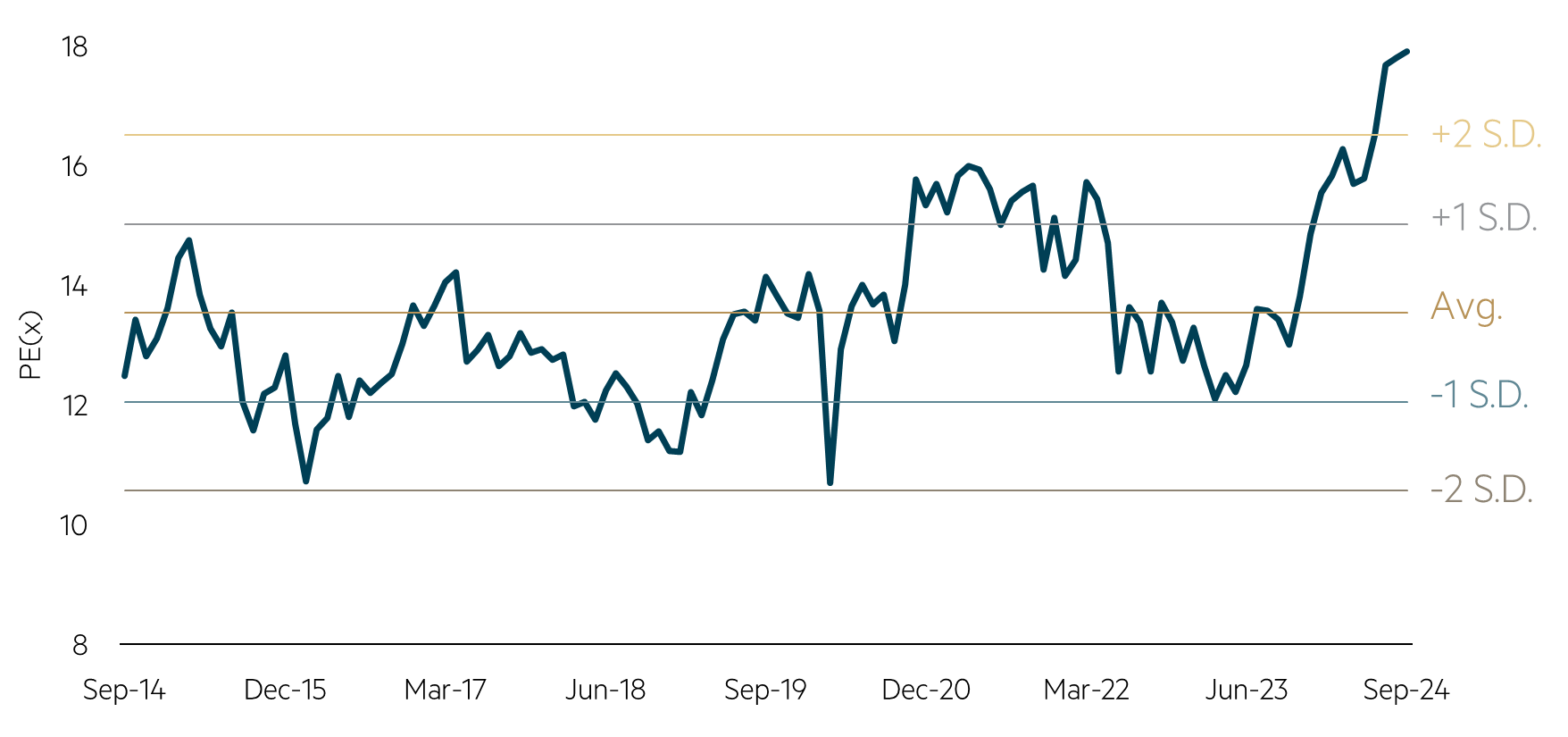

A significant part of the valuation conundrum facing our market is explained by the extraordinary moves in the price of bank stocks since their lows of mid-2023. Since that date, the sector has risen ~40% and has accounted for ~60% of the gain in the S&P/ASX 300. This is despite no discernible move in consensus earnings forecasts for either CY24 or CY25, an extraordinary outcome. The sector was deeply out of favour at the lows with good upside potential and we were well overweight the sector. As the dire forecasts that some had for the sector were not forthcoming, there was a substantial re-rating. This was fuelled by a host of factors including international money coming into the sector as investors exited China and money flowing into passive strategies that saw all the banks purchased irrespective of valuation considerations. The sector now looks significantly overpriced, with CBA notably leading the way as one of the most expensive banks in the world. The fact that the sector comprises more than 20% of the benchmark helps explain some of the valuation premium in our market.

Bank PE multiples at record levels

S&P/ASX 300 Banks – PE (NTM)

Source: FactSet, data to September 2024.

What opportunities are we seeing?

Late in the quarter we saw a strong package of policy easing measures announced by the governor of the People’s Bank of China, followed by statements from the Politburo which suggested a much more coordinated approach to Chinese economic malaise was going to be forthcoming. Commodity stocks rallied significantly, recovering some of their earlier losses. Valuations in this part of the market continue to look attractive to us, particularly relative to the rest of the market, and it was notable that it was primarily the banks that were sold as investors rotated in resources. Our largest overweight position is in energy stocks, which rallied less strongly than the metal stocks.

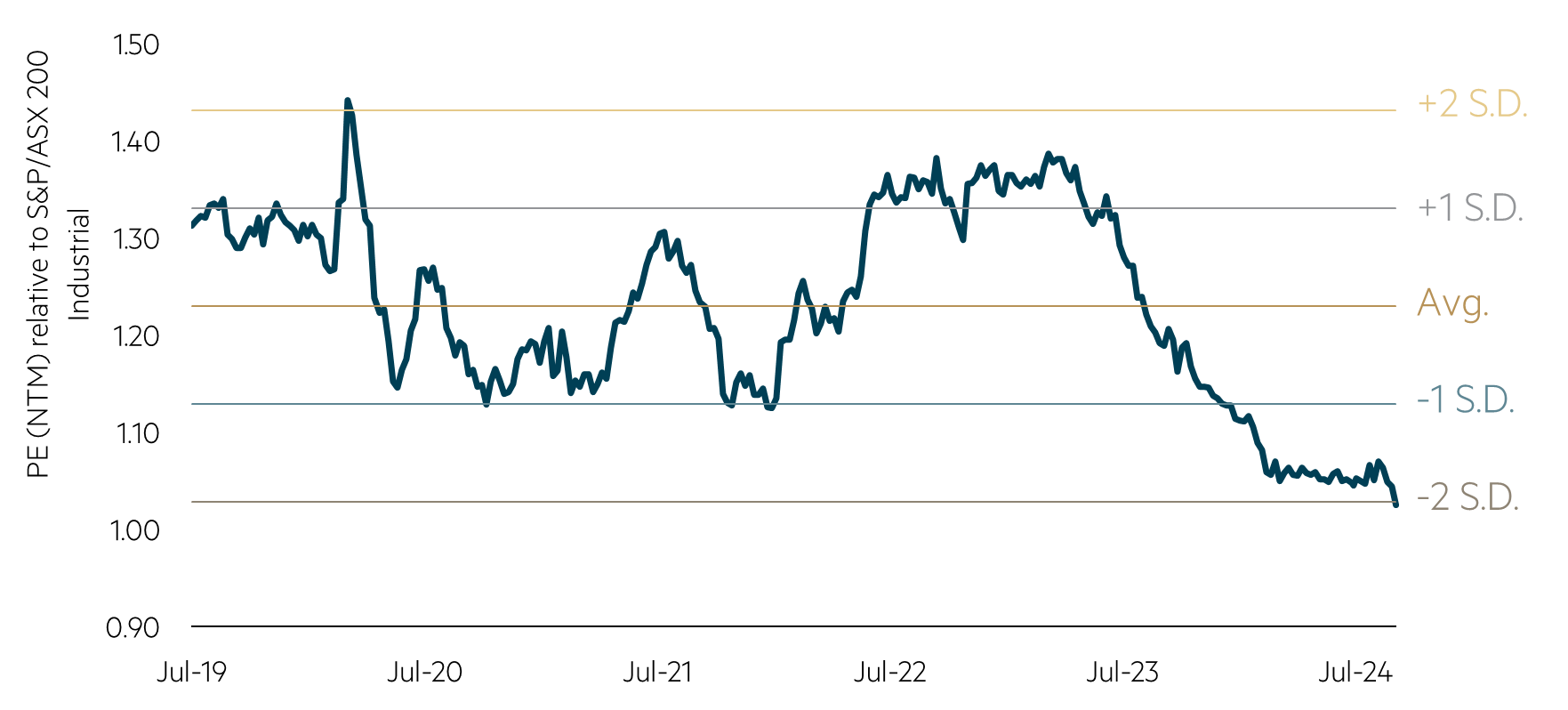

In addition to resources, our portfolios continue to be well exposed to the more defensive parts of the market such as beverages and food retail, where valuations are more attractive.

Defensive stocks have lagged and appear cheap relative to recent trading history

Valuation of major defensive stocks in the ASX 200

Source: FactSet, data to Sept 2024. Represents unweighted average next 12 month PE relative to S&P ASX200 Industrials Index of RMD, COL, WOW, AMC, TWE, TLS, CSL and BXB.

This segment of the market has not been without its challenges, a recent example being the Australian Consumer & Competition Commission (ACCC) suing Coles and Woolworths for misleading conduct. In general, defensive stocks endured a slightly chastening reporting season, somewhat unfairly in our view, but this is often the case when stocks are out of favour.

Summary

With the market continuing to trade to new highs as valuation metrics test previous extremes, we believe the best opportunities are increasingly focused on resources, select defensive industrials and a group of companies where idiosyncratic challenges have negatively impacted valuations.

1 FactSet consensus

Disclaimer

This information is prepared and issued by Maple-Brown Abbott Ltd ABN 73 001 208 564, AFSL. 237296 (‘MBA’) as the Responsible Entity of the Maple-Brown Abbott Australian Share Fund – Wholesale ARSN 087 294 504 (‘Fund’). This article contains general information only, and does not take into account your investment objectives, financial situation or specific needs. Before making a decision whether to acquire, or to continue to hold an investment in the Fund, investors should obtain independent financial advice and consider the current PDS and Target Market Determination (TMD) or any other relevant disclosure document of those products. For the Fund, the PDS, AIB and TMD are available at maple-brownabbott.com/document-library or by calling 1300 097 995. Any views expressed on individual stocks or other investments, or any forecasts or estimates, are not a recommendation to buy, sell or hold, they are point in time views and may be based on certain assumptions and qualifications not set out in part or in full in this document. The individual stocks referred to may or may not be currently held by the Fund. Information derived from sources is believed to be accurate, however such information has not been independently verified and may be subject to assumptions and qualifications not described in this document. To the extent permitted by law, neither MBA, nor any of its related parties, directors or employees, make any representation or warranty as to the accuracy, completeness, reasonableness or reliability of this information, or accept liability or responsibility for any losses, whether direct, indirect or consequential, relating to, or arising from, the use or reliance on this information. This information is current as of 30 September 2024 and is subject to change at any time without notice. © 2024 Maple-Brown Abbott Limited.

Interested in investing with us?

Investment Insights

The case for holding resources in an Australian small caps fund

The gold rush in the small caps market

Australian Equities March 2025 update